November 11, 2019

Counting the cost of financial warfare

Recalibrating sanctions policy to preserve U.S. financial hegemony

By Enea Gjoza

Key points

- The American economy, dollar, and banking system create unparalleled power for the U.S. in the global financial system. This power provides disproportionate influence over the world’s key economic and financial institutions, regulatory authority over major foreign companies and banks, and allows borrowing on favorable terms and in dollars, enabling long-term deficit spending.

- U.S. policymakers are increasingly deploying financial sanctions to punish or coerce other states. Once targeted at weak rogue states, sanctions are now used against great powers and allies.

- These sanctions yield few political victories because they ask too much and are often implemented reflexively, to punish, rather than strategically, to achieve a desired outcome. But they carry serious political and economic costs—damaging relations with allies and locking American companies out of foreign markets.

- The overuse of financial sanctions has spurred Russia, China, and now the EU to work on alternative institutions that would place their companies outside the reach of the U.S.

- While this parallel infrastructure is still in the early stages, it could threaten U.S. financial dominance and the status of the dollar if it succeeds—balkanizing the global financial system into different spheres of influence.

- The U.S. need not forswear sanctions altogether but should dial them back. Sanctions should be deployed against adversaries rather than allies or partners—rarely and strategically against great powers—in pursuit of clear, attainable goals, and continually re-evaluated for effectiveness.

- With no perceived threat, other countries will likely abandon their alternative institutions, which are expensive and worthwhile only so long as U.S. action makes the current system unreliable.

Overview

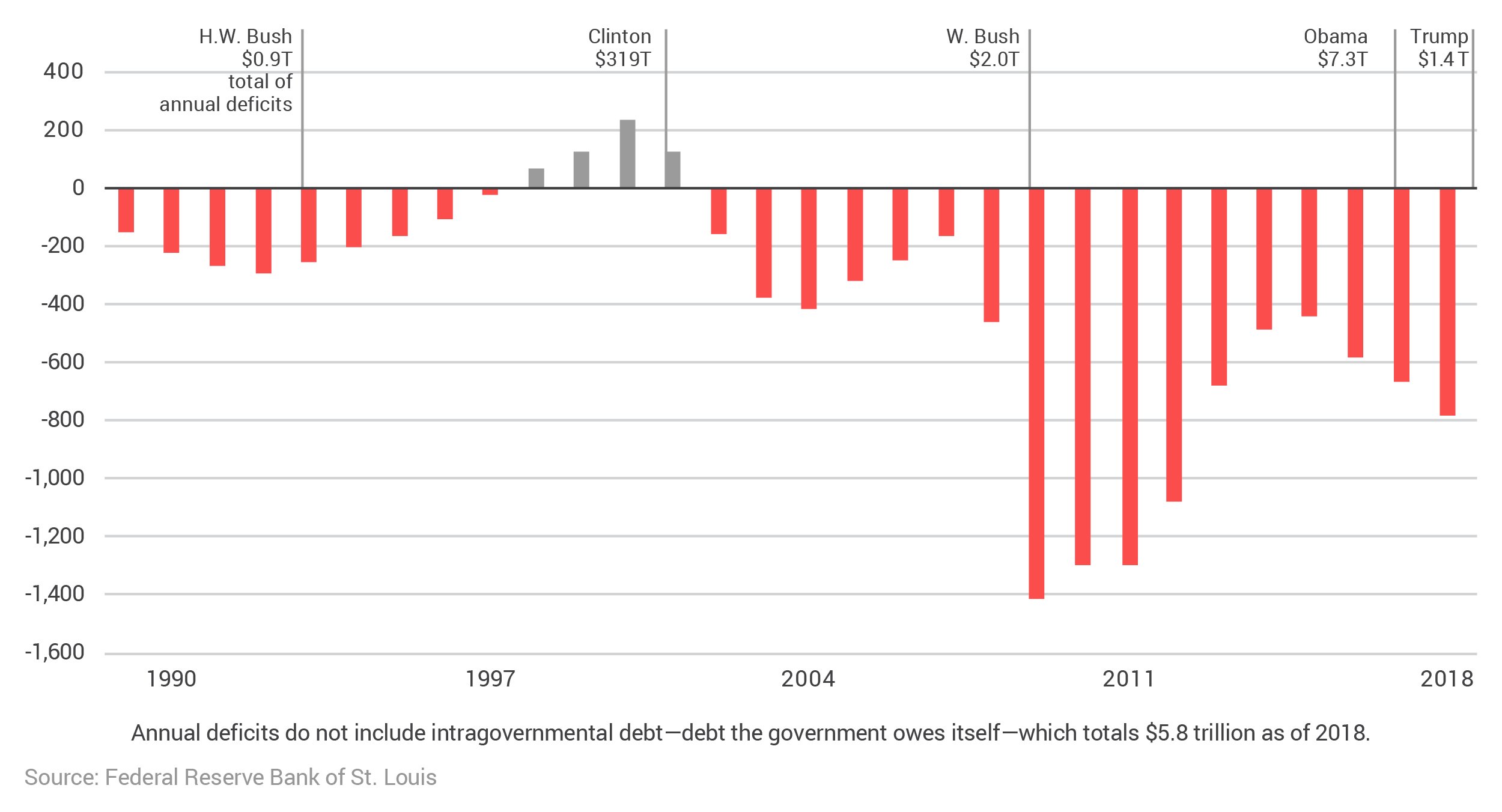

Dominance in global finance benefits the U.S. in several ways. The U.S. government disproportionately shapes the rules and norms governing global economic activity, can borrow on favorable terms and in its own currency—allowing it to run up massive, consistent deficits with little penalty—and can influence foreign firms and nations in pursuit of its foreign policy goals.

In recent decades, the U.S. has liberally leveraged this position to pressure foreign governments, including European allies, in the hopes of changing their political behavior.1“Economic Sanctions: Agencies Assess Impacts on Targets, and Studies Suggest Several Factors Contribute to Sanctions’ Effectiveness,” Government Accountability Office, pg. 12, October 2019, https://www.gao.gov/assets/710/701891.pdf. The results of this effort have largely been unsatisfactory, yielding little in the way of political gains while inflicting costs on the U.S. economy and degrading the foundation of U.S. financial power.

Access to the American financial system and U.S. dollars (USD) is essential for global transactions. By implementing financial sanctions—locking other nations out of its system until they submit to political demands—the U.S. has a powerful tool to extract political concessions. Overusing this tool motivates other states to develop alternatives to U.S.-dominated institutions, however, which erodes U.S. financial hegemony—and might eventually end it.

Although financial sanctions have come into vogue among policymakers as a seemingly low-cost, effective way to manage hostile states, other nations are increasingly alarmed at the weaponization of commercial institutions. Financial coercion has made both allies and adversaries aware of just how vulnerable they are to U.S. pressure. This realization has spurred other major economies to invest in alternatives to the current U.S.-led system.

Aside from carrying long-term costs for U.S. dominance, the efficacy of liberally applied sanctions deserves further scrutiny. Sanctions often succeed in punishing adversaries but this tactical achievement rarely reforms target states’ behavior when important policies are at stake.2Gary Clyde Hufbauer, Jeffrey J. Schott, Kimberly Ann Elliott, and Barbara Oegg, “Economic Sanctions Reconsidered,” Peterson Institution for International Economics, November 2007, https://piie.com/bookstore/economic-sanctions-reconsidered-3rd-edition-paper. Sanctions do shift commercial activity to channels outside the reach of the U.S., however, and change the cost benefit calculus for affected nations, making them more likely to invest in building their own alternative institutions to bypass the American-led system.

The U.S. should not renounce sanctions as a policy tool but should use them far more judiciously. In many cases, policymakers have reacted to the failure of sanctions to change a target’s behavior with even more sanctions, locking in hostile relationships and locking American firms and those of U.S. allies out of the sanctioned economy. This means forgone opportunities for wealth creation in the U.S. and a market opening for competitors, often from great power rivals like China and Russia.

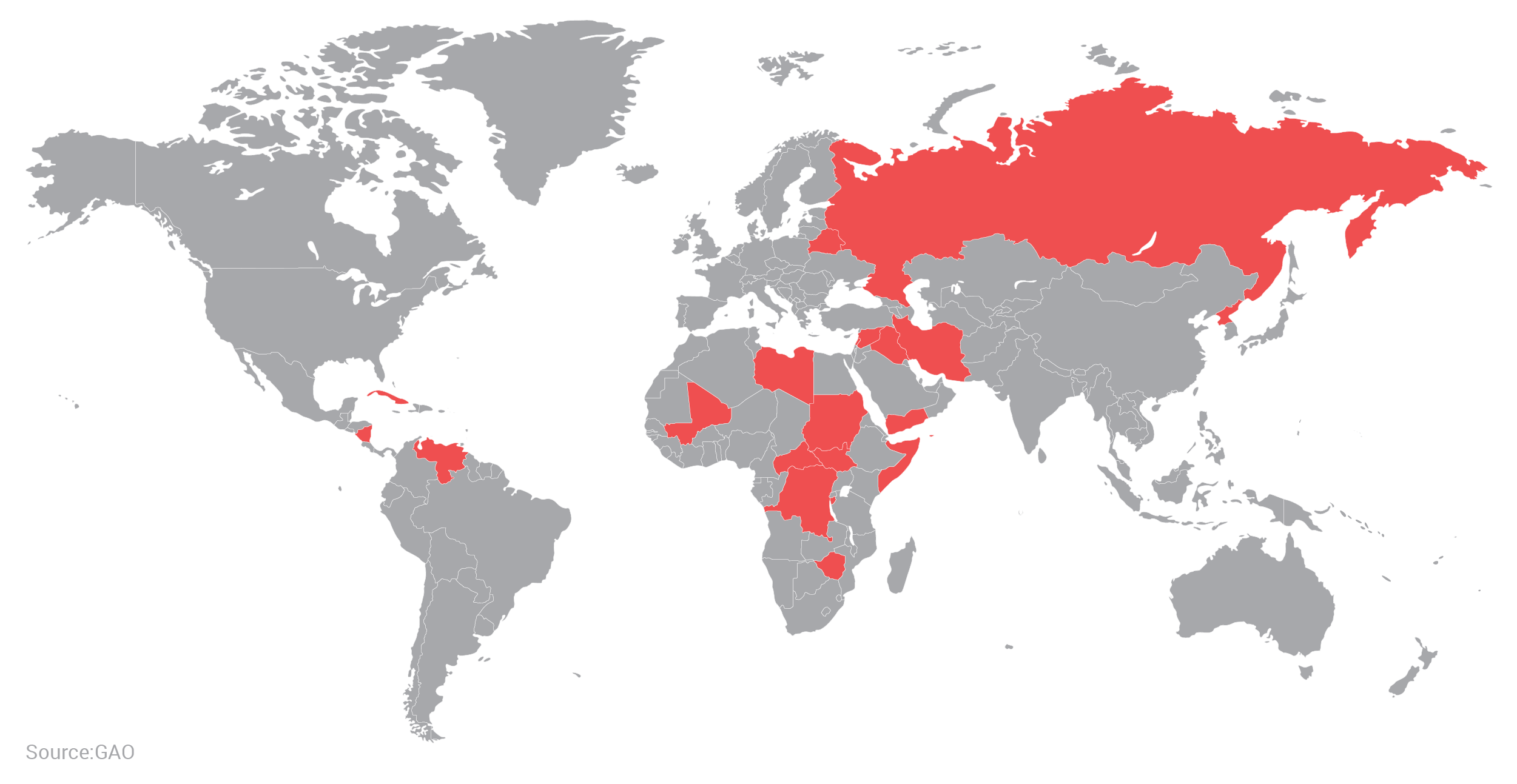

There are currently 20 country-based or country-related sanctions programs

Foreign governments and companies aren’t bound to use the U.S.-led system—they do so because it’s the most attractive among existing alternatives. As that appeal wanes through increased financial and economic weaponization, they will inevitably seek out other avenues to conduct business.

Many of these alternatives are still in their infancy but as they grow, they will diminish the U.S.’s dominance of the global financial system. Should they become fully viable competitors to the U.S.-led order, they will undermine a key pillar of American power. The U.S. gains many economic benefits from its role as the world’s financial hub, as this paper will demonstrate. The ultimate cost of losing financial hegemony will far outweigh the often-modest gains the U.S. secures by weaponizing its dominance.

Underpinning the global economy and the U.S. dollar

The U.S. emerged from World War II as a superpower, the preeminent capitalist nation, and was in the enviable position of being able to shape the institutions that would govern the world economy. In the 1944 Bretton Woods conference, the U.S., along with 43 other nations, established the so called “twin pillars” of the global economic and financial system: the International Bank for Reconstruction and Development (IBRD), later to become part of the World Bank; and the International Monetary Fund (IMF).3“Bretton Woods Conference,” Encyclopedia Britannica, https://www.britannica.com/event/Bretton-Woods-Conference.

The IBRD was created to promote economic development and rebuild nations devastated by the war, while the IMF was designed to provide short-term financing to nations facing financial crises and maintain “a system of fixed exchange rates centered on the U.S. dollar and gold.”4“The Bretton Woods Conference, 1944,” U.S. Department of State, https://2001-2009.state.gov/r/pa/ho/time/wwii/98681.htm. By the end of WWII, the U.S. held 75 percent of the world’s monetary gold reserves and was the only nation with a currency still pegged to gold, making it the only viable candidate to be the lynchpin of this system.5Robert Mundell, “A Reconsideration of the Twentieth Century,” American Economic Review 90, no. 3 (June 2000): 327-340, https://www.aeaweb.org/articles?id=10.1257/aer.90.3.327. An informal agreement among the allies meant that the head of the World Bank would always be an American, and the head of the IMF would always be a European.6Jonathan Masters and Andrew Chatzky, “The World Bank Group’s Role in Global Development,” Council on Foreign Relations, April 9, 2019, https://www.cfr.org/backgrounder/world-bank-groups-role-global-development. The Soviet Union, while present at Bretton Woods, never ratified the treaty and did not participate in these institutions until its successor states joined following the Soviet collapse.7Harold James, “Bretton Woods to Brexit,” International Monetary Fund, Finance & Development 54, no. 3 (September 2017): 4–9, https://www.imf.org/external/pubs/ft/fandd/2017/09/james.htm.

