Key points

Taiwan’s dominance in advanced semiconductor manufacturing and rising U.S.-China tensions have produced alarm that a Chinese invasion or blockade of Taiwan could cause a major disruption of the global semiconductor supply chain. This has led some to claim that the U.S. should defend Taiwan in order to maintain its supply of advanced chips.

Fears that China could seize Taiwan’s chip-manufacturing capacity and leapfrog the U.S. technologically are overblown. Interdependence cuts both ways; if China invaded Taiwan, it would be cut off from the vital inputs controlled by the U.S. or its allies, and therefore unable to resume chip production under new management.

Others fear Taiwanese chips could be disrupted during a Chinese blockade or a protracted conflict and tend to recommend bolstering U.S. capabilities to deter China. However, there are strong reasons to doubt the U.S. can ultimately deter Beijing if it feels that force is its only option for national reunification.

Further efforts by the U.S. to deter China may only present Beijing with a closing window, encouraging it to use force before its prospects worsen, and precipitating the very conflict the U.S. seeks to prevent; a war between the U.S. and China would be exponentially costlier than any potential semiconductor supply shock resulting from a cross-strait invasion.

Instead, the U.S. should seek to dial down the temperature with Beijing in order to maintain the political and territorial status quo and buy the time needed to diversify its own semiconductor supplies by onshoring or “allyshoring” chip manufacturing. The U.S. should therefore avoid provoking Beijing unnecessarily, and reaffirm the substance of the One China Policy while seeking to develop a longer-term settlement with Beijing over the future of the region.

Amid a COVID-induced supply crunch and rising tension between the United States and China, growing attention has been focused on the critical role of semiconductors in the global economy and the vulnerability of supply chains to disruption. According to one commentator, “Controlling advanced chip manufacturing in the 21st century may well prove to be like controlling the oil supply in the 20th. The country that controls this manufacturing can throttle the military and economic power of others.”1

Taiwan’s dominance in advanced chip manufacturing makes it a potential chokepoint in the global semiconductor supply chain. Taiwan’s leaders sometimes assert that the dependence of both the United States and China on their semiconductors is a “silicon shield” that deters an invasion by the mainland while assuring a U.S. security commitment.2 However, escalating U.S.-China tensions and the possibility that Beijing may seek national reunification through force have produced alarm that the United States risks being cut off from Taiwan’s chip supply in the event of a cross-strait contingency. The United States and other governments around the world have therefore initiated efforts to reduce their supply chain vulnerability, pursuing ambitious policies to onshore production and diversify suppliers. These efforts, however, will take years to bear fruit and have no guarantee of success, so that for the time being, much of the world remains dependent on Taiwan’s semiconductor industry.3

In this context, many experts have expressed fears that China could either stage a hostile takeover of Taiwan’s chip-manufacturing capacity or effect a critical disruption of chip supplies as a secondary consequence of a blockade or protracted invasion of the island. Some have therefore argued that these “nightmare scenarios” provide additional reasons for the United States to defend Taiwan.4

Neither of these scenarios, however, justify an explicit commitment to Taiwan’s defense or the risk of a great power war with China. First, Taiwan’s chip industry is a weak incentive for a cross-strait invasion. It is implausible that China could successfully absorb Taiwan’s chip industry and continue production under new management, given China’s inability to substitute vital upstream inputs supplied by the United States and its allies. This would make capture of the island’s manufacturing base a hollow prize for Beijing as it continues to struggle for technological self-sufficiency. On the other hand, the “silicon shield” is also a weak deterrent against a cross-strait conflict, as Beijing may accept enormous economic costs if its objective of national reunification is otherwise at risk. From the United States’ perspective, the danger that a Taiwan conflict would cut off semiconductor supplies is outweighed by the far more severe costs and risks that a great power war would entail. Furthermore, efforts by the United States to deter China through additional military buildups or expressions of resolve have a high risk of provoking the very conflict they are meant to prevent. The United States can best prevent the latter scenario by easing tensions with Beijing and returning to the substance of the One China Policy—at a minimum, in order to buy time for the United States to diversify its chip supplies.

The chip race

The semiconductor industry is characterized by a high degree of specialization and interdependence at each node of the global supply chain. The production process requires enormous capital expenditures, precise conditions, and sophisticated technical know-how, driving a relentless need for efficiency in order to successfully compete at scale. Incorporating some of the most advanced technology on the planet, the industry’s pace of innovation is dizzying, the barriers to entry by new firms are formidable, and a lack of quickly available substitutes make adaptation to disruptions particularly costly.5 While U.S. firms maintain a formidable lead at many stages of the global supply chain—particularly in R&D and design—the United States’ total share of semiconductor manufacturing has fallen over the past three decades from 37 percent to 12 percent.6

The two main types of chip producers are integrated device manufacturers like Samsung and Intel who perform each stage of the production process, and “foundries” like Taiwan Semiconductor Manufacturing Company (TSMC) that act as contract manufacturers for firms like Apple, Qualcomm, and Nvidia. Semiconductor chips vary in sophistication, but at present only two firms—TSMC and Samsung—can reliably produce at scale the advanced logic chips needed for the latest iPhone or MacBook, as well as F-35 fighter jets and emerging AI systems.

