Key points

Despite having the world’s largest navy, important questions can be asked about China’s ability to challenge the U.S. Navy on a global scale. A number of factors—geography, logistical infrastructure, force structure, and command culture—all argue that China cannot do so at this time.

In particular, China would need to significantly expand the number and caliber of its overseas bases in order to support large-scale, blue-water operations by the People’s Liberation Army Navy (PLAN). China currently has just two overseas bases—at Djibouti and Cambodia—and both are of limited capacity.

Absent such a basing network, the PLAN is reliant on at-sea replenishment, a capability that is inherently vulnerable in wartime. China possesses some quality at-sea replenishment vessels but not nearly in sufficient quantities to support widespread global operations.

While Chinese naval aviation has shown important improvements over the last year, the PLAN does not appear to have the logistical capacity to sustain high-tempo carrier operations outside the First Island Chain for an extended period of time.

Super-quiet Chinese nuclear submarines would be game-changers in terms of Chinese blue-water operations. But thus far China has not shown mastery of the requisite technologies to build boats with this capability. It would also take China several years to grow a fleet of super-quiet submarines once the necessary technological challenges have been solved.

Structural issues with the Chinese economy raise new concerns about Beijing’s ability to fund a blue-water navy over the long term. Such calculations must include the expense of ship construction, but also the massive operations and maintenance budget needed to deploy a potential navy of over 400 ships.

Introduction

In terms of raw ship numbers, the People’s Liberation Army Navy (PLAN) is now the world’s largest fleet.1 This has led to understandable concern about the level of threat the Chinese navy poses. Already, many commentators believe China has established naval superiority in the far western Pacific to the United States’ detriment.2 A critical question is whether China could expand its naval power into the broader Pacific or even beyond into the world’s other oceans. Might the PLAN emerge as a blue-water competitor, one able to challenge the U.S. Navy not just at the regional level but worldwide?

Answering that question requires looking not just at the number of Chinese ships, but also a careful examination of how those vessels operate, their specific capabilities, and the overall nature of naval power projection. This paper is an attempt to dispassionately weigh these factors. It begins with a discussion of general terms and an overview of China’s maritime geography. Subsequent sections examine overseas basing and logistics, how the PLAN is constituted and structured, command arrangements, and funding. The paper concludes with summary thoughts on the future of Chinese naval power.

Green water vs. blue water

To begin this discussion, it is helpful to establish terms. Although phrases like “brown water,” “green water,” and “blue water” are frequently used in naval discussions, there are no universally accepted definitions.3 Generally speaking, the terms refer to both water depth and the scope of maritime operations.

“Brown water” is the easiest to quantify, as it applies to rivers and other inland bodies of water as well as perhaps the immediate coastal zone, a few miles off the beach.

“Blue water” implies open-ocean operations over deep water, the kind of sea-going global reach associated with traditional maritime powers, like the U.S. Navy today or the Royal Navy before it.

“Green water” is the hardest of the three to pin down. It can apply to coastal zones, albeit much farther from the shore than “brown water.” Sometimes it refers to operations in the wider sea zones adjacent to the naval power in question. In the case of China, “green water” is often used to quantify Chinese operations in three Asian littoral seas—the South China Sea, the East China Sea, and the Yellow Sea. China has confined the bulk of its naval operations to these three bodies of water over the past 30 years, even as it has substantially modernized its navy.