The system of fixed exchange rates that emerged from Bretton Woods lasted until 1971, when President Nixon ended the international convertibility of USD to gold.8Mamdouh G. Salameh, “Salameh, Mamdouh G., Has the Petrodollar Had its Day?” USAEE Working Paper No. 15-216, June 22, 2015, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2621599. By 1973, the world had transitioned into a system of floating exchange rates and fiat money—meaning currencies backed by government decree and the wealth of each country, rather than explicitly supported by precious metals. Despite this transition, given that America was still the preeminent political and economic powerhouse, the USD supplanted gold to become the world’s only reserve currency.

The dollar being the world’s reserve currency means that other countries are willing to hold USD they receive and not demand American goods or their own currencies in return. Their monetary authorities build up USD “reserves,” which they use to back the value of their money. In the developed world, countries do not need to hold dollars to back their currencies. But because almost everyone has USD, the dollar is used for much more than simply backing the value of foreign currencies.

Currencies serve several functions:9Ronald McKinnon, “The World Dollar Standard and Globalization: New Rules for the Game?” Stanford Center for Global Development, September 2003, https://kingcenter.stanford.edu/sites/default/files/publications/181wp.pdf.

- Medium of exchange—a means of facilitating trade;

- Store of value—a mechanism of preserving existing wealth;

- Unit of account—the currency in which many goods and services are priced; and

- Standard of deferred payment—the means of pricing bonds and other debt.

In the decades after WWII, USD gradually became the predominant mechanism for fulfilling all these functions. Most global trade was and is conducted in USD. Even trade done by eurozone countries with non-eurozone countries is largely conducted in USD.

Furthermore, a key global commodity—oil—is also mostly priced in USD, forcing those who wish to buy and sell it to use the dollar. No longer backed by gold after 1971, the USD was instead supported by a deal cut in 1974 with Saudi Arabia and other Middle Eastern oil producers. In exchange for U.S. political and military support, major oil producers agreed to only accept USD for oil and reinvest some of their profits into U.S. Treasury bonds (reserves to back their own currencies).10James Grant, “The End Of The Petrodollar?” American Foreign Policy Council, March 20, 2018, https://www.afpc.org/publications/articles/the-end-of-the-petrodollar. This arrangement stimulated massive international demand for “petrodollars,” as countries needed to acquire USD and dollar assets to purchase oil, which in turn helped finance U.S. deficit spending.11Grant, “Petrodollar.”

As global trade was dominated by the dollar, so went the global financial system. While the world was transitioning into a floating exchange rate regime in 1973, a consortium of 239 banks from 15 countries launched the Society for Worldwide Interbank Financial Telecommunication (SWIFT).12“SWIFT history,” Society for Worldwide Interbank Financial Telecommunication, 2019, https://www.swift.com/about-us/history. Headquartered in Belgium, SWIFT’s purpose was to standardize inter-bank communications globally, allowing banks to communicate (and thus transact) across borders despite differences in language and systems. Over the years, membership in the consortium has become essential for banks to operate internationally. As a result, SWIFT has grown to 11,000 member institutions, representing nearly every country.

Because the world needs USD, and because the dollar runs through American banks and ultimately the Federal Reserve, the U.S. also has incredible control over foreign banks who need USD, their clients who need to transact in USD, and institutions such as SWIFT. The dollar overwhelmingly dominates the foreign exchange markets, accounting for 87.6 percent of global market turnover in 2016.13“Foreign exchange turnover in April 2016,” Bank of International Settlements, September 2016, https://www.bis.org/publ/rpfx16fx.pdf. This means those looking to convert one third-party currency to another (say Chinese yuan to Pakistani rupees) will often have to convert their own currency to USD before buying the destination currency. The ability to limit access to USD thus creates a potent bottleneck even for those not trading with the U.S.

Tools in the toolbox

Foreign regimes often behave in ways the U.S. finds distasteful, but given the high cost of military action, the U.S. government has sought ways to coerce or punish them short of war. By offering a means to exert pressure at a seemingly low cost (given the size and strength of the U.S. economy relative to many of its targets), sanctions have become a preferred policy tool for such ventures.

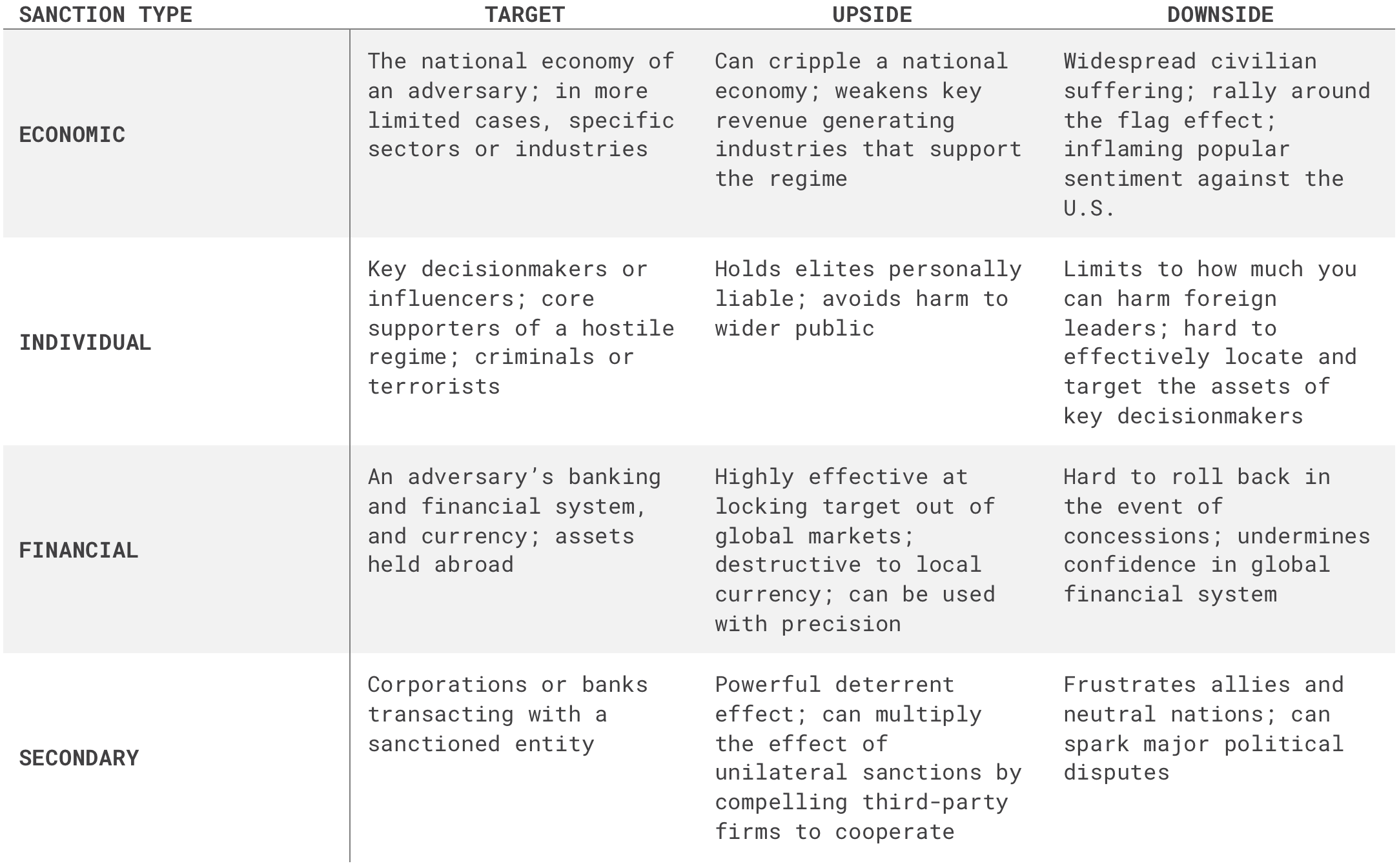

The U.S. has historically deployed several types of sanctions to achieve its foreign policy goals:

- Economic sanctions are designed to sever a target nation from its international trade relationships at either the industry or economy-wide level, drying up markets for its products and denying it crucial imports. They have been a longstanding and particularly popular tool for U.S. policymakers and have often been undertaken unilaterally, as in the case of Cuba, which has been under U.S. economic sanctions for decades.14Gary Clyde Hufbauer, Kimberly Ann Elliott, Tess Cyrus, and Elizabeth Winston, “US Economic Sanctions: Their Impact on Trade, Jobs, and Wages,” Peterson Institute for International Economics, 1997, https://ideas.repec.org/p/iie/wpaper/wpsp-2.html.

- Individual sanctions represent an attempt to avoid harming the adversary’s civilian population by personally punishing key elites. These sanctions were first introduced against Haitian military leaders in 1993 and have since grown to include visa bans, asset freezes, and blacklisting of the affected individual (and sometimes their family members) from conducting business with reputable financial institutions.15Elena Servettaz, “A Sanctions Primer: What Happens to the Targeted?” World Affairs 177, no. 2 (2014): 82–89, https://www.jstor.org/stable/43556206?seq=1#page_scan_tab_contents); Peter Rutland, “The Impact of Sanctions on Russia,” Russian Analytical Digest 157, December 17, 2014, https://www.files.ethz.ch/isn/186842/Russian_Analytical_Digest_157.pdf.

- Financial sanctions are designed to block the target from transacting with the financial institutions and in the financial markets of the U.S. and its commercial partners. In practice, this severing from the dollar system can undermine the target nation’s banking industry, currency, and ability to process international payments. With the so-called War on Terror, the U.S. honed its ability to apply pressure on adversaries via the international financial system and has deployed such sanctions repeatedly against both state and non-state actors.16Juan Zarate, Treasury’s War: The Unleashing of a New Era of Financial Warfare, (New York: Public Affairs, 2013).

- Secondary sanctions are used to sanction third-party economic actors that attempt to do business with sanctioned entities. While they are simply an enforcement mechanism for primary sanctions and often take the form of financial sanctions on banks or corporations that transact with a sanctioned entity, it is useful to treat them as distinct because they must inevitably target the firms of allied or neutral states, thus generating detrimental political consequences.

Cost-benefit analysis of various types of sanctions

Cost-benefit analysis of various types of sanctions

Do sanctions work?

Sanctions are a frequently used tool because the domestic politics behind them are compelling. Imposing sanctions provides a political bump to policymakers who want to appear strong during international disputes without incurring domestic political risk.17Taehee Whang, “Playing to the Home Crowd? Symbolic Use of Economic Sanctions in the United States,” International Studies Quarterly 55, no. 3 (September 2011): 787–801, https://academic.oup.com/isq/article-abstract/55/3/787/1834344. In these cases, whether the sanction works well or not as a policy tool is less important than its ability to be touted before domestic audiences. As long as sanctions remain on, policymakers can argue that the target entity is paying a price for its behavior, regardless of whether the sanction is actually advancing the desired foreign policy objective.

Scholars have extensively examined the effectiveness of sanctions; the research shows economic sanctions tend to be ineffective at changing state behavior, primarily because other self-interested nations will step in to fill the void where the U.S. or its allies have severed relations.18Gary Clyde Hufbauer, Jeffrey Schoot, Kimberly Ann Elliott, Barbara Oegg, “Economic Sanctions Reconsidered,” Peterson Institute for International Economics, 2009, A. Cooper Drury, “Sanctions as Coercive Diplomacy: The U.S. President’s Decision to Initiate Economic Sanctions,” Political Research Quarterly 54, no. 3 (2001): 485–508, https://journals.sagepub.com/doi/abs/10.1177/106591290105400301; Robert Pape, “Why Economic Sanctions Still Do Not Work,” International Security 23, no. 1, (Summer 1998): 66–77, https://www.mitpressjournals.org/doi/abs/10.1162/isec.23.1.66?journalCode=isec; Bryan Early, Busted Sanctions: Explaining Why Economic Sanctions Fail, (Palo Alto: Stanford University Press, 2015). For example, with U.S. and European firms locked out of Iran due to the Trump administration’s “maximum pressure” policy, Chinese companies have provided Iran with a lifeline, in the process establishing near monopolies for themselves in key sectors of the Iranian economy.19Jon Gambrell, “Iran looks warily to China for help as US sanctions resume,” Associated Press, September 12, 2018, https://apnews.com/b664060c6d5c46f3917ebb920f2af712. In this way, sanctions can at times be strategically self-defeating.

Additionally, sanctions are often used to compel a costly political concession from an adversary—one that touches on a perceived national interest that the target government is willing to endure economic hardship to protect. Despite several rounds of U.S. sanctions designed to deter Pakistan from pursuing a nuclear weapon, Pakistan ultimately ignored outside pressure and acquired its own nuclear arsenal to defend against archrival India.20Shubhangi Pandey, “U.S. sanctions on Pakistan and their failure as strategic deterrent,” ORF Issue Brief, August 1, 2018, https://www.orfonline.org/research/42912-u-s-sanctions-on-pakistan-and-their-failure-as-strategic-deterrent/. Germany is proceeding with the construction of the Nord Stream 2 pipeline despite U.S. sanctions threats because of the importance of Russian natural gas to its economy.21“Despite Looming U.S. Sanctions, the Nord Stream 2 Pipeline Will Likely Proceed,” Stratfor, July 17, 2019, https://worldview.stratfor.com/article/despite-looming-us-sanctions-nord-stream-2-pipeline-will-likely-proceed. Similarly, Turkey demonstrated it is willing to accept mandatory U.S. sanctions in order to purchase the S-400 air defense system over U.S. objections.22Enea Gjoza, “U.S. Sanctions Will Not Stop Turkey’s Shift Towards Russia,” The National Interest, August 14, 2019, https://nationalinterest.org/blog/middle-east-watch/us-sanctions-will-not-stop-turkeys-shift-towards-russia-73521.