THE GLOBAL PATH OF A SMARTPHONE APPLICATION PROCESSOR

Manufacturing semiconductors is a truly global endeavor. Even if China captured Taiwan’s chip manufacturing capacity, the United States or its allies could halt production by cutting off essential upstream inputs.

Advanced semiconductors are currently understood to be chips at the 7-nanometer (nm) node or under.7 The current state-of-the-art is 5-nm, although manufacturers have already started to produce 3-nm chips, with advances towards 2-nm chips already in progress.8 Advanced logic chips only make up 2 percent of the total chip market, but they define the threshold of innovation. While TSMC produces over 92 percent of advanced logic chips, no firms in the United States currently produce any.9 Samsung can produce chips at least as sophisticated as TSMC, though it has struggled to do so reliably to meet demand.10 U.S.-based Intel, long an industry titan, has fallen behind its foreign competitors in recent years, though it is investing heavily in order to re-emerge as a leader in cutting-edge chips by mid-decade.11

Taiwan’s centrality in the global semiconductor supply chain is only one element in a broader technological competition between the United States and China. China’s largest and most advanced chip company, Semiconductor Manufacturing International Corporation (SMIC) has been at the center of Beijing’s ambitious “Made in China 2025” plan to ascend the global value chain from low-end manufacturing to high-tech leadership. American policy-planners have become increasingly worried that China might eventually overtake the United States in technological advancement, potentially endowing it with a commanding position in the global economy and conferring a military advantage over the United States in emerging domains like AI.12 The United States began imposing export restrictions on chip-making technology to China during the Trump administration, in turn motivating China to pursue greater technological and supply chain self-sufficiency.13

Fears of an eventual “chip gap” have produced unwarranted alarm within the Beltway ecosystem. For example, in an article titled “China Has Leapfrogged the U.S. in Key Technologies,” David Sanger of the New York Times writes that “progress in chip manufacturing is now scrutinized as a way to define national power” and that “China was surging ahead” in semiconductor innovation due to its enormous government expenditure and the appearance of its first 7-nm chip.14

These fears are overstated, however. According to the U.S.-China Economic and Security Commission’s (USCC) 2021 Report, China’s “Made in China 2025” has been an immensely costly and wasteful boondoggle:

Despite massive investment, the CCP has fallen far short of its ambition of creating a self-sufficient domestic manufacturing base to meet China’s technological needs. The Made in China 2025 Plan, released in 2015, called for Chinese firms to produce 40 percent of semiconductors used in China by 2020 and 70 percent by 2025. In 2020, Chinese firms produced only 5.9 percent of semiconductors used in China [. . .] 15

As a result, a wave of corruption and fraud investigations are currently sweeping the executive ranks and corporate beneficiaries of the multi-billion-dollar government investment program (“Big Fund”) for China’s domestic chip industry.16

Furthermore, industry experts have concluded that SMIC was only able to produce its 7-nm chip painstakingly and time-intensively by using less advanced “deep ultraviolet” (DUV) photolithography technology, meaning that SMIC cannot produce 7-nm chips at anything like the yield or scale needed to match its foreign rivals.17 Yet even if it could, this would still put SMIC approximately four years behind leading firms like TSMC and Samsung, a lifetime in an industry where the pace of change is set by Moore’s law.18 While it is true that no U.S. firms or foreign-owned fabrication plants are currently making chips 7-nm or less, TSMC, Samsung, and Intel are building fabs in the United States that will begin producing chips 5-nm and less by mid-decade, and Intel has placed the first orders for ASML’s upcoming High-NA technology in order to produce chips at the 18- and 20-”Angstrom” (≤2-nm) node.19 Therefore, while SMIC’s 7-nm chip is a clever workaround and a triumph of determination, it is far from a breakthrough innovation putting China in a position of technological leadership.20

Nightmare scenarios

Hostile takeover

Given China’s continuing dependence on Taiwanese chips, some experts have posited that the supposed dual deterrent of Taiwan’s “silicon shield” may actually be a “double-edged sword” that incentivizes China to try to seize control of the island’s semiconductor manufacturing base.21 Robert Work, former Deputy Secretary of Defense and vice chair of the National Security Commission on Artificial Intelligence, told the Financial Times in 2021, “We’re 110 miles away from going from two generations ahead to maybe two generations behind [. . .] If China absorbed Taiwan . . . that would really be a competitive problem for us.”22 Similarly, the report’s chair, former Google CEO Eric Schmidt, recently wrote with Graham Allison that “Washington recognizes the need to deter Beijing from seizing the chips that power American electronics.”23 Cable host Tucker Carlson has even warned that a hypothetical Chinese takeover of TSMC would put America “in the beta position.”24

At first glance, these fears might appear to have some justification. Indeed, one Chinese economist has explicitly stated that if sanctions like those imposed on Russia are levied against China, then “in the reconstruction of the industrial chain and supply chain, we must seize TSMC.”25

However, a hostile takeover of TSMC is unlikely to succeed or to drive Beijing’s calculations regarding an invasion of Taiwan, particularly as long as its goal of self-sufficiency remains unfulfilled.26 On the one hand, the risk for damage to TSMC’s facilities would be significant, and given the shortage of skilled workers already bedeviling chipmakers, a Chinese occupation would likely have trouble retaining TSMC’s engineering talent and absorbing its knowledge productively.27 But even if Chinese forces were able to capture Taiwan’s chip manufacturing capacity intact, resumed production could not be sustained due to a panoply of essential upstream inputs supplied by the United States or its allies, all of which could be cut off in a Taiwan contingency, leaving China without available substitutes. All advanced semiconductor manufacturers are dependent upon ASML, the only producer of the “extreme ultraviolet” (EUV) photolithographic technology needed to produce advanced chips at scale.

