Home / Grand strategy / Recalibrating sanctions to preserve U.S. financial hegemony

Grand strategy, Sanctions

February 5, 2021

Recalibrating sanctions to preserve U.S. financial hegemony

U.S. sanctions are an overused foreign policy tool

- U.S. dominance of the global economic and financial system provides unmatched leverage to coerce other countries via sanctions. But sanctions have been overused to punish and signal disapproval, rather than as a tool to serve achievable U.S. foreign policy ends.1This explainer is in part based on a report by Enea Gjoza, “Counting the Cost of Financial Warfare: Recalibrating Sanctions Policy to Preserve U.S. Financial Hegemony,” Defense Priorities, November 2019, https://www.defensepriorities.org/explainers/counting-the-cost-of-financial-warfare.

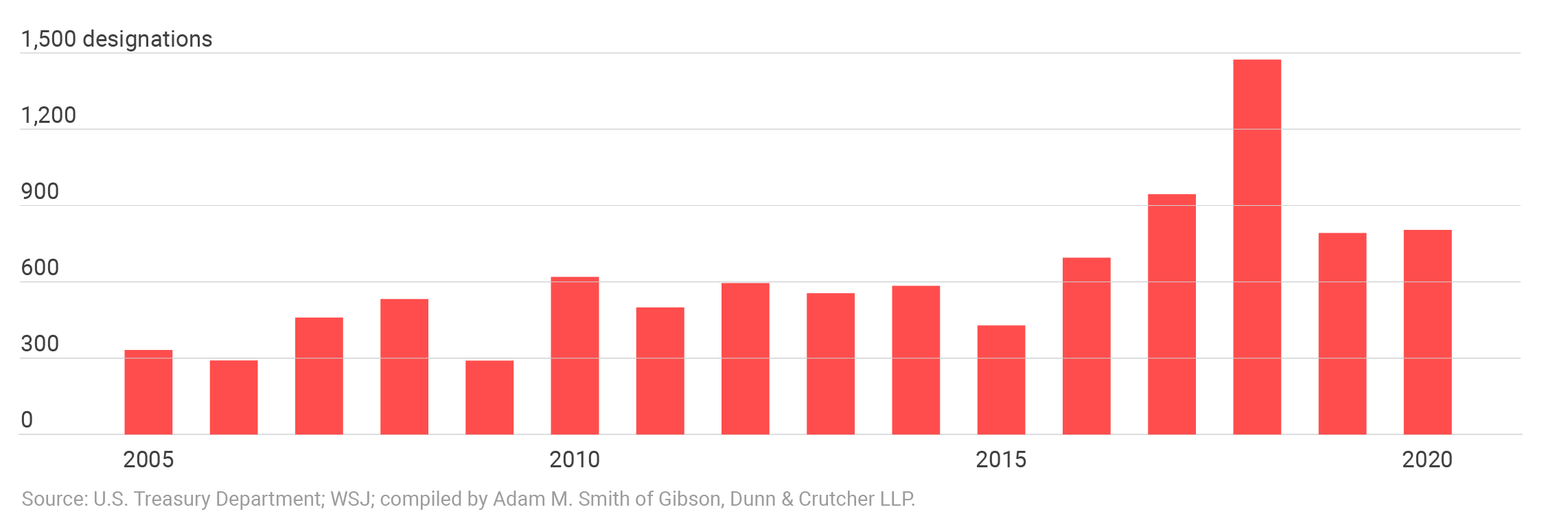

- Washington is increasing its use of sanctions. While the Clinton administration averaged around 8 new sanctions designations per year, the Obama administration average more than 525 per year, and the Trump administration added more than 975 per year.

- Sanctions rarely succeed because (1) they tend to demand states cease activities their leaders deem critical to their rule or security and (2) often other markets can open to replace those sanctions close.

- Sanctions cost the U.S.: They dilute U.S. power over time, as states seek alternatives to the U.S.-dominated financial system that exposes them to punishment. They increase tension, impose hardship on civilian populations, and can create long-term hostility.