The most comprehensive sanctions ever imposed—on Iraq between 1990 and 2003—nearly halved its GDP but led to neither regime change nor major political concessions.23Daniel W. Drezner, “Targeted Sanctions in a World of Global Finance,” International Interactions 41, no. 4 (2015): 755–764. In autocracies, which tend to be the primary targets, sanctions often help strengthen the ruling regime, allowing it to deny scarce resources to domestic opponents while lavishing them on a narrow group of supporters.24Dursun Peksen and A. Cooper Drury, “Coercive or Corrosive: The Negative Impact of Economic Sanctions on Democracy,” International Interactions 36, no. 3 (2010), https://www.tandfonline.com/doi/abs/10.1080/03050629.2010.502436. Rather than weakening the regime in Tehran with its domestic public, “maximum pressure” actually helped Iran’s Revolutionary Guards sell a nationalist message to Iranians—convincing many to rally behind the regime against the perceived foreign adversary.25Narges Bajoghli, “Trump’s Iran Strategy Will Fail. Here’s Why,” New York Times, June 30, 2019, https://www.nytimes.com/2019/06/30/opinion/trump-iran-revolutionary-guards.html. Thus, paradoxically, the oppressive regimes most likely to be on the receiving end of U.S. sanctions are least likely to alter their behavior, since they are least accountable to their constituents suffering economic hardship.

Coercive actions like sanctions can work well in situations of deterrence. This is when the credible threat of sanctions dissuades a state from pursuing a venture they are not otherwise already engaged in, by raising the perceived cost.26Thomas Schelling, Arms and Influence (New Haven: Yale University Press, 1966). They work less effectively in situations of “compellence,” where a nation has already invested considerable resources going down a particular path and the coercive action seeks to force them to back off. Denial—preventing the adversary from acquiring the means to engage in harmful activities, such as nuclear weapon components—can work well as a substitute measure in these situations.

When sanctions are effective, it tends to be under the following conditions: they are applied quickly, decisively, and in a multilateral manner; the target is “small and weak;” they are used in pursuit of “modest policy goals;” they are used against semi-democratic rather than authoritarian regimes; they are coupled with positive inducements; and the target believes the sanctions will be adjusted based on its behavior.27Dursun Peksen, “When Do Economic Sanctions Work Best?,” Center for a New American Security, June 10, 2019, https://www.cnas.org/publications/commentary/when-do-economic-sanctions-work-best; Jonathan Masters, “What Are Economic Sanctions?,” Council on Foreign Relations, August 12, 2019, https://www.cfr.org/backgrounder/what-are-economic-sanctions#chapter-title-0-8; Gary Clyde Hufbauer, “Trade as a Weapon,” Peterson Institute for International Economics, April 12, 1999, https://piie.com/commentary/speeches-papers/trade-weapon. Targeted sanctions, while cheaper to enforce and less damaging to the civilian population, have proven to be even less effective than broad economic sanctions—serving primarily as a symbolic means of signaling U.S. displeasure.28David Cortright and George Lopez, Smart Sanctions: Targeting Economic Statecraft (Lanham, MD: Rowman and Littlefield, 2002), 8.

While economic sanctions have a disappointing track record, financial sanctions have proven to be a potent tool, being “more effective and of shorter duration than trade sanctions.”29Drezner, “Targeted Sanctions in a World of Global Finance.” Financial sanctions have succeeded in compelling capitulations on lower-priority issues like money laundering and even major ones like nuclear weapons, and have been effective in inflicting serious damage to the target economy, even for countries with undeveloped financial sectors. However, dealing the appropriate amount of economic damage to a target and converting that damage into political gains remains a challenge.

The case of financial sanctions imposed against Russia following its 2014 takeover of Crimea illustrates how difficult it is to calibrate the tool to the desired objective. The U.S.-imposed sanctions were intended to target the assets of the Kremlin-linked elite, pressuring President Vladimir Putin to return Crimea. However, they coincided with EU sanctions and a global drop in oil prices, doing widespread damage to the Russian economy that the U.S. did not intend.30Peter Feaver and Eric Lorber, “Understanding the Limits of Sanctions,” Lawfare, June 26, 2015, https://www.lawfareblog.com/understanding-limits-sanctions. This made relations with Russia—a nuclear armed adversary—substantially more hostile. Furthermore, rather than backtrack, the Kremlin expropriated property from liberal-leaning elites to compensate for the losses of Putin’s inner circle.31Feaver and Lorber, “Understanding the Limits of Sanctions.

Encouraging moral hazard

While sanctions are often conceived as an attempt to take action without using military force, they can incentivize behavior that makes an unwanted military confrontation more likely. When imposing sanctions, the U.S. is essentially trying to cause economic harm that can later be reversed for concessions, but target states can resist by shifting the baseline on other issues of importance to the U.S. They seek to create new, alarming conditions—developing new weaponry or taking provocative military action—that they can later trade for sanctions relief.

Iran did this following U.S. attempts to drive its oil exports to zero in 2019, launching attacks on shipping in the Strait of Hormuz, shooting down a U.S. drone, and violating uranium enrichment caps in the Joint Comprehensive Plan of Action (JCPOA).32Natasha Turak, “Iran seizes foreign tanker in the Gulf, detains sailors, state TV says,” CNBC, August 4, 2019, https://www.cnbc.com/2019/08/04/iran-seizes-foreign-tanker-in-the-gulf-detains-sailors-state-tv-says.html. Similarly, North Korea expanded its nuclear and missile arsenal despite intensifying U.S. and UN sanctions over the last few years, drawing calls for more forceful military action against the regime.33Sharon Shi and Clément Bürge, “While Trump and Kim Talk, North Korea Appears to Expand Its Nuclear Arsenal,” Wall Street Journal, July 27, 2019, https://www.wsj.com/articles/while-trump-and-kim-talk-north-korea-appears-to-expand-its-nuclear-arsenal-11564059627. In these cases, sanctions were envisioned as a cheap alternative to war—punishing the target state while hopefully changing its calculus. Instead, they increased the probability of a potentially very costly military confrontation.

Speedy removal is difficult

A key impediment to the success of financial sanctions (and indeed all sanctions) is that their power to derive political concessions comes primarily from the promise of their repeal, rather than the economic damage inflicted. When it comes to removing financial sanctions, however, repeal is not a clear-cut process.

Iran, considered the marquee success case for financial sanctions, illustrates this problem. Following Iran’s entry into and compliance with the JCPOA, the five permanent members of the UN Security Council and Germany (P5+1), which negotiated the deal with Tehran, rolled back some of their restrictions on the Iranian financial system and allowed Iran to rejoin SWIFT. This permitted non-U.S. banks to resume business with Iran.

Because the U.S. continued to maintain some sanctions on Iran and parts of the U.S. government were publicly hostile to the JCPOA, however, many foreign banks were afraid to re-enter for fear of running afoul of U.S. law.34Joel Schectman and Yeganeh Torbati, “New U.S. guidance on Iran sanctions seeks to reassure banks,” Reuters, October 10, 2016, https://www.reuters.com/article/us-iran-usa-sanctions-idUSKCN12A29Q. This problem arose even before the U.S. decided to withdraw itself from the agreement. As a result, Iran complained that it did not receive the promised benefits of sanctions relief, and that the U.S. was not adhering to the spirit of the deal.35Bozorgmehr Sharafedin, “Iran says European banks reluctant to resume transactions,” Reuters, March 5, 2016, https://www.reuters.com/article/us-iran-europe-banks-idUSKCN0W70OX; “Kerry and Zarif to meet again on Iranian sanctions relief,” Middle East Eye, April 21, 2016, https://www.middleeasteye.net/news/kerry-and-zarif-meet-again-iranian-sanctions-relief-1911411596.

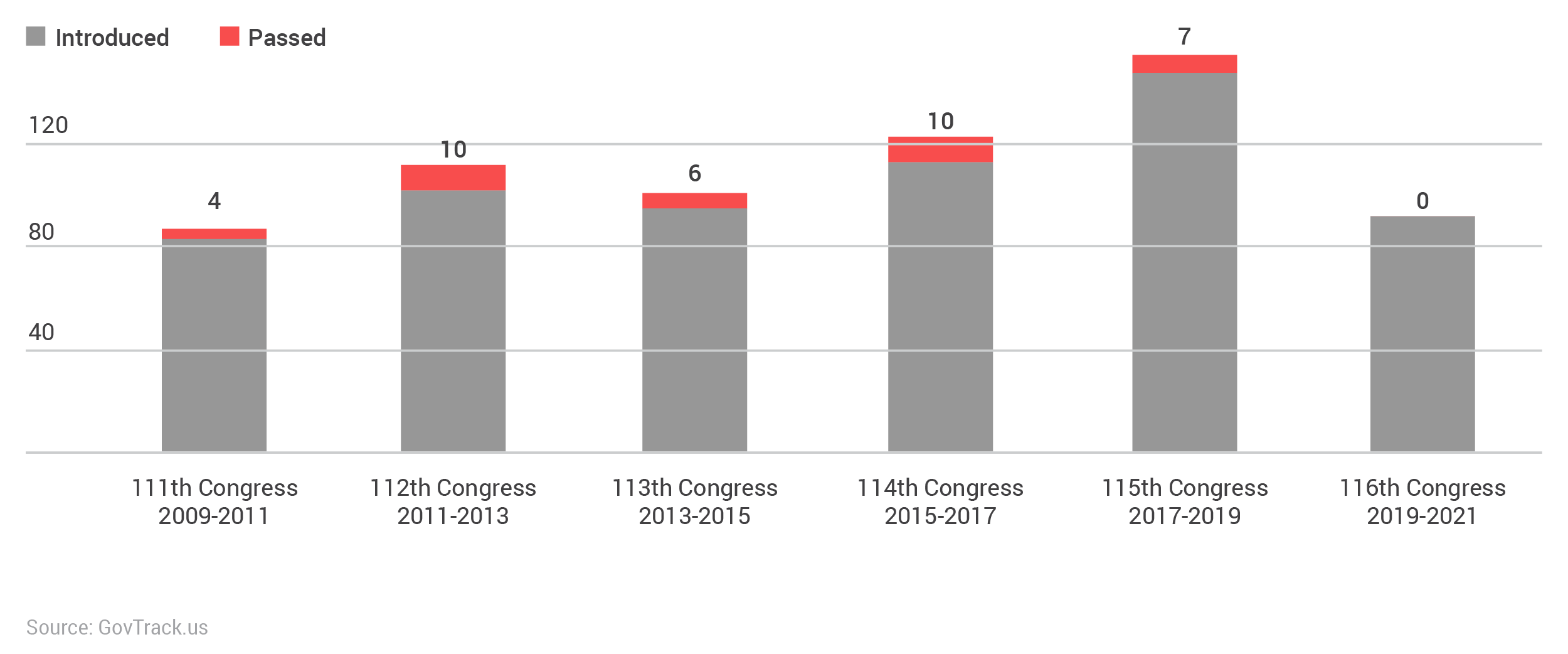

Despite these vulnerabilities, policymakers have become over-reliant on financial sanctions to punish bad behavior or attempt to extract concessions from adversaries and even friends.36Daniel W. Drezner, “Targeted Sanctions in a World of Global Finance,” International Interactions 41, no. 4, (2015): 755–764; Richard N. Haas, “Economic Sanctions: Too Much of a Bad Thing,” Brookings Institute, June 1, 1998, https://www.brookings.edu/research/economic-sanctions-too-much-of-a-bad-thing. Even in cases where decades of sanctions have failed to yield results, such as Cuba and North Korea, policymakers continue to layer on new punitive measures. Congress in particular has vigorously sought new sanctions—with strong support among members from both parties. As the table below shows, members of Congress have introduced hundreds of bills over the past decade alone seeking to impose sanctions on various nations.

Sanctions bills introduced in Congress and signed into law

Congress has initiated scores of sanctions bills each session over the past decade. Legislative sanctions are especially difficult to reverse or repeal as circumstances change.

Congress has initiated scores of sanctions bills each session over the past decade. Legislative sanctions are especially difficult to reverse or repeal as circumstances change.37“Sanctions,” GovTrack, https://www.govtrack.us/congress/bills/subjects/sanctions/6232#_=.

Congress’ increased use of sanctions is troubling because laws have tremendous inertia. The status-quo has a strong hold on policy. Therefore, the sanctions prove difficult to lift even after the underlying motivation for them no longer exists. A clear example of this is the Jackson-Vanik Amendment, introduced in 1972 and signed into law in 1975, ostensibly to sanction the USSR for charging a “diploma tax” to emigrating Jewish citizens. The Soviet Union had actually stopped charging these exit fees in late 1972, but the amendment was passed anyway and was not repealed until 2012, nearly a quarter century after the USSR’s collapse.38Julie Ginsberg, “Reassessing the Jackson-Vanik Amendment,” Council on Foreign Relations, July 2, 2009, https://www.cfr.org/backgrounder/reassessing-jackson-vanik-amendment.

As sanctions have proliferated in recent years, a large industry of law firms, think tanks, and other institutions has arisen that has a vested interest in keeping and expanding them, making repeal even harder.39Esfandyar Batmanghelidj and Nicholas Mulder, “Lifting Sanctions Isn’t as Simple as It Sounds,” Foreign Policy, April 15, 2019, https://foreignpolicy.com/2019/04/15/lifting-sanctions-isnt-as-simple-as-it-sounds-sudan-iran-bashir-rouhani-obama-trump-jcpoa-reconstruction. Given how important timely lifting of sanctions is to their success as a negotiating tool, it is clear that in practice, most sanctions only punish rather than achieve policy change, and thus do nothing but harden the hostility between the U.S. and the target.

It’s good to be king

The U.S. is the world’s largest national economy, but its economic influence pales in comparison to its dominance of the global financial system. U.S. financial dominance is predicated on three pillars:

- U.S. dollar dominance makes it the world’s foremost reserve currency;

- U.S. banks’ role as a clearinghouse for many global financial transactions; and

- The reach of its regulatory apparatus.