Semiconductor industry by activity and region

Different regions specialize in different parts of the value chain. The reliance on a diverse and global supply chain makes it difficult for any one country to truly leapfrog or surge ahead of the others.

Based in the Netherlands and with factories in the United States, ASML has its own network of unique suppliers and already complies with western export restrictions that prevent China from buying EUV machinery.28 ASML is not the only chokepoint; one industry report identifies at least 50 supply chain bottlenecks determined by geographic concentration, the vast majority of which are located either in the United States or among its allies.29 These include essential semiconductor manufacturing equipment (SME) producers like Applied Materials, Lam Research, and KLA Corp., on whom rapidly tightening export restrictions to China are being imposed.30 Given the relentless pace of change and innovation in the industry, and without the ability to replenish or replace its existing materials and equipment, China’s new acquisition would quickly be outpaced by its foreign competitors.

In its 2021 Report, the USCC came to a similar conclusion:

Taiwan’s singular leadership in the global semiconductor supply chain would be difficult for China to recreate in the short term [. . .] If China invaded Taiwan, damage inflicted on the island’s foundries during a conflict would prevent their immediate use once seized. For example, uncontrolled shutdowns to semiconductor manufacturing facilities would damage equipment, the repair or replacement of which would take months or years depending on the equipment involved. Additionally, U.S. allies and partners that serve as chief suppliers to Taiwan’s semiconductor industry could impose sanctions and embargoes following a Chinese invasion of the island. This would leave Beijing with highly advanced semiconductor manufacturing assets but without the resources needed to operate them in the immediate term.31

From Beijing’s view, therefore, a hostile takeover of TSMC would be equivalent to “one step forward, two steps back.” An attempt to capture TSMC is therefore unlikely to drive the mainland’s considerations about whether—or when—to invade Taiwan. The fact that the mainland continues to pursue self-sufficiency while poaching talent and intellectual property from Taiwan implies that Beijing is not seeking to achieve semiconductor dominance through conquest anytime soon.

Disruption

The other nightmare scenario posited by some experts is that a Chinese blockade or a protracted conflict over Taiwan could result in a shortage of semiconductor supplies, triggering a crisis throughout the global economy. While the prospect of successfully capturing and harnessing TSMC’s capacity is too remote to be a positive incentive for Beijing to initiate a conflict over Taiwan, the “silicon shield” may not be a robust enough deterrent against an attack by the mainland either.32 This has supplemented calls by China hawks for a stronger U.S. defense commitment to Taiwan.33

A shutdown of Taiwanese semiconductor exports to the rest of the world would certainly have widespread repercussions. According to an industry study:

In an extreme hypothetical scenario of complete disruption for one year, Taiwanese foundries would lose their current cumulative $42 billion in revenues, but that could also cause a $490 billion drop in revenue, or 12 times more negative impact, for electronic device makers across different application markets. The global electronics supply chain would come to a halt, creating significant global economic disruptions. If such hypothetical complete disruption were to be [sic] become permanent, it could take a minimum of three years and $350 billion of investment in what would be an unprecedented effort to build enough capacity in the rest of the world to replace the Taiwanese foundries.34

As the two largest markets in the world for semiconductors, the United States and China would both be hard hit by an exigency of this kind.35 According to the logic of the “silicon shield,” this should be enough to deter China from attacking Taiwan and ensure a U.S. commitment to the island’s security. Nevertheless, the vast asymmetry in the balance of resolve between the United States and China—and the emergent asymmetry in the local balance of power—makes the “silicon shield” a poor deterrent. If China can be deterred by the economic costs of a disruption of Taiwanese chip exports, it will be likely to wait until after it achieves self-sufficiency before seriously contemplating a blockade or invasion. But if China is willing to accept the much higher costs of a confrontation with the United States in order to achieve its national goals, there is no reason to believe it would be deterred by semiconductors.

China is likely willing to accept enormous costs—economic and otherwise—in order to prevent Taiwanese independence and achieve its cardinal objective of national reunification.36 However severe the effects of a semiconductor supply shock might be, they would pale in comparison to the costs of either sanctions on China or a direct U.S.-China conflict. According to an internal Chinese report, even if the United States refrained from direct intervention in a Taiwan conflict and instead imposed sanctions on China comparable to those levied on Russia following its invasion of Ukraine, over $2.6 trillion could be wiped out from the global economy, producing a depression even more severe than that caused by the coronavirus.37

A direct conflict between the United States and China would be far more catastrophic—even when only assessing the economic fallout. A study by RAND estimated that one year of severe war between the United States and China would cause a 5 percent to 10 percent decline in GDP for the United States and a 25 percent to 35 percent decline for China.38