- While sanctions should not be totally abandoned, the U.S. should deploy them judiciously by dropping maximalist policy demands, setting clear expectations about realistic political outcomes, and stating upfront the process and benefits of removal.

Additions to the U.S. sanctions list

The number of states, entities, and individuals added to the U.S. sanctions list each year has increased.

Four types of U.S. sanctions

- Economic sanctions cut states off from markets for goods. The longtime U.S. embargo of Cuba is an example.

- Financial sanctions cut off access to banking, capital, and dollar markets. Such sanctions, like those imposed on Iran and then reimposed with the U.S. withdrawal from the Joint Comprehensive Plan of Action, were used with increasing frequency during the war on terror, against state and non-state actors.

- Individual sanctions apply economic, financial, and travel restrictions against particular people, often political and business elites in foreign nations—Russian oligarchs suspected of crime, Iranian officials, suspected terrorists, and many more.

- Secondary sanctions target economic actors for doing business with sanctioned entities or states. Examples include penalties threatened against entities that do business with Iran or work on the Russian Nord Stream 2 gas pipeline in Europe.

Why sanctions rarely work

- Considerable literature shows that while they can inflict economic damage, sanctions are most effective in changing behavior when imposed multilaterally, when demands are modest, when targeting weak states, and when there is a clear path to relief.2For example: Daniel W. Drezner, The Sanctions Paradox: Economic Statecraft and International Relations (Cambridge, U.K.: Cambridge University Press, 1999); Gary Clyde Hufbauer, Jeffrey Schoot, Kimberly Ann Elliott, Barbara Oegg, “Economic Sanctions Reconsidered,” Peterson Institute for International Economics, 2009; A. Cooper Drury, “Sanctions as Coercive Diplomacy: The U.S. President’s Decision to Initiate Economic Sanctions,” Political Research Quarterly 54, no. 3 (2001): 485–508; Robert Pape, “Why Economic Sanctions Still Do Not Work,” International Security 23, no. 1, (Summer 1998): 66–77; Bryan Early, Busted Sanctions: Explaining Why Economic Sanctions Fail, (Palo Alto: Stanford University Press, 2015); Daniel W. Drezner, “Targeted Sanctions in a World of Global Finance,” International Interactions 41, no. 4 (2015): 755–764.

- Yet most comprehensive U.S. sanctions regimes do not fit these parameters and have failed to elicit major changes. Recent U.S. sanctions tend to be unilateral, accompanied by maximalist demands, and targeted at increasingly stronger powers.

- Often, the target—wary of capitulating on what it perceives as core national interests and fearful that showing weakness will invite more punishment—responds by resisting the pressure and doubling down on its previous behavior.

- Economic sanctions also fail because new domestic actors or other states can often step into the breach to fill market needs in the sanctioned state.

- Sanctions can cause suffering among civilian populations and make impoverished people more dependent on the sanctioned government. This fuels powerful, nationalistic backlashes against the U.S., making resistance to U.S. demands politically valuable.

Breakdown of global reserves by currency

The U.S. dollar’s dominance among global reserve currencies has slipped in the last two decades.

The power of financial sanctions results from U.S. dollar dominance in the global financial system

- The U.S. dollar (USD) remains the world’s dominant reserve currency, and is the predominant medium of exchange for most global trade. Dominance of the global financial system empowers the U.S. to impose costly financial sanctions on countries and entities.

- The USD accounts for more than 60 percent of foreign exchange reserves, and half of the world’s loans are denominated in USD. Among the economic benefits of USD dominance is lower borrowing rates, which enables massive U.S. deficit spending.

- U.S. banks are critical for settling international transactions—even trades between two non-U.S. states. To maintain access to the U.S. banking system, and therefore participate in global markets, nations must comply with U.S. sanctions.

- Businesses, individuals, foreign banks, and governments that run afoul of the U.S. run the risk of being blocked from the U.S. financial system, seeing their foreign assets frozen, and being exposed to hefty fines.