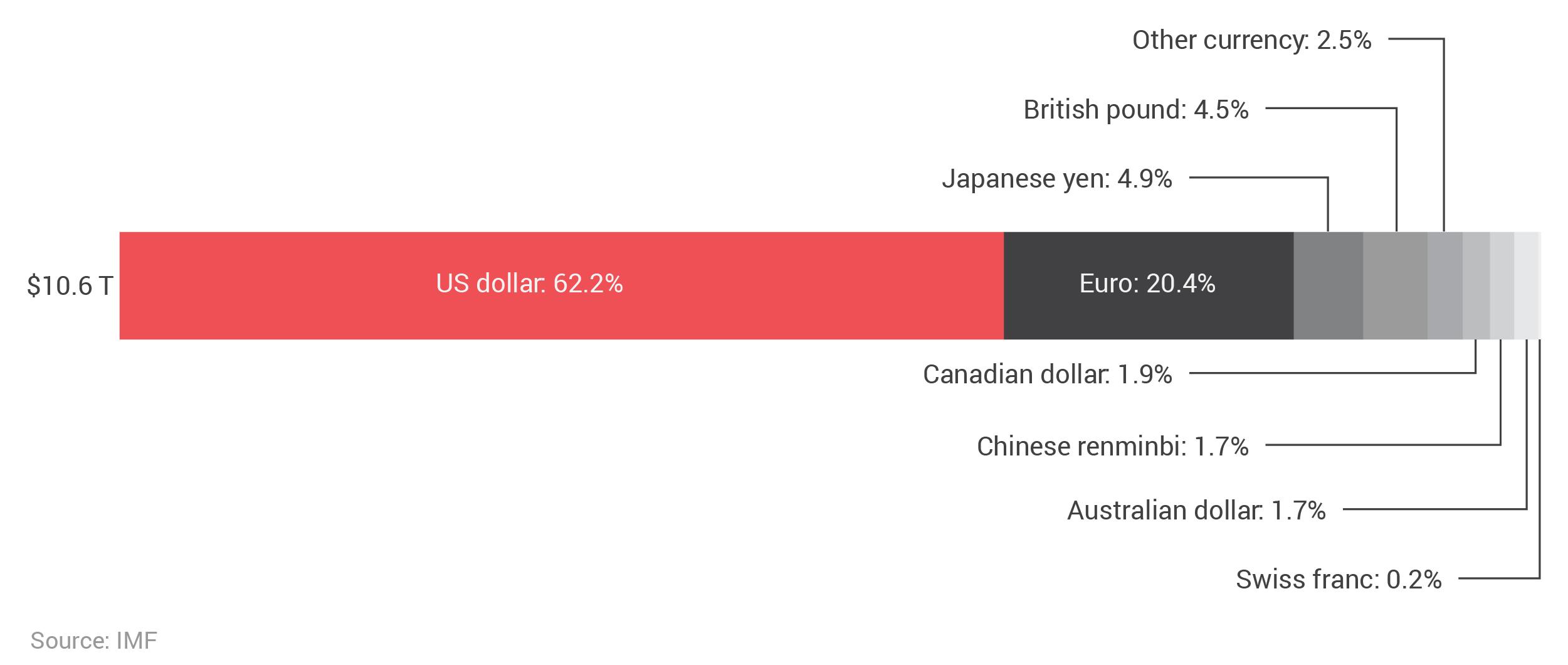

The USD is the global reserve currency, meaning central banks and other financial institutions stockpile USD to make investments and transactions or influence exchange rates.40Barry Eichengreen and Marc Flandreau, “The Rise and Fall of the Dollar (or when did the dollar replace sterling as the leading reserve currency?),” European Review of Economic History 13, no. 3, (December 2009): 377–411, https://www.cambridge.org/core/journals/european-review-of-economic-history/article/rise-and-fall-of-the-dollar-or-when-did-the-dollar-replace-sterling-as-the-leading-reserve-currency/9C78B88EBC0099E26A105DEC90CBE103; Peter Coy, “The Tyranny of the U.S. Dollar,” Bloomberg, October 3, 2018, https://www.bloomberg.com/news/articles/2018-10-03/the-tyranny-of-the-u-s-dollar. Although there are other reserve currencies, USD accounts for more than 60 percent of central bank currency reserves. Furthermore, roughly half of loans worldwide are denominated in USD, and 40 percent of international payments are processed using the dollar.41“RMB Internationalization: Where we are and what we can expect in 2018,” SWIFT, January 2018, https://www.swift.com/resource/rmb-tracker-january-2018-special-report; Peter Coy, “The Tyranny of the U.S. Dollar,” Bloomberg, October 3, 2018, https://www.bloomberg.com/news/articles/2018-10-03/the-tyranny-of-the-u-s-dollar. Because USD can only be acquired by other nations through the U.S. banking system and thus the Federal Reserve, the U.S. has substantial power to dictate who can participate in the global system simply by managing access to foreigners’ ability to clear and settle dollar transactions.

Breakdown of $10.6 trillion in global reserves by currency (2018)

Central banks prefer holding U.S. dollars as part of their reserves because of its widespread use, stability, and the strength of the U.S. economy.

The centrality of U.S. banks to the correspondent banking system is also a major source of leverage. Correspondent banking refers to “an arrangement under which one bank (correspondent) holds deposits owned by other banks (respondents) and provides payment and other services to those respondent banks.”42“Correspondent Banking,” Bank for International Settlements, July 2016, https://www.bis.org/cpmi/publ/d147.pdf. For smaller banks and those outside of major economies, correspondent relationships with multinational financial institutions are key to their ability to transact in other currencies or move funds across borders. The importance of USD as a transaction currency means international banks often need to make loans in USD, in turn requiring them to borrow USD from others. By mid-2018, non-U.S. banks had amassed a staggering $12.8 trillion in USD liabilities.43Iñaki Aldasoro and Torsten Ehlers, “The Geography of Dollar Funding of non-US banks,” Bank of International Settlement, December 16, 2018, https://www.bis.org/publ/qtrpdf/r_qt1812b.htm.

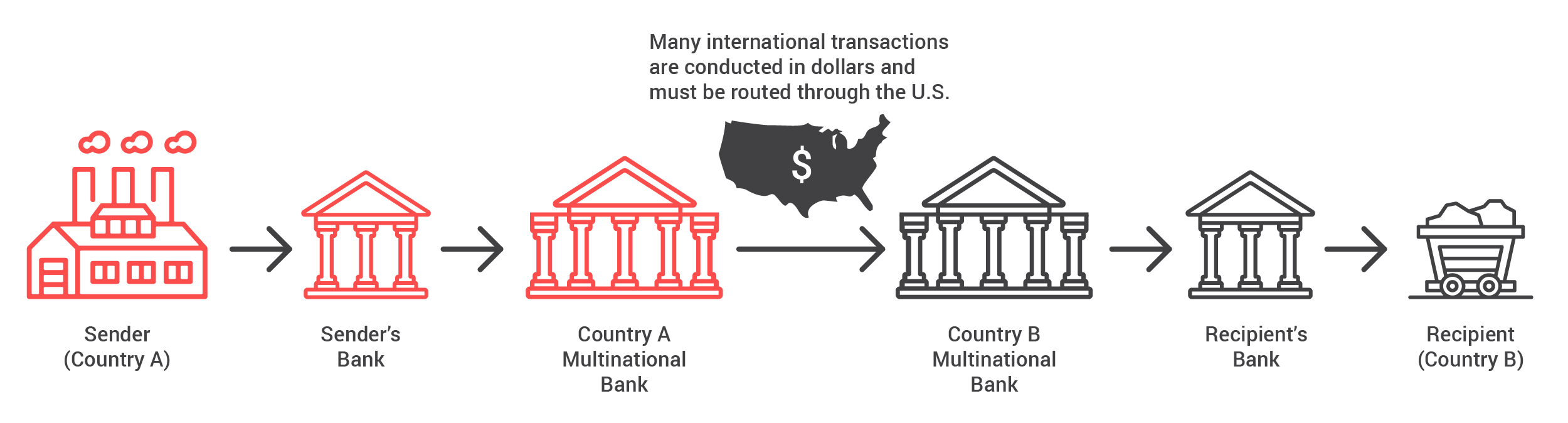

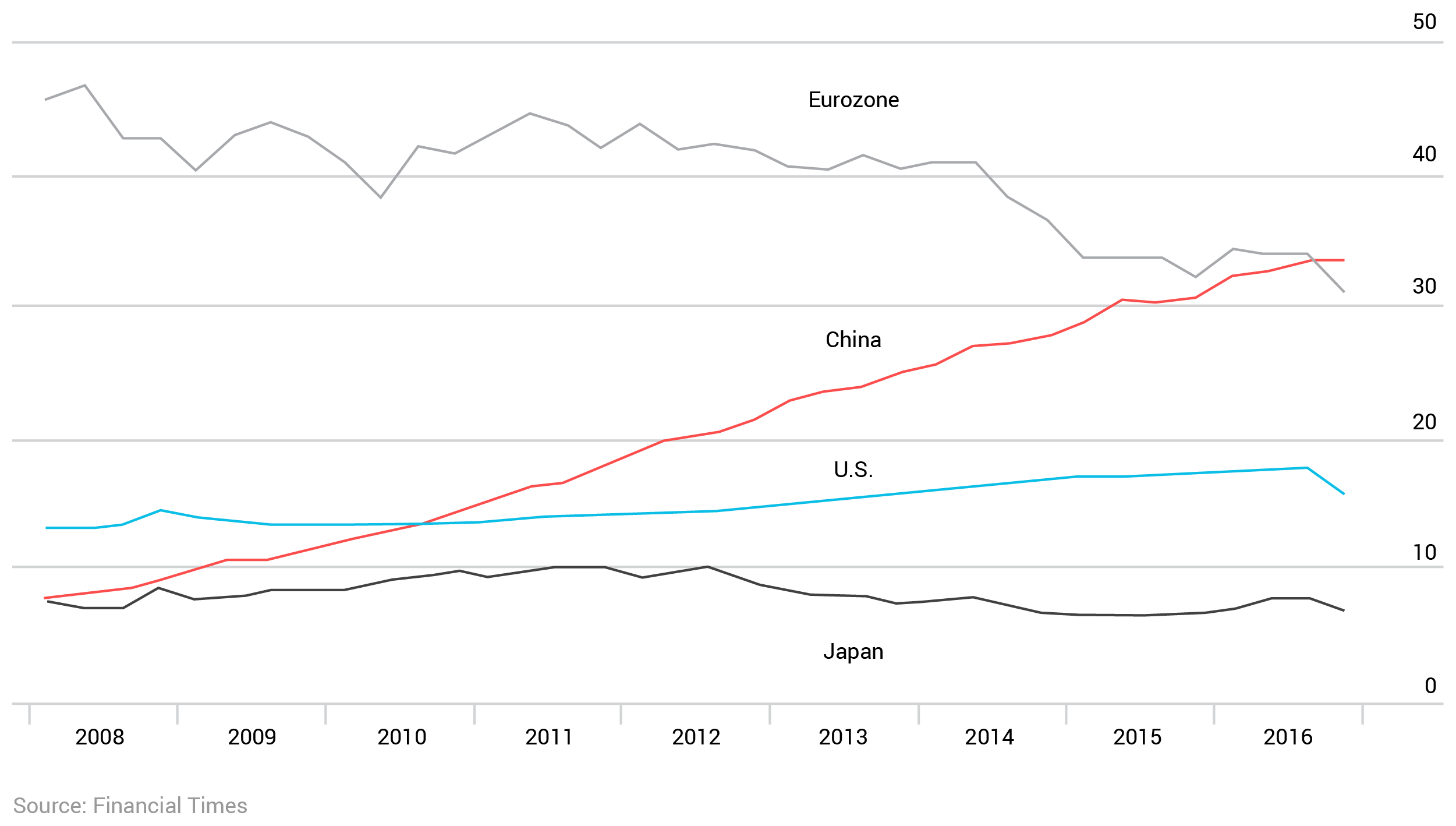

Correspondent banking in the global financial system

In the above example, a factory in “Country A” pays for minerals from “Country B.”

Relationships with U.S. banks (or European ones licensed to clear USD transactions) are therefore essential for many financial institutions. When the U.S. government appears unfavorably disposed to specific banks or even whole nations, the main correspondent banks move to sever those relationships, essentially sealing the conduit to the USD or Euro markets for their counterparties.44Jim Woodsome, Vijaya Ramachandran, Clay Lowery, and Jody Myers, “Policy Responses to De-risking,” Center for Global Development, 2018, https://www.cgdev.org/sites/default/files/policy-responses-de-risking.pdf; “A Crackdown on Financial Crime Means Global Banks Are Derisking,” Economist, July 8, 2017, https://www.economist.com/news/international/21724803-charities-and-poor-migrants-are-among-hardest-hit-crackdown-financial-crime-means. Losing access to this massive market is effectively a death sentence for a major financial institution.45Zachary Laub, “International Sanctions on Iran,” Council on Foreign Relations, July 15, 2015, https://www.cfr.org/backgrounder/international-sanctions-iran. Since the 2008 financial crisis, U.S. banks have overtaken the previously larger European banking sector in profit and market capitalization and have become even more crucial in global finance.46Martin Arnold, “How US banks Took over the Financial World,” Financial Times, September 16, 2018, https://www.ft.com/content/6d9ba066-9eee-11e8-85da-eeb7a9ce36e4.

The importance of the American market to multinational corporations also means the American regulatory system affects nearly every significant economic actor, even outside its borders.47Masters, “What Are Economic Sanctions?”; Yalman Onaran, “Dollar Dominance Intact as U.S. Fines on Banks Raise Ire,” Bloomberg, July 16, 2014, https://www.bloomberg.com/news/articles/2014-07-15/dollar-dominance-intact-as-u-s-fines-on-banks-raise-ire. Firms that run afoul of U.S. sanctions laws can be subject to heavy fines or even locked out of the U.S. altogether. The U.S. is such a crucial market that the Department of Financial Services, a state-level New York regulator with no prosecutorial authority, has been able to extract billions of dollars in fines and force the ouster of executives at foreign banks simply by threatening to revoke their charter to operate in New York City.48Lynnley Browing, “Regulator Benjamin Lawsky Is the Man Banks Fear Most,” Newsweek, June 30, 2014, https://www.newsweek.com/regulator-benjamin-lawsky-man-banks-fear-most-256626.

The U.S. also wields substantial influence over the global economic order through institutions like the World Bank, the International Monetary Fund, and SWIFT. Because of the close relationship between the U.S. and EU, European regulators often coordinate sanctions activity with the U.S. (as they did against Iran, Iraq, North Korea, and Russia), increasing its effectiveness. The integration of China and Russia’s financial systems into the U.S.-led order also works as a low-level deterrent to hostilities between those nations and the U.S. The certainty that their economies would suffer in the event of conflict augments other key deterrents—U.S. military dominance and the U.S. nuclear arsenal. The interconnectedness of the U.S. and Chinese economies has likely also deterred the U.S. from more forcefully confronting China militarily.