Based solely on the asymmetric economic damage that China would suffer in a major war with the United States, one might conclude that America’s forward posture already provides a sufficient deterrent. This conclusion would be mistaken, however. The economic imbalance favoring the United States is certainly offset to some degree by the imbalance of resolve favoring China. Therefore, even if a U.S.-China war were to become protracted, China might well continue to prioritize its political objectives over its potential economic losses. Chinese military planning over the past quarter-century—specifically its development of anti-access/area denial capabilities—makes clear that Beijing has already factored in the likelihood of an American intervention, particularly in the event of a Taiwan contingency.39 Consistent outcomes in U.S. war-gaming do not produce confidence in the U.S.’s ability to intervene successfully in such a scenario; in short, the war tends to escalate rapidly, and the United States tends to lose.40

Most advocates for a more robust deterrent posture concede that the United States cannot currently defend Taiwan, and therefore argue that the United States must aggressively increase its capabilities in the western Pacific.41 Proponents of an augmented deterrent posture are faced with further dilemmas, however.

First, deterrence is not an alternative to war; it signals a preference for peace below a certain price, and a preference for war above that price. How does one square the argument, then, that the costs of a disruption to Taiwan’s chip supplies would be too high to bear when the costs of a war with China would be immeasurably higher?

Secondly, further attempts to deter China over Taiwan may very likely provoke the very conflict they are supposed to prevent by presenting Beijing with the prospect of a closing window. Bringing additional capabilities to bear will take time, and yet the faster and more efficiently the United States can supplement its posture in the region, the more urgency it imposes on Beijing to take action before its prospects worsen.

In other words, a “deterrence-first” approach to the Taiwan issue simultaneously raises the stakes and the probability of deterrence failure. It is a case of the cure being worse than the disease, or in Bismarck’s words, of “committing suicide for fear of death.”

Stepping back for a moment: what are the United States’ goals regarding Taiwan, and how can they best be achieved? The United States’ overarching goal regarding Taiwan should be to maintain the politico-territorial status quo for as long as possible. The United States’ specific goal regarding its dependence on Taiwanese semiconductors should be to maintain the status quo at least long enough to diversify its semiconductor manufacturing supplies. Therefore, insofar as semiconductor manufacturing is considered a critical industry, the United States should be seeking to buy time as it tries to onshore a minimum of semiconductor manufacturing, while trusted partners like South Korea, Japan, and Germany try to boost their own chip production capacity.

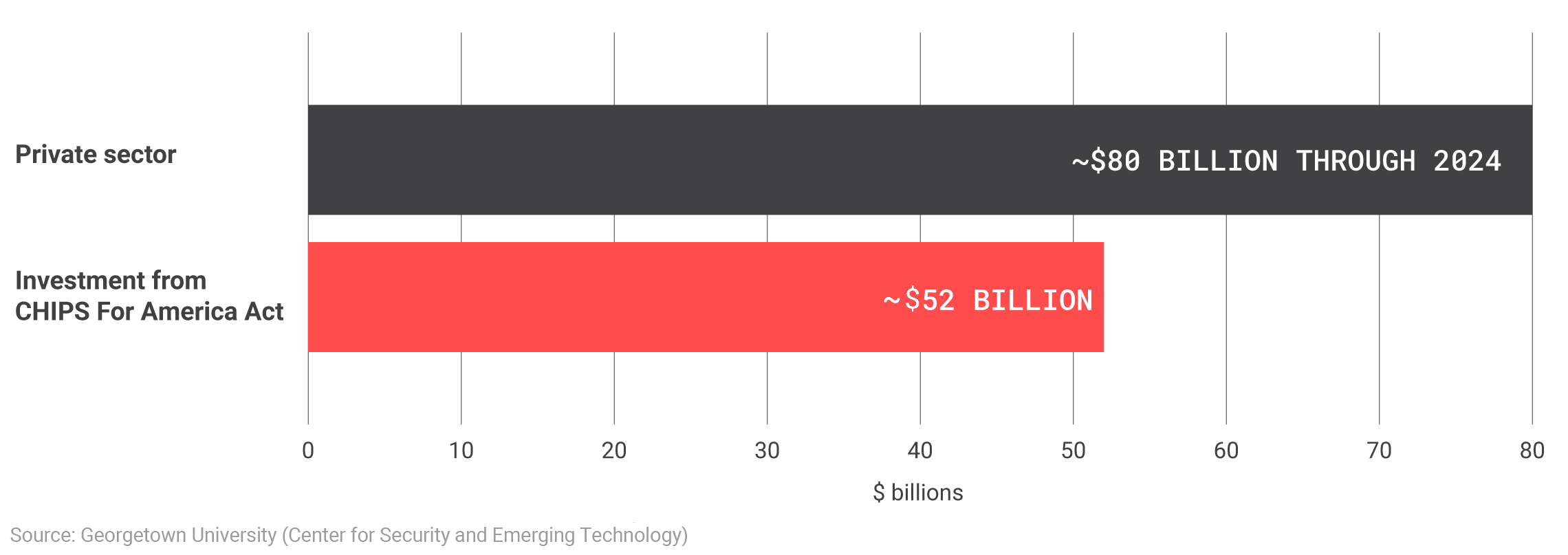

ANNOUNCED NEAR-TERM investment in U.S.-based semiconductor capabilities

Announced investment plans by U.S. semiconductor companies and the U.S. government show investment in local semiconductor production capabilities is increasing. The U.S. should prioritize maintaining the status quo in Taiwan indefinitely, but the status quo should be preserved at the very least until these investments take hold and the United States onshores semiconductor manufacturing.