China’s maritime geography

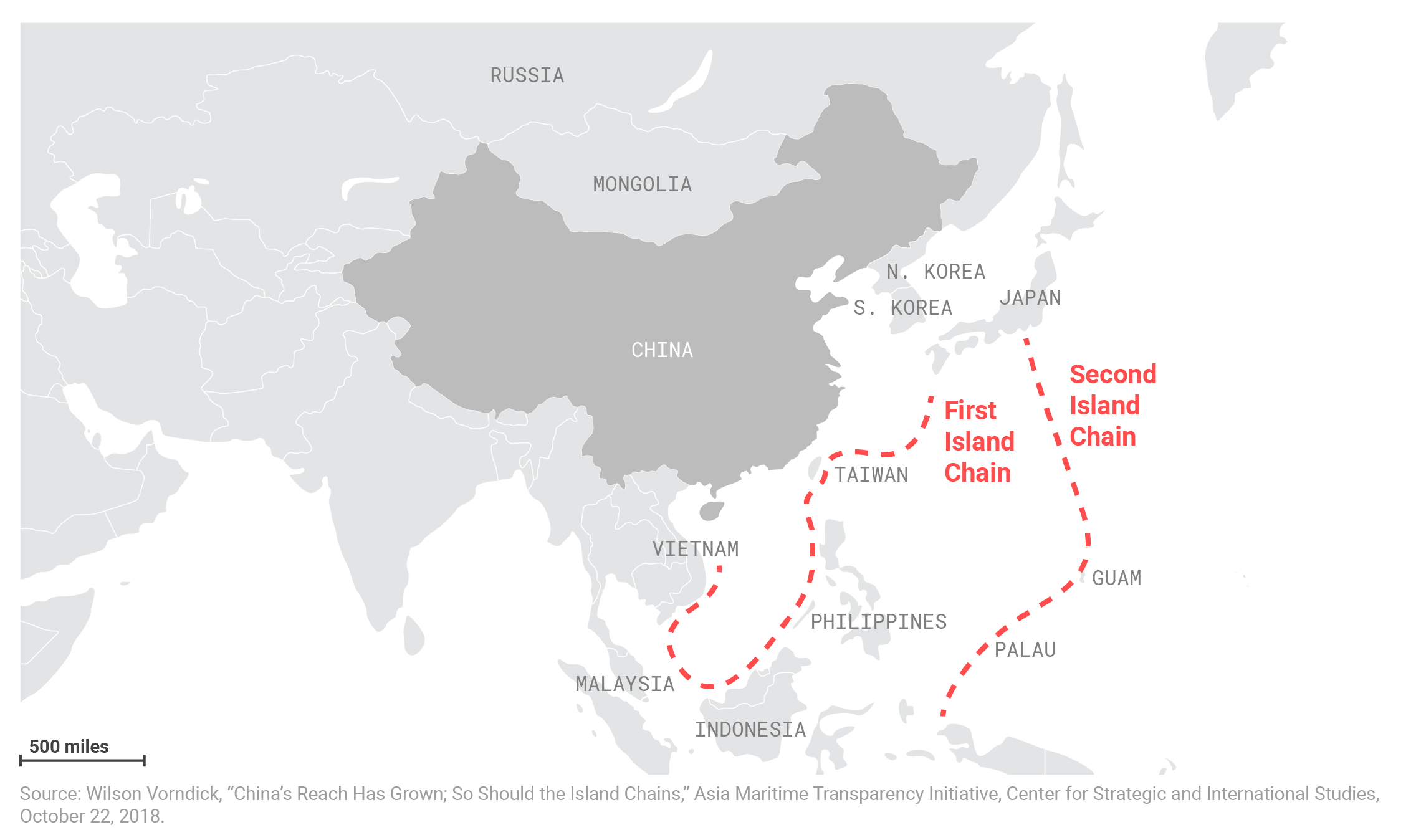

A central question for U.S. defense planners is whether China will make the next leap to widescale blue-water operations and a sustained global naval presence. Geographically, China is not well-positioned to do so. Immediate, unimpeded access to the deep water of an ocean has traditionally been seen as an important prerequisite for major maritime powers. As an island situated in the North Atlantic, Britain innately possessed this, while the United States is blessed with not one but two long, unobstructed coastlines affording ready access to the deep waters of the Atlantic and Pacific oceans. In contrast, China’s direct access to blue water is blocked by the barrier commonly known as the First Island Chain.

The First Island Chain

Extending from the Japanese Islands in the north down through the Philippines, with the main island of Taiwan linking them in the middle, the First Island Chain hems China in. Indeed, the term itself originates with efforts by U.S. strategists to contain both Soviet and Chinese naval expansion in the Pacific during the early years of the Cold War.4 Add the Indonesian Archipelago to the south, and China has no direct route to either the Pacific or Indian oceans.

While piercing the First Island Chain is sometimes seen as China’s strategic goal, its default position is a caged naval power that must pass through one of a half dozen narrow waterways to escape the Asian littoral seas. These chokepoints include the Malacca, Lombok, and Sunda Straits to the south; the Bashi Channel and the Miyako Strait, which lie due west and bound Taiwan; and the Tsushima Strait, the main passageway north between Japan and the Korean Peninsula. In wartime, these bottlenecks could compromise the freedom of movement for the PLAN or possibly leave China vulnerable to economic blockade.5

Western Pacific maritime chokepoints

China divides its navy into three main fleets, each of which corresponds with one of the three Asian littoral seas. There is the North Fleet (Yellow Sea) based at Qingdao, the East Fleet (East China Sea) at Ningbo, and the South Fleet (South China Sea) at Zhanjiang.6 Each fleet has additional support bases along the Chinese coast, including at Lushun, Fujian, Zhoushan, and Guangzhou.7 The South Fleet also operates a major facility near Yulin on Hainan Island, which is particularly important to nuclear submarine basing in addition to being the homeport for the carrier Shandong.8 All of the PLAN’s main operating bases are thus on Chinese national territory and all well within the First Island Chain.

Overseas bases

China has been linked to a number of efforts to secure foreign bases in recent years and several of these have been met with concern. Yet China has not actually occupied any overseas bases as a result of its various overtures, with two exceptions, each of which requires its own set of caveats.