In addition to its political advantages, U.S. financial dominance yields economic gains. Among these is the so-called “exorbitant privilege,” which allows the U.S. to borrow at low interest rates and in its own currency, reducing the cost of debt and minimizing exchange risk.49Gary Richardson and Cathy Zhang, “Barry Eichengreen, Exorbitant Privilege. The Rise and Fall of the Dollar and the Future of the International Monetary System,” Oeconomia, 2013, https://journals.openedition.org/oeconomia/314; Thomas Palley, “Why Dollar Hegemony Is Unhealthy,” YaleGlobal Online, June 20, 2006, https://yaleglobal.yale.edu/content/why-dollar-hegemony-unhealthy. Access to capital at such favorable terms permits the U.S. to run long-term deficits and avoid fiscal discipline in a way no other country can.50Barry Eichengreen, “Global Imbalances and the Lessons of Bretton Woods,” NBER Working Paper No. 10497, May 2004, https://www.nber.org/papers/w10497. The U.S. also generates funds through seigniorage—the money made by selling USD to foreigners—and U.S. banks and firms can do business in their own currency internationally, reducing transaction costs.51Robert N. McCauley, “Does the US dollar confer an exorbitant privilege?” Journal of International Money and Finance 57 (October 2015): 1–14, https://www.sciencedirect.com/science/article/pii/S0261560615001059.

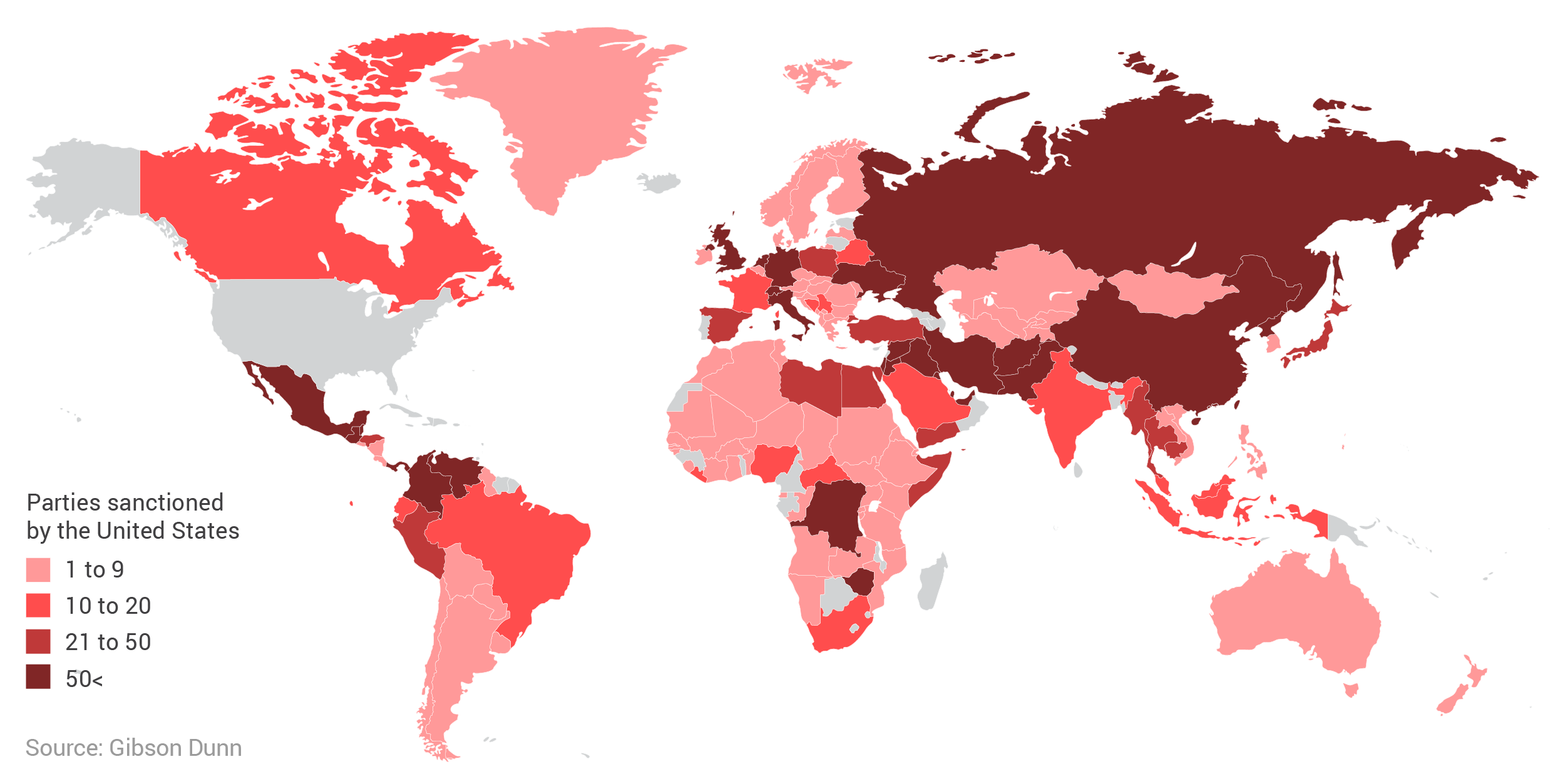

Weaponizing economic interdependence

As policymakers have realized the power financial dominance confers, they have weaponized economic interdependence—to use the term coined by political scientists Henry Farrell and Abraham Newman—against an increased set of targets.52Henry Farrell and Abraham L. Newman, “Weaponized Interdependence: How Global Economic Networks Shape State Coercion,” International Security 44, no. 1 (Summer 2019): 42–79, https://www.mitpressjournals.org/doi/full/10.1162/isec_a_00351. The first major targets of U.S. financial sanctions in the post-Cold War era—Iraq, North Korea, and Iran—were fringe states with few allies. U.S. attempts to isolate them were also multilateral, an approach that has largely been discontinued.

The UN imposed “comprehensive sanctions” on Iraq in 1990, which featured a near total ban on both economic and financial activity with Iraq.53“Clear Search Resolution 661,” UN Security Council Resolution, 1990, http://unscr.com/en/resolutions/661. These sanctions led to a collapse of the Iraqi dinar, a halving of its national GDP, and 5,000 percent inflation over five years.54David Armitage, “Economic Sanctions on Iraq: Going Nowhere Fast,” US Army War College, Strategy Research Project, 1998, https://apps.dtic.mil/dtic/tr/fulltext/u2/a344179.pdf.

Combined with broader sanctions on trade and oil sales, these measures caused lasting damage to Iraq’s economy and society.55Abbas Alnasrawi, “Iraq: Economic Sanctions and Consequences, 1990–2000,” Third World Quarterly 22, no. 2 (2001): 205–218, https://www.tandfonline.com/doi/abs/10.1080/01436590120037036. But they failed in their aim of causing political capitulation. Widespread Iraqi suffering did not cause Iraq’s government to back down. Instead, it provided an opportunity for the Hussein regime to consolidate its power over the population by controlling access to scarce necessities.56John F. Burns, “10 Years Later, Hussein Is Firmly in Control,” The New York Times, February 25, 2001, https://www.nytimes.com/2001/02/25/world/10-years-later-hussein-is-firmly-in-control.html.

North Korea has been under various U.S. economic and financial sanctions since 1950 when it invaded South Korea. It was targeted further in response to its nuclear program when the Treasury Department sanctioned Macau-based Banco Delta Asia in 2005.57Dianne E. Rennack, “North Korea: Economic Sanctions,” Congressional Research Service, October 17, 2006, https://fas.org/sgp/crs/row/RL31696.pdf. The bank—which was reportedly assisting with North Korean money laundering efforts—was seized by the Macau government, along with North Korea’s assets there. Fear of further U.S. sanctions led two dozen other banks to voluntarily reduce or end their North Korean exposure.58David Lague and Donald Greenlees, “Squeeze on Banco Delta Asia hit North Korea where it Hurt,” New York Times, January 18, 2007, https://www.nytimes.com/2007/01/18/world/asia/18iht-north.4255039.html.

The financial sanctions seriously hampered the regime’s ability to buy and sell abroad (combined with the broader economic sanctions implemented both unilaterally and through the UN), but North Korea eventually succeeded in acquiring nuclear weapons. New UN and U.S. sanctions imposed during the Trump administration have not diminished North Korea’s ability to expand its arsenal, which it has pledged to keep until it no longer perceives a threat from the U.S.59Eleanor Albert, “What to Know About Sanctions on North Korea,” Council on Foreign Relations, July 16, 2019, https://www.cfr.org/backgrounder/what-know-about-sanctions-north-korea.

Much like Iraq and North Korea, Iran was targeted with a broad array of economic, financial, and individual sanctions against its leadership once it was discovered to have violated its obligations under the Non-Proliferation Treaty in 2005. The U.S., UN, and EU imposed multiple rounds of sanctions between 2006 and 2016.60“Treasury Targets Assets of Iranian Leadership,” U.S. Department of the Treasury, June 4, 2013, https://www.treasury.gov/press-center/press-releases/pages/jl1968.aspx. The most damaging of these was the removal of Iran’s banks from the SWIFT system in 2012, an unprecedented move that severed Iran’s financial sector from the rest of the world.

The SWIFT sanctions helped drive an already weak economy into contraction. Iranian GDP growth went from roughly 4 percent in 2011 to negative 9 percent in 2012, while by 2013, annualized inflation exceeded 40 percent.61Bo Ram Kwon, “The Conditions for Sanctions Success: A Comparison of the Iranian and North Korean Cases,” Korean Journal of Defense Analysis 28, no. 1 (2016): 139–161, https://www.researchgate.net/profile/Bo_Ram_Kwon3/publication/298715566_The_Conditions_for_Sanctions_Success_A_Comparison_of_the_Iranian_and_North_Korean_Cases/links/59fbd295a6fdcca1f29301a9/The-Conditions-for-Sanctions-Success-A-Comparison-of-the-Iranian-and-North-Korean-Cases.pdf. In 2012, the Iranian currency lost 80 percent of its value. Between 2011 and 2013, oil revenues, which generated 60 percent of the government’s funding, had dropped from $100 billion to $35 billion.62Farhad Rezaei, “Sanctions and Nuclear Rollback: The Case of Iran,” Middle East Policy Council XXIV, no. 4 (Winter 2017), https://www.mepc.org/journal/sanctions-and-nuclear-rollback-case-iran. At the same time, oil exports more than halved from 2.5 million barrels per day (BPD) to 1.1 million. Although many credit the sanctions regime with driving Iran to the negotiating table, plummeting crude oil prices and the self-inflicted wound of economic mismanagement did as much, or more, to get them there.63Kwon, “Conditions for Sanctions Success”; Suzanne Maloney, “Sanctions and the Iranian Nuclear Deal: Silver Bullet or Blunt Object?,” Social Research: An International Quarterly 82 no. 4 (Winter 2015): 887–911, https://muse.jhu.edu/article/610666; Katariina Simonen, “The Strong Do What They Can and the Weak Suffer What They Must—But Must They? Fairness as a Prerequisite for Successful Negotiation (Benchmarking the Iran Nuclear Negotiations),” Journal of Conflict and Security Law 22, no. 1 (Spring 2017): 125-145, https://academic.oup.com/jcsl/article-abstract/22/1/125/2525365; Eujin Jung, “Iran Sanctions: A Successful Episode,” Peterson Institute for International Economics, January 29, 2016, https://piie.com/blogs/trade-investment-policy-watch/iran-sanctions-successful-episode; David Francis and Lara Jakes, “‘Sanctions Are a Failure…Let’s Admit That’,” Foreign Policy, April 28, 2016, https://foreignpolicy.com/2016/04/28/sanctions-are-a-failurelets-admit-that/.

From marginal states to major powers and allies

As policymakers became more aware of the ability of financial sanctions to do damage, they increasingly became a response of first resort for expressing U.S. displeasure, even toward major powers like Russia and allies like Turkey. Following Russia’s seizure of Crimea in 2014, the U.S. and EU implemented a growing list of financial sanctions that targeted scores of Russian individuals, companies, and banks, including major state-owned banks Gazprombank and Vnesheconombank.64Ivan Gutterman and Wojtek Grojec, “A Timeline Of All Russia-Related Sanctions,” Radio Free Europe Radio Liberty, September 19, 2018, https://www.rferl.org/a/russia-sanctions-timeline/29477179.html. The sanctions also restricted exports of equipment for the energy and arms sectors. Several U.S senators publicly advocated for punishing Russia by expelling it from SWIFT, a move which was ultimately not adopted.65Ramsey Cox, “GOP senators to Treasury: Put the ‘squeeze’ on Russia,” The Hill, October 26, 2014, https://thehill.com/blogs/floor-action/senate/219010-gop-senators-to-treasury-put-the-squeeze-on-russia. The sanctions on Russia, combined with lower global prices of oil (Russia’s primary export) led the ruble to lose more than half its value against the dollar from 2014 to 2016.66“Russian Ruble Keeps on Falling, Hits New Record Low,” CBS News, January 21, 2016, https://www.cbsnews.com/news/russian-ruble-keeps-on-falling-hits-new-record-low.

Similarly, as a result of the conflict between the U.S. and Turkey over the imprisonment of American pastor Andrew Brunson and other matters, the U.S. imposed financial sanctions on two top Turkish officials.67Adam Goldman and Gardiner Harris, “U.S. Imposes Sanctions on Turkish Officials Over Detained American Pastor,” New York Times, August 1, 2018, https://www.nytimes.com/2018/08/01/world/europe/us-sanctions-turkey-pastor.html. These sanctions were quickly followed with a doubling of tariffs for Turkish steel and aluminum, leading the lira to drop by 20 percent and the Turkish president to declare America’s actions an “economic war.”68David Reid, “Turkish Lira Hits Fresh Record Low Following U.S. Sanctions,” CNBC, August 3, 2018, https://www.cnbc.com/2018/08/03/turkish-lira-hits-fresh-record-low-following-us-sanctions.html; “Trump doubles metal tariffs on Turkey as lira falls by 20%,” BBC News, August 10, 2018, https://www.bbc.com/news/world-us-canada-45123607. These sanctions were unique in that they were imposed on a treaty ally and NATO member at a time when its currency was already weakening, with the explicit intent of generating political pressure by hurting its economy.