Both goals call for the United States to dial down the temperature with Beijing and reaffirm the substance (not just the label) of the “One China Policy”—whereby the United States recognizes the PRC as the sole legitimate government of China, acknowledges (but does not accept) Beijing’s claim to Taiwan, and maintains a position of “strategic ambiguity” to deter both the mainland from invasion and the island from secession. An invasion of Taiwan is most likely viewed as a last resort by Beijing, not a first choice. Despite China’s repeated preference for peaceful reunification, the Anti-Secession Law of 2005 makes clear that if Taiwan either pursued de facto independence, or if peaceful reunification became impossible, China would feel compelled to use force.42 Washington should therefore refrain from provocative moves such as shifts to “strategic clarity,” official visits by high-ranking public officials, or major buildups of the United States’ military presence in the western Pacific.43 Washington has been reckless in all these regards of late; unsurprisingly, Beijing has reacted furiously, further escalating tensions. Xi’s backdoor entreaty prior to Speaker Pelosi’s ill-advised visit—which Washington rebuffed—is nonetheless a promising sign of Beijing’s willingness to de-escalate (despite being provoked), particularly as it faces major domestic challenges regarding economic growth, pandemic management, and demographic imbalance.44

Preserve the status quo

The good news is that the near-impossibility of China absorbing Taiwan’s semiconductor manufacturing base by force also renders it a weak incentive for a cross-strait invasion. The bad news is that Taiwan’s “silicon shield” is also a poor deterrent in the face of Beijing’s determination to achieve national reunification. Rather than risk provoking a war by redoubling the United States’ commitments to Taiwan and disrupting the political status quo, Washington’s goal should be to ease tensions and reduce Beijing’s sense of urgency, buying the time needed to diversify semiconductor production onshore and among allies. In doing so, the United States will be well-placed to maintain its technological edge by benefitting from the gains in efficiency that come with a supply chain spread across a number of allies, whereas China in its drive for self-sufficiency will have a steeper hill climb by having to go it alone.45

The semiconductor issue is largely irrelevant to the debate about whether or not the United States should defend Taiwan. The United States’ efforts to develop an onshore manufacturing base and resilient supply chains with reliable partners are primarily matters for economic, not defense, policy. Similarly, the United States’ ongoing technological competition with China is distinct from issues related to U.S. force posture, alliance structure, and extended deterrence in the western Pacific. Limited technological competition does not have to spill over into armed confrontations over long-standing politico-territorial disputes. Experts and policymakers should avoid unnecessarily conflating economic and technological challenges with military threats, which only serves to confuse the issue and distort America’s policy choices.

Endnotes

1 Steve Blank, “The Chip Wars of the 21st Century,” War on the Rocks, June 11, 2020, https://warontherocks.com/2020/06/the-chip-wars-of-the-21st-century/.

2 Indeed, Taipei’s belief in a “silicon shield” has likely contributed to Taiwan’s low level of defense spending despite its increasingly threatening environment, and therefore to its ultimate unpreparedness. Christopher Vassallo, “The ‘Silicon Shield’ Is a Danger to Taiwan and America,” The National Interest, May 15, 2022, https://nationalinterest.org/feature/%E2%80%98silicon-shield%E2%80%99-danger-taiwan-and-america-202363.

3 Cheng Ting-Fang and Lauly Li, “The Resilience Myth: Fatal Flaws in the Push to Secure Chip Supply Chains,” Financial Times (Nikkei Asia), August 4, 2022, https://www.ft.com/content/f76534bf-b501-4cbf-9a46-80be9feb670c.

4 See, for example, Hal Brands and Michael Beckley, Into the Danger Zone: The Coming Crisis in US-China Relations (Washington, DC: American Enterprise Institute, 2021), 4; Stephen Ezell, “The Future of Taiwan: Semiconductors Alone Make the Island’s Continued Freedom Crucial to the U.S.,” Discourse, April 16, 2021, https://www.discoursemagazine.com/politics/2021/04/16/the-future-of-taiwan-semiconductors-alone-make-the-islands-continued-freedom-crucial-to-the-u-s/; Ian Eaton, “Why the US defends Taiwan,” Taipei Times, September 16, 2019, https://www.taipeitimes.com/News/editorials/archives/2019/09/16/2003722357; Jason Matheny, “The U.S. Has a Microchip Problem. Safeguarding Taiwan is the Solution,” The Atlantic, October 3, 2022, https://www.theatlantic.com/international/archive/2022/10/taiwan-microchip-supply-chain-china/671615/.