- This financial power deters many banks and lending organizations from operating at cross-purposes with the U.S. It can cause them to limit risk by avoiding even legal trade in sanctioned countries for fear that murky laws might be interpreted to punish them.

The U.S. incurs costs by imposing sanctions

- The weaponization of the U.S. financial system encourages states to move away from the dollar as a reserve currency, a grave threat to long-term U.S. prosperity. The USD accounted for 72 percent of global reserves in 2000; today, the figure is 61 percent.

- Russia, China, and even the European Union have all sought to reduce dependence on the dollar. Each has moved to insulate its economy from U.S. pressure by creating alternatives, or reducing exposure, to the U.S.-dominated international banking system.

- Secondary sanctions, such as those blocking European firms from purchasing oil from Iran, alienate and anger allies, making them chafe at U.S. “leadership.”

- Sanctions also invite economic retaliation. For example, Russia’s ban on agricultural imports in response to U.S. sanctions were harmful to pear and apple producers in the Pacific Northwest and to the Alaskan seafood industry.

- Sanctions on civilian populations—Iran, Syria, Iraq in the 1990s, Yemen—generate suffering by design and, as a result, intensify anti-U.S. sentiment, risking future blowback. This also weakens U.S. soft power and influence.

- Broad-based U.S. sanctions campaigns can also aid near-peer competitors. Iran sanctions have locked out Western companies, providing China with the opportunity to invest in Iran’s natural resources, construction, and infrastructure markets at bargain rates.

Getting U.S. sanctions right

- Sanctions should be a practical means to achieve modest and specific security or economic goals. The U.S. should not reflexively apply sanctions to signal disapproval of a country’s behavior or its government.

- Overreliance on financial sanctions risks the dollar’s status as the dominant reserve currency. The mere possibility of such profound economic risk urges restraint. Sanctions should therefore be used judiciously and weighed against the inevitable costs.

- Mandatory sanctions legislation—such as the Countering America’s Adversaries Through Sanctions Act—limits the executive branch’s freedom to negotiate and can complicate the conclusion of a diplomatic settlement.

- Sanctions programs should be evaluated based on their effectiveness at achieving specific political outcomes, not by the amount of economic punishment they inflict. That coercive pain is a means, not an end.

- The U.S. should curtail financial and secondary sanctions, which are most likely to imperil the dollar’s status in the long term as the world’s dominant reserve currency.

- The new administration should conduct a broad review of all sanctions with an eye toward working with Congress to remove ineffective sanctions. In the end, the power of sanctions to secure concessions comes from lifting them, not imposing them.

Endnotes

- 1This explainer is in part based on a report by Enea Gjoza, “Counting the Cost of Financial Warfare: Recalibrating Sanctions Policy to Preserve U.S. Financial Hegemony,” Defense Priorities, November 2019, https://www.defensepriorities.org/explainers/counting-the-cost-of-financial-warfare.

- 2For example: Daniel W. Drezner, The Sanctions Paradox: Economic Statecraft and International Relations (Cambridge, U.K.: Cambridge University Press, 1999); Gary Clyde Hufbauer, Jeffrey Schoot, Kimberly Ann Elliott, Barbara Oegg, “Economic Sanctions Reconsidered,” Peterson Institute for International Economics, 2009; A. Cooper Drury, “Sanctions as Coercive Diplomacy: The U.S. President’s Decision to Initiate Economic Sanctions,” Political Research Quarterly 54, no. 3 (2001): 485–508; Robert Pape, “Why Economic Sanctions Still Do Not Work,” International Security 23, no. 1, (Summer 1998): 66–77; Bryan Early, Busted Sanctions: Explaining Why Economic Sanctions Fail, (Palo Alto: Stanford University Press, 2015); Daniel W. Drezner, “Targeted Sanctions in a World of Global Finance,” International Interactions 41, no. 4 (2015): 755–764.

The Latest

op-edNATO, Europe and Eurasia, Russia

September 12, 2025

Events on Grand strategy

virtualSyria, Balance of power, Basing and force posture, Counterterrorism, Middle East, Military analysis

February 21, 2025