The U.S. almost imposed sanctions on a powerful ally yet again as Jamal Khashoggi’s murder frayed relations between the U.S. and Saudi Arabia.69Saudi Arabia is a non-NATO U.S. ally without a formal mutual defense treaty with the U.S. However, the U.S. has for decades implicitly provided military support and security guarantees for the Saudi regime. “U.S.-Saudi Arabia Relations,” Council on Foreign Relations, December 7, 2018, https://www.cfr.org/backgrounder/us-saudi-arabia-relations#chapter-title-0-1. Members of Congress argued for sanctions against the Saudis, and the Kingdom responded by threatening to hit the U.S. where it hurt—by selling oil in Chinese renminbi (RMB) instead of USD.70Enea Gjoza, “Here’s How to Deal with the Khashoggi Incident,” National Interest, November 1, 2018, https://nationalinterest.org/feature/heres-how-deal-khashoggi-incident-34887. Had an RMB market for oil actually been created, it would have represented a remarkable about-face for the Saudis. The Kingdom’s traditional policy of selling its oil for USD on the international markets remains a core driver of demand for USD since the end of the gold standard.71Salameh, Mamdouh G., “Has the Petrodollar Had its Day?” Although the administration wisely sidestepped a potential crisis, the proposed Saudi countermeasures showed an increasing willingness by even an ostensible ally to go after the source of U.S. financial dominance.

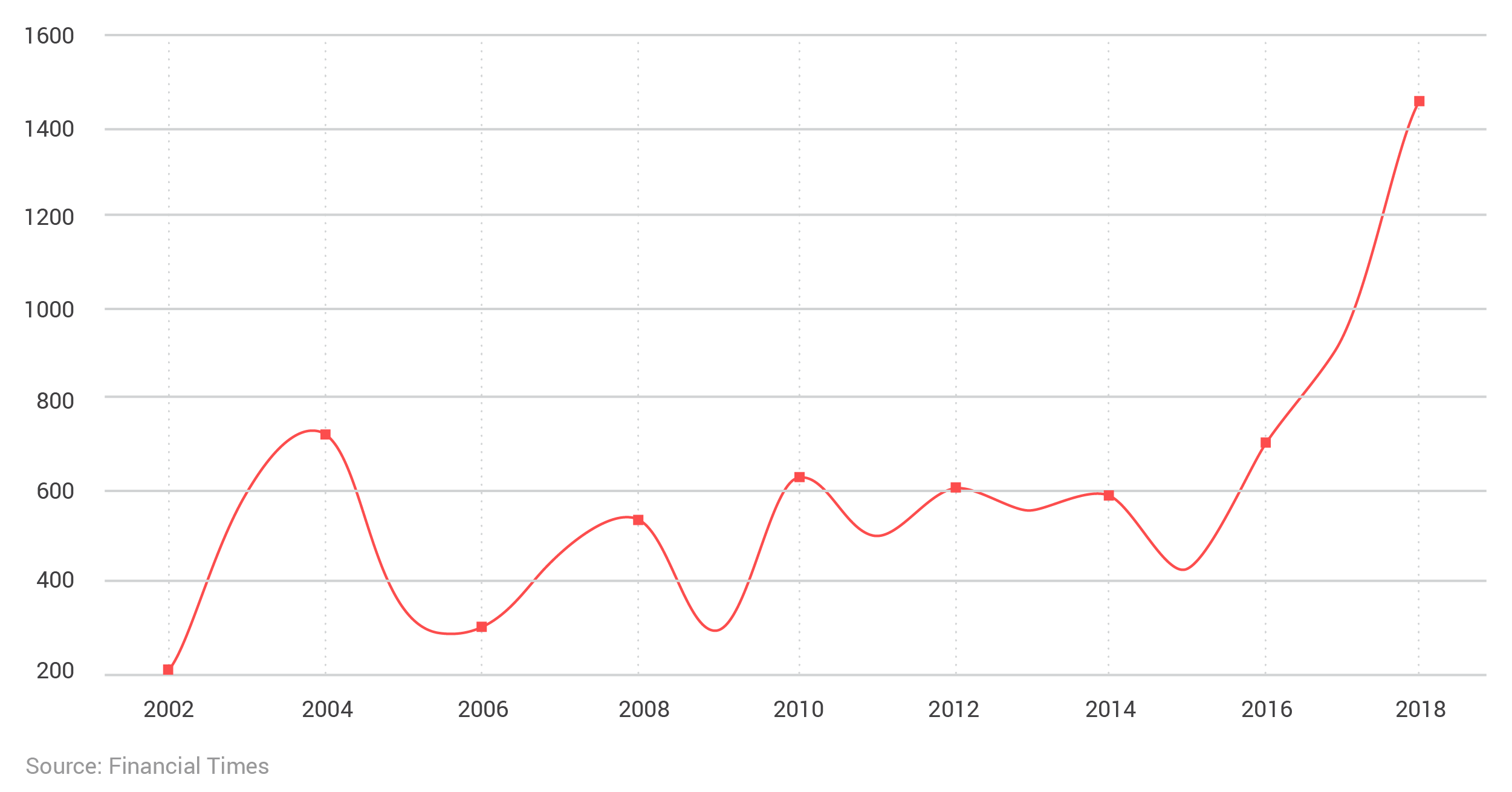

New entities targeted by U.S. sanctions from 2002–2018

The number of new entities targeted by U.S. sanctions has spiked significantly during the second half of the decade.

Tightening the net with secondary sanctions

As the U.S. has become more comfortable with financial sanctions, it has also taken to using secondary sanctions to completely isolate targets even from neutral third parties. An example is the Helms-Burton Act of 1996, which allows suits in U.S. courts against foreign companies doing business with the Castro regime in Cuba.72Mark A. Groombridge, “Missing the Target: The Failure of the Helms-Burton Act,” Cato, Trade Briefing Paper No. 12, June 5, 2001, https://www.cato.org/publications/trade-briefing-paper/missing-target-failure-helmsburton-act. The passage of the act led the Europeans and Canada to pass “blocking statutes,” which forbid their companies from cooperation with U.S. sanctions efforts.73John Forrer, “Secondary Economic Sanctions: Effective Policy or Risky Business?” Atlantic Council, May 2018, https://www.atlanticcouncil.org/in-depth-research-reports/issue-brief/secondary-economic-sanctions-effective-policy-or-risky-business/. De-escalation was achieved before the conflict came to a head after the Europeans and the Clinton administration agreed not to pursue sanctions against each other.

The August 2017 passage of the Countering America’s Adversaries Through Sanctions Act (CAATSA) stimulated new secondary sanctions, with the act prescribing punishments for third-party entities transacting with sanctioned nations like Russia, Iran, and North Korea.74“H.R.3364 – Countering America’s Adversaries Through Sanctions Act,” 115th Congress, 2017, https://www.congress.gov/bill/115th-congress/house-bill/3364/text. That same month, the Treasury Department imposed secondary sanctions on Chinese and Russian firms doing business with North Korea, and contemplated but did not follow through on sanctions targeting Chinese banks.75David Brunnstrom and Doina Chiacu, “U.S. targets Chinese, Russia entities for helping North Korea,” Reuters, August 22, 2017, https://www.reuters.com/article/us-northkorea-nuclear-sanctions/u-s-targets-chinese-russia-entities-for-helping-north-korea-idUSKCN1B21OG; John Alun, “How US sanctions against North Korea could affect Chinese banks,” South China Morning Post, August 14, 2017, https://www.scmp.com/business/banking-finance/article/2106606/how-us-sanctions-against-north-korea-could-affect-chinese. In September, the U.S. sanctioned the Chinese military’s weapons development department following the purchase of Russian weapons in violation of U.S. sanctions on Russia.76“US imposes sanctions on China for buying Russian weapons,” BBC News, September 21, 2018, https://www.bbc.com/news/world-us-canada-45596485.

More recently, the chief financial officer of Chinese tech giant Huawei was arrested in Canada at the request of the U.S. for allegedly helping violate sanctions on Iran, sparking a diplomatic row and the retaliatory arrests of Canadians in China.77Jessica Murphy, “‘Alone in the world’: Canada squeezed by superpowers in Huawei dispute,” BBC News, December 19, 2018, https://www.bbc.com/news/world-us-canada-46562132; Chun Han Wong, John Lyons, and Josh Chin, “‘No Coincidence’: China’s Detention of Canadian Seen as Retaliation for Huawei Arrest,” Wall Street Journal, December 12, 2018, https://www.wsj.com/articles/no-coincidence-chinas-detention-of-canadian-seen-as-retaliation-for-huawei-arrest-11544619753; Kate Conger, “Huawei Executive Took Part in Sanctions Fraud, Prosecutors Say,” New York Times, December 7, 2018, https://www.nytimes.com/2018/12/07/technology/huawei-meng-wanzhou-fraud.html. The U.S. has followed up with criminal charges against Huawei itself for sanctions evasion and other crimes, a move that is a negotiating chip in a trade dispute, but also likely to further harm U.S.-China relations.78Julia Horowitz, David Shortell, and Laura Jarrett, “U.S. files criminal charges against China’s Huawei,” CNN, January 28, 2019, https://www.cnn.com/2019/01/28/business/huawei-charges/index.html.

Recently, the U.S. has begun threatening to use secondary sanctions to coerce allies. Turkey was repeatedly threatened with sanctions under CAATSA for purchasing Russia’s S-400 air defense system instead of the U.S.-made Patriot. The Erdogan government proceeded with the purchase anyway, and will now likely be subject to the mandatory sanctions enshrined in the law for major buyers of Russian defense equipment.79Karoun Demirjian, “The law says Trump must punish Turkey. Congress may force him to follow through,” Washington Post, August 6, 2019, https://www.washingtonpost.com/national-security/law-says-trump-must-punish-turkey-congress-may-force-him-to-follow-through/2019/08/06/92d77a38-b597-11e9-8f6c-7828e68cb15f_story.html. The administration has done its best to stall the implementation, but it appears Congress will eventually force the president’s hand.

Following the U.S.’s unilateral withdrawal from the JCPOA, the U.S. also threatened EU companies with sanctions unless they cease business activities with Iran, even while the EU continues to adhere to the deal. Despite the strenuous objections of EU leaders and their claims of a breach of sovereignty, the U.S. has successfully pressured European companies, and even the nominally independent Belgium-based SWIFT, to once again sever ties with Iran.80Peter Eavis, “Important European Financial Firm Bows to Trump’s Iran Sanctions,” New York Times, November 5, 2016, https://www.nytimes.com/2018/11/05/business/dealbook/swift-iran-sanctions.html.

The EU lacks an effective mechanism to shield its corporations from U.S. sanctions. Although EU law can protect them within its jurisdiction, all European companies need to access the global banking system, and often have customers or suppliers associated with America’s economy, easily exposing them to U.S. financial sanctions.81Elizabeth Rosenberg, “The EU Can’t Avoid U.S. Sanctions on Iran,” Foreign Affairs, October 10, 2018, https://www.foreignaffairs.com/articles/europe/2018-10-10/eu-cant-avoid-us-sanctions-iran. In an attempt to provide some legal shelter for companies doing business in Iran, the EU recently updated the decades-old Blocking Statute that originated with Helms-Burton, forbidding European companies from cooperating with U.S. sanctions, negating any legal judgments against European firms arising from sanctions, and allowing European companies to file suit for damages incurred as a result of sanctions.82“Updated Blocking Statute in support of Iran nuclear deal,” European Commission, https://ec.europa.eu/fpi/what-we-do/updated-blocking-statute-support-iran-nuclear-deal_en.

Ironically, these rules accelerated the rate at which major European companies left Iran. Under the Blocking Statute, European companies would have to explain a decision to exit Iran to the EU authorities, who at the same time lacked the ability to truly protect them from U.S. retaliation. Caught between European law and the credible American threat of huge fines, major firms like Total, Maersk, and Allianz opted to leave Iran immediately for “business reasons” once the updated rules were proposed, rather than formally defend their decision following the Statute’s passage.83Jonathan Eyal, “Europe appears to buckle under US sanctions on Iran,” Straits Times, November 6, 2018, https://www.straitstimes.com/world/europe/europe-appears-to-buckle-under-us-sanctions-on-iran.

A similar scenario played out with SWIFT. Although SWIFT is a nominally independent institution governed by European law, the U.S. possessed multiple ways to punish non-compliance. It could sanction SWIFT directly (albeit at a big cost for global financial stability), issue visa bans and asset freezes for its board of directors, or directly target member banks that fail to comply with sanctions through fines and criminal charges.84Katrina Manson, “Europe steps up drive to exempt Swift from Iran sanctions,” Financial Times, October 9, 2018, https://www.ft.com/content/1db52c7a-ca27-11e8-b276-b9069bde0956; Peter Eavis, “Trump’s New Iran Sanctions May Hit Snag with Global Financial Service,” New York Times, October 12, 2018, https://www.nytimes.com/2018/10/12/business/dealbook/swift-sanctions-iran.html. The U.S. ultimately did not have to actually carry out any of these measures, as despite the EU’s best efforts, SWIFT participated in renewed U.S. sanctions—the messaging service was forced to suspend several Iranian banks.85Gibson Dunn, “Iran Sanctions 2.0,” November 9, 2018, https://www.gibsondunn.com/wp-content/uploads/2018/11/iran-sanctions-2-0-the-trump-administration-completes-abandonment-of-iran-nuclear-agreement.pdf.

The ease with which the U.S. was able to ignore a multilateral legal framework to which it had signed on, and compel compliance by corporations around the world motivated the EU, Iran, China, and Russia to work together to build alternative channels of keeping the deal afloat.86Steven Erlanger, “Iran Widens an Already Huge Rift Between Europe and U.S.” New York Times, October 6, 2018, https://www.nytimes.com/2018/10/09/world/europe/europe-trump-iran.html; Natasha Turak, “Europe, Russia and China join forces with a new mechanism to dodge Iran sanctions,” CNBC, September 25, 2018, https://www.cnbc.com/2018/09/25/eu-russia-and-china-join-forces-to-dodge-iran-sanctions.html. This development threatens to further undermine the effectiveness of U.S. sanctions—because the EU is a crucial partner whose cooperation the U.S. often relies on in sanctions enforcement—and could also undermine cooperation in other policy areas.