5 Overviews can be found in Antonio Varas et al., “Strengthening the Global Semiconductor Supply Chain in an Uncertain Era,” Boston Consulting Group and Semiconductor Industry Association, April 2021, https://web-assets.bcg.com/9d/64/367c63094411b6e9e1407bec0dcc/bcgxsia-strengthening-the-global-semiconductor-value-chain-april-2021.pdf; Saif M. Khan et al., “The Semiconductor Supply Chain: Assessing National Competitiveness,” Center for Security and Emerging Technology, January 2021, https://cset.georgetown.edu/publication/the-semiconductor-supply-chain/; Jan-Peter Kleinhans and Nurzat Baisakova, “The Global Semiconductor Value Chain: A Technology Primer for Policy Makers,” Stiftung Neue Verantwortung, October 2020, https://www.stiftung-nv.de/sites/default/files/the_global_semiconductor_value_chain.pdf.

6 Antonio Varas et al., “Government Incentives and US Competitiveness in Semiconductor Manufacturing,” Boston Consulting Group and Semiconductor Industry Association, September 2020, https://web-assets.bcg.com/27/cf/9fa28eeb43649ef8674fe764726d/bcg-government-incentives-and-us-competitiveness-in-semiconductor-manufacturing-sep-2020.pdf.

7 Advanced nm nodes no longer strictly refer to physical properties of circuits, but instead refer to progressive advancements. See Samuel K. Moore, “A Better Way to Measure Progress in Semiconductors,” IEEE Spectrum, July 21, 2020, https://spectrum.ieee.org/a-better-way-to-measure-progress-in-semiconductors.

8 Scott Foster, “U.S., Japan Reaching for a 2-nm Chip Breakthrough,” Asia Times, August 1, 2022, https://asiatimes.com/2022/08/us-japan-reaching-for-a-2-nm-chip-breakthrough/.

9 Varas et al., “Strengthening the Global Semiconductor Supply Chain,” 18, 35.

10 Kotaro Hosokawa and Hideaki Ryugen, “Samsung Slips Further Behind TSMC in Chipmaking Race,” Financial Times (Nikkei Asia), July 27, 2022, https://www.ft.com/content/bb13d912-773a-4c1a-bf33-358b3c40ca5a; Song Jung-a and Christian Davies, “Samsung Seeks to Reassure Markets over Semiconductor Competitiveness,” Financial Times, July 30, 2022, https://www.ft.com/content/74c20cba-1f19-4447-ac01-a52c30470d37.

11 Richard Waters, “Intel’s Manufacturing Hold-up Sends Shockwaves Through Chip Industry,” Financial Times, July 24, 2020, https://www.ft.com/content/051b2c80-d53b-410e-8e80-f433d25a82dd; Ian King and Emily Chang, “Intel CEO Promises Quicker Return to Technological Leadership,” Bloomberg, April 29, 2022, https://www.bloomberg.com/news/articles/2022-04-29/intel-ceo-promises-quicker-return-to-technological-leadership.

12 National Security Commission on Artificial Intelligence, “Final Report,” March 2021, https://www.nscai.gov/wp-content/uploads/2021/03/Full-Report-Digital-1.pdf; Graham Allison et al., The Great Tech Rivalry: China vs the U.S. (Cambridge, MA: Belfer Center/Harvard Kennedy School, 2021), https://www.belfercenter.org/sites/default/files/GreatTechRivalry_ChinavsUS_211207.pdf.

13 Yuan Yang, Kathrin Hille, and Qianer Liu, “China’s Biggest Chipmaker SMIC Hit by US Sanctions,” Financial Times, September 27, 2020, https://www.ft.com/content/7325dcea-e327-4054-9b24-7a12a6a2cac6; Yuan Yang, “US Tech Backlash Forces China to be More Self-sufficient,” Financial Times, January 15, 2020, https://www.ft.com/content/c6993200-1ff3-11ea-b8a1-584213ee7b2b.

14 David E. Sanger, “China Has Leapfrogged the U.S. in Key Technologies. Can a New Law Help?” New York Times, July 28, 2022, https://www.nytimes.com/2022/07/28/us/politics/us-china-semiconductors.html.

15 U.S.-China Economic and Security Commission (USCC), 2021 Report to Congress of the U.S.-China Economic and Security Commission (Washington, DC: U.S. Government Publishing Office, November 2021), 44, https://www.uscc.gov/sites/default/files/2021-11/2021_Annual_Report_to_Congress.pdf.

16 Cheng Leng and William Langley, “China hits Big Fund Chip Executives with Corruption Probes,” Financial Times, August 10, 2022, https://www.ft.com/content/1e3fe107-1b6e-43dd-8f04-e3c88502c36b. For related context, the USCC writes that: “The CCP’s efforts to foster technological self-sufficiency have also highlighted the inefficiency of China’s state-led investment approach, with approximately 50,000 new Chinese firms registering as “semiconductor-related businesses” in 2020, nearly quadruple the number of registrants in 2015. These registrants included companies that had highly questionable connections with semiconductors, including restaurants and real estate developers. In October 2020, a spokeswoman for China’s National Development and Reform Committee said that some firms “with insufficient knowledge of integrated circuit development have blindly entered into projects.” The case of Wuhan Hongxin Semiconductor Manufacturing, a company founded in 2017, is a recent illustration of this problem. In March 2021, the Chinese technology company 36Kr reported that Wuhan Hongxin Semiconductor Manufacturing was a fraudulent business whose founder had no expertise in semiconductors. The company reportedly received an estimated $1.9 billion (RMB 12.4 billion) in government investments, bank loans, and contractor deposits before failing.” USCC, 2021 Report to Congress, 44.