More recently, the U.S. has also returned to a hardline embargo policy against Cuba that features punitive measures against foreign and domestic firms. Title III of the Helms-Burton Act that tightened sanctions on Cuba allows Americans to sue foreign companies that benefit from properties confiscated by the Cuban government after the revolution.87Michael Weissenstein, “Trump weighs dramatic tightening of US embargo on Cuba,” Associated Press, January 17, 2019, https://www.apnews.com/6f9a8642852a402a9ef858adc271149f. It has traditionally been suspended in six-month intervals since the law was passed. But the law was allowed to go into effect in April of 2019, opening the door for as many as 200,000 lawsuits to be filed against long-established foreign companies on the island, and rankling relations with allied governments in Europe and Latin America.88Lioman Lima, “Helms-Burton Act: US firms face lawsuits over seized Cuban land,” BBC News, May 3, 2019, https://www.bbc.com/news/world-us-canada-48113549; “U.S. considering allowing lawsuits over Cuba-confiscated properties,” Reuters, January 16, 2019, https://www.reuters.com/article/us-usa-cuba/us-considering-allowing-lawsuits-over-cuba-confiscated-properties-idUSKCN1PA30I.

Targets of U.S. sanctions

As noted earlier, sanctions tend not to change the target state’s political behavior, leading to the continual imposition of more and more sanctions in an attempt to achieve the goal. The usual result is that the target state, feeling besieged but without an opportunity to arrive at a compromise, continues to defy U.S. demands. Allies can also peel off from a multilateral sanctions effort over time if they feel the U.S. is being unreasonable.

U.S. sanctions imposed on major targets

Where the U.S. imposes one type of sanction, it tends to layer on others as well.

In aggressively enforcing secondary sanctions, the U.S. is essentially claiming an expansive right to impose its own laws internationally, even where third parties are transacting with each other in compliance with their own laws.89Simond de Galbert, “Transatlantic Economic Statecraft: The Challenge to Building a Balanced Transatlantic Sanctions Policy between the U.S. and the European Union,” CNAS, June 2016, http://csis-prod.s3.amazonaws.com/s3fs-public/publication/160621_CNASReport_Economic_State.pdf. Again, the U.S. has this clout because of two advantages competitors lack—its dominant position over key aspects of the global financial system and a set of highly developed institutions.90Farrell and Newman, “Weaponized Interdependence.” These advantages allow it to exploit the “weaponized interdependence” created by an interconnected global financial system.91Farrell and Newman, “Weaponized Interdependence.” Such an approach is not without consequences, however.

Challenges to U.S. financial hegemony

The U.S. has dominated the global financial system for a long time. As long as other nations perceived U.S. power to be exercised judiciously and with a nod to their interests, they had no incentive to pursue radical change. But as the U.S. weaponized this system in recent years, the risk of relying on U.S. goodwill has become evident to other nations, leading them to take steps to counter American dominance. This manifests primarily in efforts to build alternative infrastructure and moves to chip away at the dominance of the dollar.

Russia and China have been two of the first movers in this regard, due to their size and role as traditional rivals of the U.S. After the first round of sanctions forced Visa and Mastercard, two major payment processors in Russia, to cut ties with some of their customers, Russia introduced a national payment system known as Mir in 2014.92Tatiana Voronova and Gabrielle Tétrault-Farber, “Mir card payment system looks beyond Russia,” Reuters, April 19, 2019, https://www.reuters.com/article/us-russia-cards/mir-card-payment-system-looks-beyond-russia-idUSKCN1RV0KZ. It also developed a domestic messaging service known as SPFS that mirror’s SWIFT’s function.93Samantha Sultoon, “SWIFT Action Risks Unintended Consequences,” Atlantic Council, October 9, 2018, https://www.atlanticcouncil.org/blogs/new-atlanticist/swift-action-risks-unintended-consequences.

Since then, it has taken steps to strengthen this system by having state banks wind-down relationships with American payment processors and reduce their USD holdings.94“Major Russian bank ready to shut off Visa & Mastercard, halves dollar holdings,” RT, December 20, 2018, https://www.rt.com/business/447054-russia-bank-visa-mastercard-switchover; “Russia Steps Up Efforts To Cut Reliance On U.S. Dollar, Payments System,” Radio Free Europe, August 8, 2017, https://www.rferl.org/a/russia-steps-up-efforts-cut-reliance-us-dollar-visa-payments-system-mastercard/28664423.html. According to its deputy prime minister, Russia has also hardened its financial system so it can operate independently in case it is severed from SWIFT.95Natasha Turak, “Russia’s central bank governor touts Moscow alternative to SWIFT transfer system as protection from US sanctions,” CNBC, May 24, 2018, https://www.cnbc.com/2018/05/23/russias-central-bank-governor-touts-moscow-alternative-to-swift-transfer-system-as-protection-from-us-sanctions.html. In 2019, Turkey, which has increasingly been at odds with the U.S., became the first non-Russian speaking country to begin accepting Mir payments.96“İş Bank first Turkish bank to accept Russian payment system MIR,” Daily Sabah, April 18, 2019, https://www.dailysabah.com/finance/2019/04/18/is-bank-first-turkish-bank-to-accept-russian-payment-system-mir.

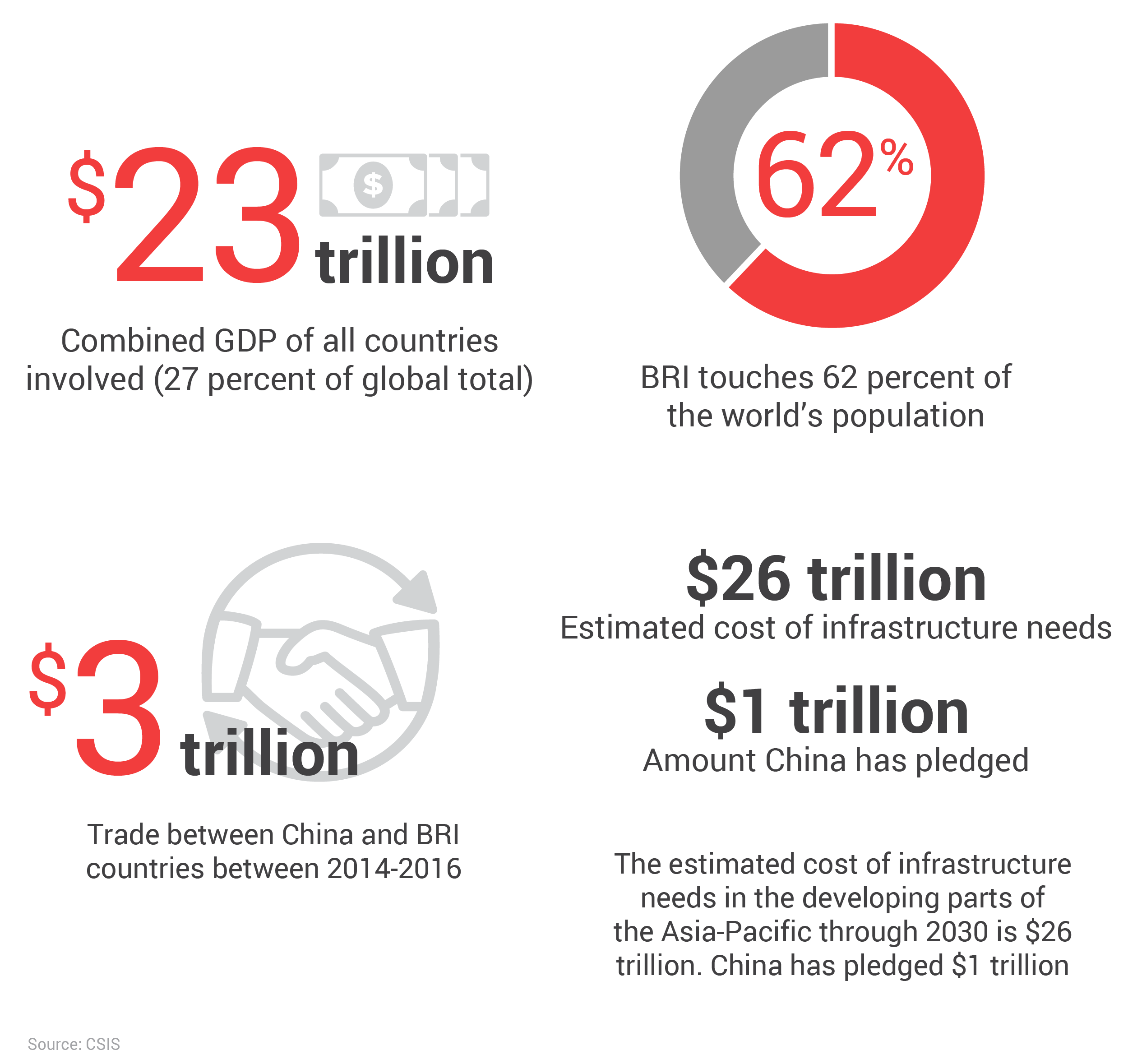

For its part, China—a growing economic power with a GDP that may surpass the U.S. as early as 2030, and which already has in terms of purchasing power parity—has launched several new institutions to challenge the U.S.-led equivalents while simultaneously attempting to increase the prominence of the RMB.97“China’s Economic Outlook in Six Charts,” IMF Country Focus, July 26, 2018, https://www.imf.org/en/News/Articles/2018/07/25/na072618-chinas-economic-outlook-in-six-charts. These include the Asian Infrastructure Investment Bank (AIIB), the Belt and Road Initiative (BRI), and the Cross-Border Interbank Payment System (CIPS).98Enea Gjoza, “RMB Internationalization Implications for U.S. Economic Hegemony,” Belfer Center, May 2018, https://www.belfercenter.org/sites/default/files/files/publication/PAE%20Gjoza%20-%20web.pdf. Possibly due to a translation issue, the Cross-Border Interbank Payment System is sometimes also interchangeably referred to as the China International Payment Service Corp., for example in the Shanghai government’s official website. http://www.shanghai.gov.cn/shanghai/n46669/n46905/n47986/u22ai108565.html.

The AIIB is designed as a World Bank equivalent for Asia where China is the dominant shareholder, as opposed to the Asian Development Bank dominated by Japan and the U.S. It is currently making loans in USD but looking to eventually expand into RMB. BRI is an infrastructure funding effort for developing nations that incentivizes increased use of RMB among loan recipients. CIPS, an RMB-based SWIFT equivalent, is particularly important to strengthening the RMB by “providing the infrastructure that will connect global RMB users through one single system.”99Gabriel Wildau, “China launch of renminbi payments system reflects Swift spying concerns,” Financial Times, October 8, 2015, https://www.ft.com/content/84241292-66a1-11e5-a155-02b6f8af6a62. It also provides a mechanism for China to continue to operate its banking system should it be sanctioned from SWIFT, and allows it to carry out transactions that are harder for Western intelligence services to monitor.100Gjoza, “RMB Internationalization.”

China has also sealed well over $400 billion worth of trade swap agreements with partners like Argentina, Indonesia, and Pakistan since 2008, using the RMB and partner states’ currencies to bypass the dollar entirely in those country-to-country transactions.101Cindy Li, “Banking on China through Currency Swap Agreements,” Federal Reserve Bank of San Francisco, October 23, 2015, https://www.frbsf.org/banking/asia-program/pacific-exchange-blog/banking-on-china-renminbi-currency-swap-agreements. Recently, China struck a $30 billion swap with Japan, which the Chinese government-affiliated Global Times called “clearly a significant step toward eroding the USD’s status in the global financial system” and a response to the “U.S. government’s reckless, unilateral moves.”102Tetsushi Kajimoto, “China-Japan sign three-year FX swap deal to strengthen financial stability, business activity,” Reuters, October 26, 2018, https://www.reuters.com/article/us-china-japan-agreements-swap/china-japan-sign-three-year-fx-swap-deal-to-strengthen-financial-stability-business-activity-idUSKCN1N00GD; Xiao Xin, “Revived Beijing-Tokyo currency swap could be key to ending US dollar’s domination,” Global Times, October 21, 2018, www.globaltimes.cn/content/1123860.shtml.

During the Cold War, the Soviet Union played the role of “black knight” in U.S. sanctions policy, driving additional business and economic support to nations sanctioned by the U.S. in order to help them resist U.S. pressure.103Elizabeth Rogers, “Using Economic Sanctions to Prevent Deadly Conflict,” Harvard Belfer Center, May 1996, https://www.belfercenter.org/publication/using-economic-sanctions-prevent-deadly-conflict. While no state has emerged as the clear successor to the Soviets in this role, China appears to be the most likely candidate. Chinese support helped keep both North Korea and Iran afloat during stringent U.S. sanctions, although primarily to advance its own economic and political interests rather than sabotage U.S. policy. As U.S.-China relations continue to degrade due to trade and political disputes, China’s role as a “black knight” will likely become more pronounced.

Both China and Russia have also dramatically increased their purchases of gold over the last 15 years, presumably to strengthen their currencies and reduce their dependence on dollar reserves. Gold was instrumental in Iran’s ability to continue trading when under U.S. sanctions prior to the JCPOA, and thus would no doubt also be useful to manage payments in the event of a financial or actual war between the U.S. and Russia or China.104Addison Wiggin, “How Gold Helped Iran Withstand U.S. Financial Fury,” Forbes, May 23, 2014, https://www.forbes.com/sites/greatspeculations/2014/05/23/how-gold-helped-iran-withstand-u-s-financial-fury/#42ab6d024925.

Europe has also tried to increase its independence from the U.S. following America’s withdrawal from the JCPOA. Given the success the U.S. has had in deterring European companies from doing business with Iran and forcing SWIFT to evict Iranian banks from the system, it became obvious that where U.S. and European security and prosperity interests diverged, the U.S. was willing and able to run roughshod over the Europeans.105Michael Peel, “Swift to comply with US sanctions on Iran in blow to EU,” Financial Times, November 5, 2018, https://www.ft.com/content/8f16f8aa-e104-11e8-8e70-5e22a430c1ad. The French foreign minister complained that Europe was in danger of becoming an American “vassal,” while the German foreign minister pushed for a European alternative to SWIFT that was insulated from U.S. pressure.106“France: Europe isn’t U.S. ‘vassal,’ should trade with Iran,” CBS News, May 11, 2018, https://www.cbsnews.com/news/france-europe-not-us-vassal-iran-nuclear-deal-donald-trump-germany-sanctions; Jo Harper, “Germany urges SWIFT end to US payments dominance,” Deutsche Welle, August 27,2018, https://www.dw.com/en/germany-urges-swift-end-to-us-payments-dominance/a-45242528.