17 TechInsights, “Disruptive Technology Briefing: 7nm SMIC MinerVa Bitcoin Miner,” TechInsights, 2022, https://www.techinsights.com/blog/disruptive-technology-7nm-smic-minerva-bitcoin-miner.

18 Tim Culpan, “China Has Painted Itself Into a Semiconductor Corner,” Bloomberg, August 10, 2022, https://www.bloomberg.com/opinion/articles/2022-08-10/china-has-painted-itself-into-a-semiconductor-corner-behind-taiwan-south-korea; Debby Wu and Jenny Leonard, “China’s Top Chipmaker Achieves Breakthrough Despite US Curbs,” Bloomberg, July 21, 2022, https://www.bloomberg.com/news/articles/2022-07-21/china-s-top-chipmaker-makes-big-tech-advances-despite-us-curbs; Scott Foster, “SMIC’s 7-nm Chip Process a Wake-up Call for US,” Asia Times, July 25, 2022, https://asiatimes.com/2022/07/smics-7-nm-chip-process-a-wake-up-call-for-us/.

19 Debby Wu, “TSMC, Samsung Urge U.S. to Allow Them Into $52 Billion Chip Plan,” Bloomberg, March 28, 2022, https://www.bloomberg.com/news/articles/2022-03-28/tsmc-samsung-urge-u-s-to-allow-them-into-52-billion-chip-plan; Anton Shilov, “ASML High-NA Development Update: Coming to Fabs in 2024–2025,” AnandTech, May 26, 2022, https://www.anandtech.com/show/17415/asmls-highna-update-coming-to-fabs-in-2024-2025.

20 For the argument that imitating cutting-edge technology is becoming more difficult due to increasing complexity, see Andrea Gilli and Mauro Gilli, “Why China Has Not Caught Up Yet: Military-Technological Superiority and the Limits of Imitation, Reverse Engineering, and Cyber Espionage,” International Security 43, no. 3 (Winter 2018/2019): 141–189.

21 See for example Becca Wasser et al., “When the Chips Are Down: Gaming the Global Semiconductor Competition,” Center for a New American Security, January 2022, 4, https://s3.us-east-1.amazonaws.com/files.cnas.org/documents/CNAS-Report-Semidconductor-game-Jan-2022-final-b.pdf?mtime=20220201140415&focal=none.

22 Demetri Sevastopulo, “China on Track to Surpass US as ‘AI Superpower’, Congress Warned,” Financial Times, March 1, 2021, https://www.ft.com/content/37cf699a-1d5e-4dfd-be65-84682cb15532.

23Graham Allison and Eric Schmidt, “Semiconductor Dependency Imperils American Security,” Wall Street Journal, June 20, 2022, https://www.wsj.com/articles/semiconductor-dependency-imperils-american-security-chip-manufacturing-technology-sector-11655654650.

24 Tucker Carlson, “Chinese Leaders Treated Pelosi’s Arrival Like an Invasion,” Fox News, August 2, 2022, https://www.foxnews.com/opinion/tucker-carlson-chinese-leaders-treated-pelosi-arrival-invasion.

25 Bloomberg News, “Top Economist Urges China to Seize TSMC If US Ramps Up Sanctions,” Bloomberg, June 7, 2022, https://www.bloomberg.com/news/articles/2022-06-07/top-economist-urges-china-to-seize-tsmc-if-us-ramps-up-sanctions.

26 John Lee and Jan-Peter Kleinhans, “Would China Invade Taiwan for TSMC?” The Diplomat, December 15, 2020, https://thediplomat.com/2020/12/would-china-invade-taiwan-for-tsmc/.

27 Cheng Ting-Fang and Lauly Li, “Chip Talent War: Taiwan Faces Critical Staffing Shortage,” Nikkei Asia, February 18, 2022, https://asia.nikkei.com/Business/Business-Spotlight/Chip-talent-war-Taiwan-faces-critical-staffing-shortage; Editorial, “Tech Firms Struggle to Recruit,” Taipei Times, May 4, 2021, https://www.taipeitimes.com/News/editorials/archives/2021/05/04/2003756786.

28 Don Clark, “The Tech Cold War’s ‘Most Complicated Machine’ That’s Out of China’s Reach,” New York Times, July 19, 2021, https://www.nytimes.com/2021/07/04/technology/tech-cold-war-chips.html; Justin Feng, “Lithography: The Achilles’ Heel of China’s Semiconductor Industry?” The Diplomat, August 1, 2022, https://thediplomat.com/2022/08/lithography-the-achilles-heel-of-chinas-semiconductor-industry/.

29 Varas et al., “Strengthening the Global Semiconductor Supply Chain,” 39.

30 Andre Barbe and Will Hunt, “Preserving the Chokepoints: Reducing the Risks of Offshoring Among U.S. Semiconductor Manufacturing Equipment Firms,” Center for Security and Emerging Technology, May 2022, https://cset.georgetown.edu/wp-content/uploads/Preserving-the-Chokepoints.pdf; Debby Wu, Ian King, and Jenny Leonard, “US Quietly Tightens Grip on Exports of Chipmaking Gear to China,” Bloomberg, July 29, 2002, https://www.bloomberg.com/news/articles/2022-07-29/us-pushes-expansion-of-china-chip-ban-key-suppliers-say.