To help continue to facilitate trade with Iran, the Europeans launched a Special Purpose Vehicle, the “Instrument In Support of Trade Exchanges (INSTEX),” whose headquarters are in the French Ministry of Economy and Finance.107DLA Piper, “Unpacking INSTEX – the new mechanism to facilitate trade with Iran,” Lexology, February 14, 2019, https://www.lexology.com/library/detail.aspx?g=4336c946-1411-4c98-a3a9-7ff1eb0b2bb7. INSTEX provides a platform for handling trade-related payments through a barter-like system of credits that would not require the exchange of money, thus circumventing financial controls on Iran.108Patrick Wintour and Saeed Kamali Dehghan, “European ‘clearing house’ to bypass US sanctions against Iran,” Guardian, November 6, 2018, https://www.theguardian.com/world/2018/nov/06/european-clearing-house-to-bypass-us-sanctions-against-iran.

The U.S. initially expressed strong opposition to INSTEX, rightly viewing it as an attempt to create a viable means of circumventing U.S. financial dominance.109Jonathan Stearns and Helene Fouquet, “U.S. Warns Europe That Its Iran Workaround Could Face Sanctions,” Bloomberg, May 29, 2019, https://www.bloomberg.com/news/articles/2019-05-29/u-s-warns-europe-that-its-iran-workaround-could-face-sanctions. Ironically, when Iran began violating the JCPOA following the U.S. withdrawal, some American officials quietly began hoping INSTEX succeeded as a way to keep Iran compliant with the deal’s nuclear restrictions.110Nahal Toosi, “Trump wants to talk. Iran isn’t interested,” Politico, July 7, 2019, https://www.politico.com/story/2019/07/07/trump-iran-nuclear-north-korea-1399406. Although at present, INSTEX is far from a viable alternative to the U.S. financial system given the relatively small volume of business it handles, the determined attempt to move forward in the face of intense U.S. pressure signals Europe’s growing resentment at American heavy-handedness and desire to limit U.S. dominance of global finance.

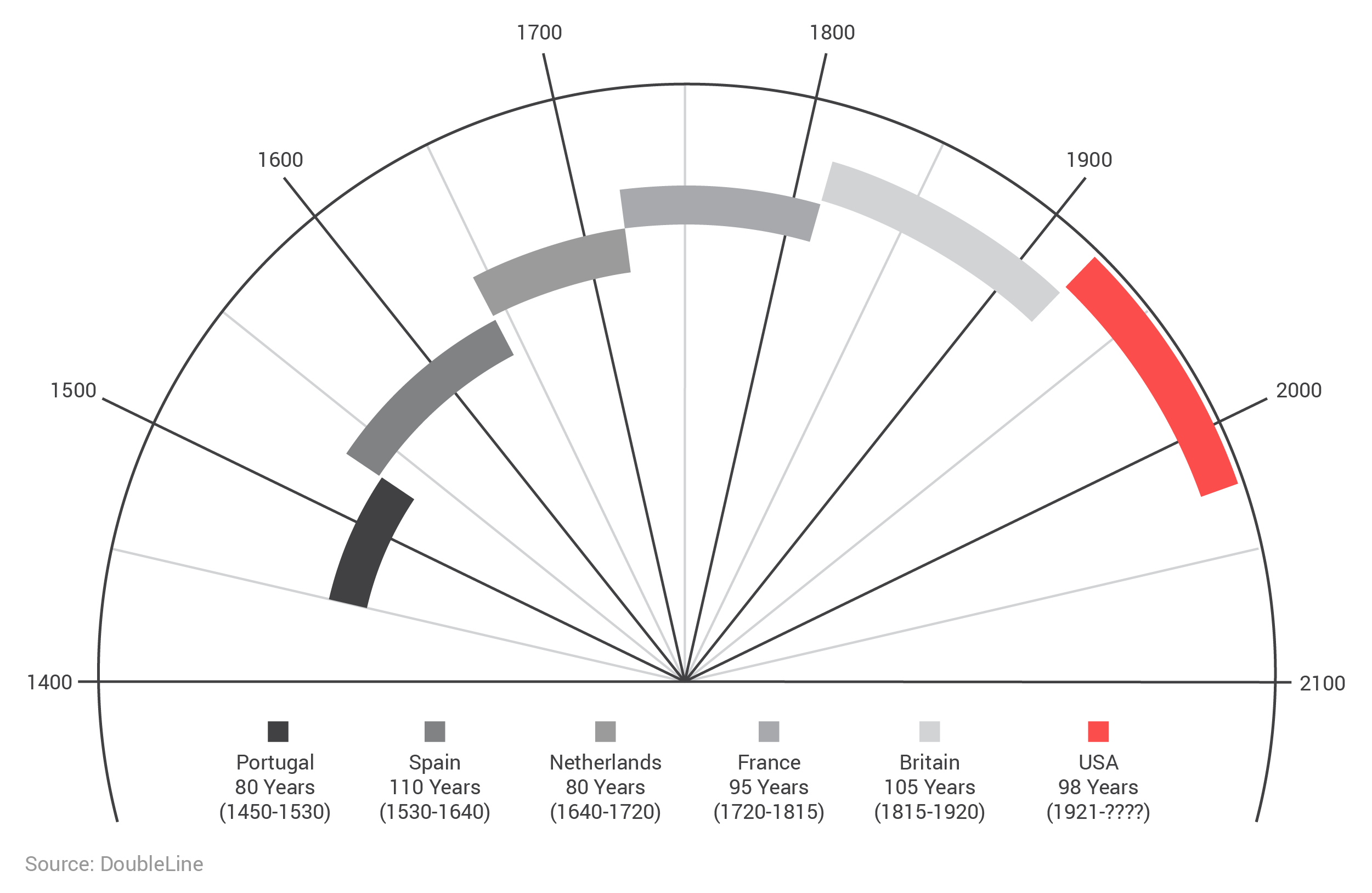

Assessing the consequences

The growing pushback to U.S. dominance has not yet materialized into a full-fledged decline of the dollar and American banking influence. Building credible alternatives is an expensive and time-consuming effort. Currency dominance tends to outlast economic dominance—the pound remained the dominant currency for 70 years after the American economy overtook the British economy.111Jeffrey Frankel, “Internationalization of the RMB and Historical Precedents,” Journal of Economic Integration 27, no. 3 (2012): 329–365.

China achieved a major victory for the RMB when it was added to the IMF’s special drawing rights basket of currencies in 2016, making it an official reserve currency.112“IMF Adds Chinese Renminbi to Special Drawing Rights Basket,” IMF, September 30, 2016, https://www.imf.org/en/News/Articles/2016/09/29/AM16-NA093016IMF-Adds-Chinese-Renminbi-to-Special-Drawing-Rights-Basket. Despite this success, the RMB comprises only roughly 2 percent of central bank reserves, and relatively little global trade is conducted in RMB.113Gjoza, “RMB Internationalization Implications.”

Capital markets that are “open and free of controls, but also deep and well-developed” are crucial to fostering a truly international currency.114Frankel, “Internationalization of the RMB,” 329–365. Private property rights—the ability to use a currency to securely purchase and then sell that country’s assets, are also essential. China’s extensive capital controls and the central’s bank’s active management of the RMB’s price are a major barrier to widespread adoption of the RMB by foreign investors.

Dominant global currencies in the past six centuries

Over the last six centuries, global currencies maintained their dominance for 94 years on average. The U.S. dollar has been dominant for 98 years so far.

Foreign investors’ inability to purchase assets in China and be guaranteed proper legal protection is another barrier—not to mention the uncertainties about whether they will be able to get their money out. A substantial shift in the Chinese government’s approach to regulation in financial and capital markets, and maybe even better legal protections that would require a change in governance, would be necessary to attract significant foreign interest in the RMB.

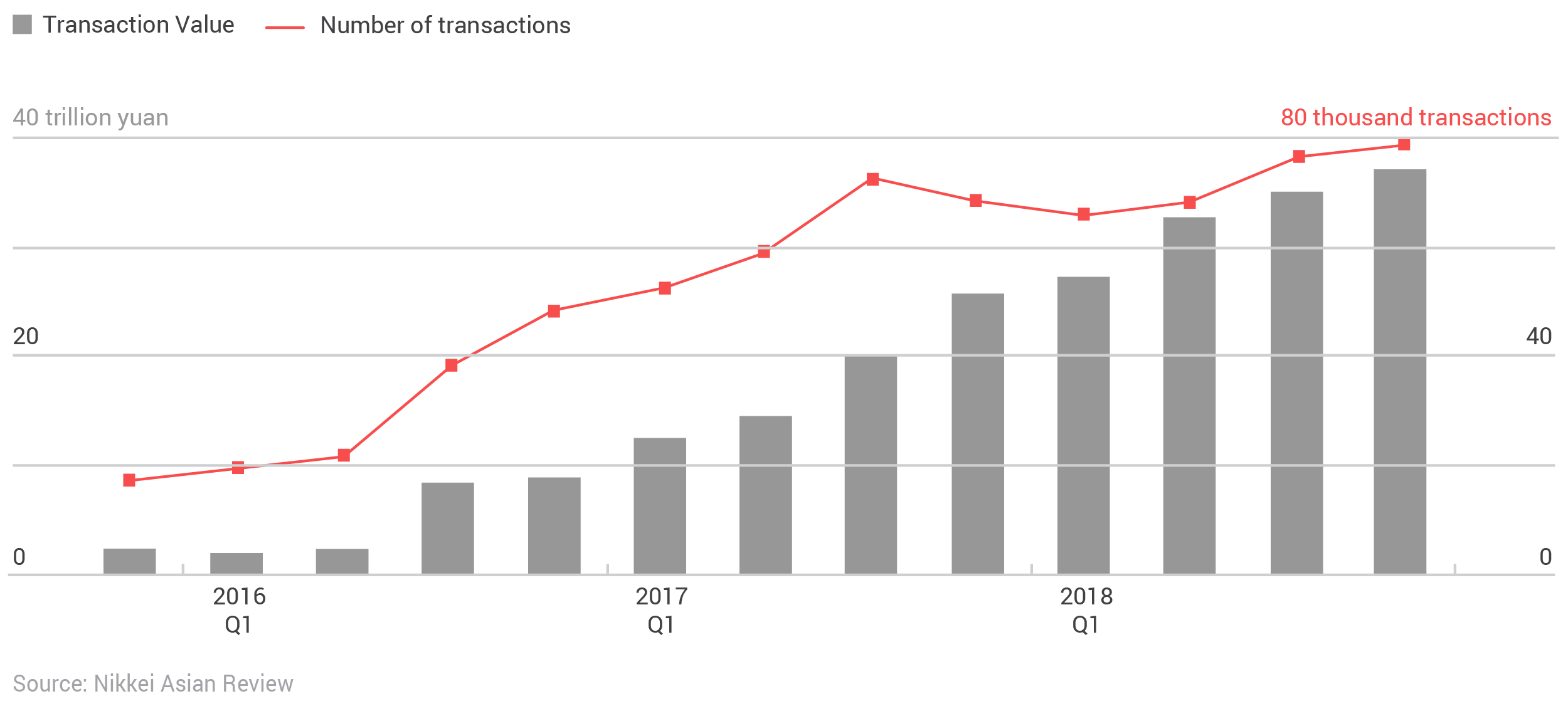

Nevertheless, China is trying. CIPS has come a long way since its 2015 founding. It has grown from 19 direct participants and 176 indirect participants at its inception to 31 direct participants and 829 indirect participants today, while also expanding service to cover more time zones and standardizing its protocols to bring them in line with SWIFT.115Gjoza, “RMB Internationalization Implications”; “CIPS World Service.” www.cips.com.cn/cipsenmobile/index.html; “Chinese Central Bank has introduced CIPS,” Deutsche Bank, https://www.db.com/specials/en/docs/chinese-central-bank-cips.pdf. It has also significantly expanded both in the volume and value of transactions it handles.

The growth of CIPS, China’s native payment clearing and settlement system

China’s payment clearing and settlement system has seen rapid growth since its launch in 2015.

Similarly, the BRI, while facilitating increased use of RMB in some areas, has seen a decline of RMB use in others.116“RMB Internationalisation: Can the Belt and Road Revitalise the RMB?,” SWIFT, July 28, 2017, https://www.swift.com/news-events/press-releases/rmb-internationalisation_can-the-belt-androad-revitalise-the-rmb. Out of the 68 BRI nations, 33 are rated below investment grade, suggesting that they pose too much of a credit risk to secure development loans on the open market.117John Hurley, Scott Morris, and Gailyn Portelance, “Examining the Debt Implications of the Belt and Road Initiative from a Policy Perspective,” Center for Global Development, March 2018, https://www.cgdev.org/sites/default/files/examining-debt-implications-belt-and-road-initiative-policy-perspective.pdf.

China’s willingness to fund projects in these nations will no doubt buy loyalty from their governments, but China will pay for this privilege in the form of higher than normal defaults. Politically, however, as long as China is able to bear the cost of these projects, it will have an easier time pushing adoption of its own currency, commercial norms, and financial institutions among the participants.

Russia by itself can chip away at the USD and dollar-based institutions, but it lacks the financial heft (its GDP is just $1.6 trillion versus $19.4 trillion for the U.S.) to do major damage unless it is integrated into a major coalition.

The EU’s drift from the U.S. is more alarming, since the Euro is the closest thing to a peer competitor for the USD, accounting for roughly 20 percent of global central bank reserves, second only to the dollar.118Richard Leong, “U.S. Dollar Share of Global Currency Reserves Fall Further—IMF,” Reuters, July 1, 2018, https://www.reuters.com/article/uk-forex-reserves/u-s-dollar-share-of-global-currency-reserves-fall-further-imf-idUSKBN1JR21G. At the same time, the EU requires consensus to function, is politically fractious, and the U.S. can slow the bloc’s initiatives by peeling off member states.119Manuel Herrera, “Collision On Course? An Assessment Of EU-US Fall-Out Over The JCPOA—Analysis,” Eurasia Review, December 27, 2018, https://www.eurasiareview.com/27122018-collision-on-course-an-assessment-of-eu-us-fall-out-over-the-jcpoa-analysis.

Snapshot of China’s “Belt and Road Initiative”