31 USCC, 2021 Report to Congress, 417–418.

32 For an analysis of a potential Chinese blockade of the island, see Bradley Martin et al., Implications of a Coercive Quarantine of Taiwan by the People’s Republic of China (Santa Monica, CA: RAND, 2022), https://www.rand.org/content/dam/rand/pubs/research_reports/RRA1200/RRA1279-1/RAND_RRA1279-1.pdf.

33 See for example Hal Brands, “Economic Chaos of a Taiwan War Would Go Well Past Semiconductors,” Bloomberg, June 23, 2022, https://www.bloomberg.com/opinion/articles/2022-06-23/economic-chaos-of-a-taiwan-war-would-go-well-past-semiconductors.

34 Varas et al., “Strengthening the Global Semiconductor Supply Chain,” 40–41.

35 Varas et al., “Strengthening the Global Semiconductor Supply Chain,” 11–12.

36 For an assessment of China’s options, see Oriana Sklyar Mastro, “The Taiwan Temptation: Why Beijing Might Resort to Force,” Foreign Affairs 100, no. 4 (July/August 2021): 58–67.

37 Nikkei Asia, “$2.6 Trillion Could Evaporate from Global Economy in Taiwan Emergency,” Nikkei Asia, August 22, 2022, https://asia.nikkei.com/static/vdata/infographics/2-dot-6tn-dollars-could-evaporate-from-global-economy-in-taiwan-emergency/.

38 David C. Gompert et al., War with China: Thinking Through the Unthinkable (Santa Monica, CA: RAND, 2016), 48, https://www.rand.org/content/dam/rand/pubs/research_reports/RR1100/RR1140/RAND_RR1140.pdf.

39 Eric Heginbotham et al., The U.S.-China Military Scorecard: Forces, Geography, and the Evolving Balance of Power, 1996–2017 (Santa Monica, CA: RAND, 2015); Stephen Biddle and Ivan Oelrich, “Future Warfare in the Western Pacific: Chinese Antiaccess/Area Denial, U.S. AirSea Battle, and Command of the Commons in East Asia,” International Security 41, no. 1 (Summer 2016): 7–48.

40 “[I]n our games, when we fight China or Russia [. . .] blue [the US] gets its ass handed to it [. . .] We lose a lot of people, we lose a lot of equipment. We usually fail to achieve our objective of preventing aggression by the adversary.” David Ochmanek, quoted in Susanna V. Blume et al., “Transcript: How the U.S. Fights Wars Today and In the Future,” Center for a New American Security, March 7, 2019, https://www.cnas.org/publications/transcript/transcript-how-the-u-s-military-fights-wars-today-and-in-the-future; Michael Evans, “US ‘would lose any war’ fought in the Pacific with China,” The Times, May 16, 2020, https://www.thetimes.co.uk/article/us-would-lose-any-war-fought-in-the-pacific-with-china-7j90bjs5b.

41 For example, see Elbridge Colby, “America Must Prepare for a War Over Taiwan,” Foreign Affairs, August 10, 2022, https://www.foreignaffairs.com/united-states/america-must-prepare-war-over-taiwan; Hal Brands and Michael Beckley, “The Coming War Over Taiwan,” Wall Street Journal, August 4, 2022, https://www.wsj.com/articles/the-coming-war-over-taiwan-11659614417.

42 Taiwan Affairs Office of the State Council and the State Council Information Office of the People’s Republic of China, “The Taiwan Question and China’s Reunification in the New Era,” Xinhua, August 10, 2022, https://english.news.cn/20220810/df9d3b8702154b34bbf1d451b99bf64a/c.html; Hu Jintao, “Anti-Secession Law Passed by NPC,” Xinhua, March 14, 2005, https://www.chinadaily.com.cn/english/doc/2005-03/14/content_424643.htm.

43 At time of writing, the Taiwan Policy Act has passed the Senate Foreign Relations Committee and President Biden has reiterated that the United States would defend Taiwan, further upsetting the status quo.

44 Lingling Wei, “Xi Sought to Send Message to Biden on Taiwan: Now Is No Time for a Crisis,” Wall Street Journal, August 11, 2022, https://www.wsj.com/articles/xi-sought-to-send-message-to-biden-on-taiwan-now-is-no-time-for-a-crisis-11660240698.

45 Barbe and Hunt’s Preserving the Chokepoints emphasizes the need for multilateral coordination of export controls and a friend-shoring approach to supply chain resiliency. While Washington’s attempts to form a “Fab 4” semiconductor alliance with South Korea, Japan, and Taiwan have so far produced mixed results, the recent U.S. Chips Act has put pressure on firms in U.S. partner countries to choose sides and limit their footprint in China. See Christian Davies et al., “US Struggles to Mobilise its East Asian ‘Chip 4’ Alliance,” Financial Times, September 12, 2022, https://www.ft.com/content/98f22615-ee7e-4431-ab98-fb6e3f9de032; Christian Davies and Song Jung-a, “Chipmakers Caught in Crossfire of Rising US-China Geopolitical Tensions,” Financial Times, August 20, 2022, https://www.ft.com/content/ffa21fd7-b8d9-4a15-be2b-cce21d12371d.