Chinese naval infrastructure

The first of these is a support base in Djibouti, which opened in 2017. The base lacked facilities to receive naval vessels upon opening; a pier capable of docking an aircraft carrier was subsequently constructed but may not have been finished until as late as 2021.9 Moreover, a PLAN vessel does not appear to have berthed at the base until March 2022 and then it was a supply ship.10 As far as can be determined from open sources, China has yet to dock a major surface combatant at the base. At a minimum, it does not appear to do so on a regular basis.11 While China does station PLAN marines in Djibouti, the U.S. Department of Defense assesses “they are currently limited in their ability to conduct expeditionary operations due to a lack of helicopters at the facility.”12

Another facet of the Djibouti base worth highlighting is its single runway. Open sources estimate it at just 400 meters (about 1,300 feet) in length, too short to accommodate China’s main strategic airlifter, the Y-20.13 (This would be akin to a U.S. base unable to accept C-17 flights.) Likewise, China cannot base fighter aircraft at the site due to runway length.14 From an operational standpoint, its inability to accommodate fixed-wing aircraft (like fighters and large transport aircraft) would seem to severely constrain the Djibouti base’s utility as an instrument of Chinese power projection. While the base should not be discounted entirely, it must be viewed as a limited asset for China rather than the type of facility needed to support a robust global presence.

China appears to have a second overseas base at the Cambodian port city of Ream.15 Yet much remains unclear about this option as well. What is not in dispute is that China has upgraded the port’s infrastructure, including completion of a pier, one again large enough to accommodate an aircraft carrier.16 But there is ongoing debate over how far China will expand the facilities at Ream and their ultimate utility to the PLAN.17 It is uncertain whether China will permanently station forces there or simply use it as a logistical waypoint.

U.S. defense infrastructure in the Pacific

Regardless, the base is still inside the First Island Chain, facing the same access challenges as the Chinese bases cited above. Ream is slightly closer to the strategic Strait of Malacca than Chinese ports, but it is only a marginal improvement of about 700 miles as compared to Hainan Island.18

Compare China’s position with the U.S. basing posture in the Pacific: the United States has access to some 71 different air and naval installations spread throughout the breadth of the ocean—on its own territory; on the territory of allied states like Australia, Japan, the Philippines, and South Korea; and on select Pacific island nations with which the U.S. maintains security agreements.19 Not only are Chinese forces blocked by the First Island Chain, but they are at a massive disadvantage to U.S. forces in terms of logistics and basing once they finally reach the open waters of the Pacific.

The Second Island Chain

The U.S. basing advantage extends to the group of islands beyond the First Island Chain, in and around the Philippine Sea. Naval strategists have increasingly identified this area as an important logistical conduit for any war in the western Pacific, with one group of analysts dubbing it “a power projection superhighway running through the heart of the North Pacific.”20 Put less dramatically, this second group of islands serves as the First Island Chain’s strategic depth and also the forward defense for Hawaii and the eastern Pacific.

There have been a number of efforts to define this region, with the most common simply referring to it as the Second Island Chain. It can be thought of as the bow-shaped line of islands to the east of the Philippine Sea, extending from Japan’s Volcano Islands and Ogasawara Islands in the north down through part of the Northern Mariana Islands and ending with Guam, the Yap Islands, and Palau.21 But there is no agreed delimitation; some analysts prefer a definition incorporating additional island groupings and following a less linear north-south path. This is sometimes referred to as the “Second Island Cloud.”22

Whichever formulation is used, the U.S. position is substantially superior to China’s. First, important islands in this grouping—including Guam and the Northern Mariana Islands—are U.S. territories. Guam in particular has emerged as an important maritime outpost, with the U.S. Navy forward-basing nuclear attack submarines there, while a massive improvement in the island’s air and missile defenses is ongoing.23

The United States also holds compacts of free association (COFA) with other key territories in the Second Island Chain, including the Federated States of Micronesia, the Republic of the Marshall Islands, and Palau. The COFA arrangements grant the U.S. exclusive military access to these countries in exchange for wide-ranging economic assistance and security guarantees.24

In contrast, China had no formal access to the Pacific beyond the First Island Chain until April 2022, when Beijing concluded a security cooperation agreement with the Solomon Islands.25 Located 1,300 miles northeast of Brisbane and 3,500 miles southwest of Honolulu, the Solomons sit astride a main transit route between Australia and the United States. The move sparked initial panic, particularly in Australia where the deputy prime minister invoked the Cuban Missile Crisis in response to the pact.26

First and Second Island Chains

But here, again, fact needs to be separated from rumor. While the security cooperation agreement does provide a legal basis for China to introduce forces into the Solomons, it has not done so.27 The move has also deepened anti-Chinese resentment among the local population, suggesting a permanent base would not be well-received.28 Furthermore, the Solomons Islands government has publicly ruled out a Chinese naval base and China has made no move to build one.29

True, the move is not wholly benign: the Solomon Islands have barred U.S. and allied warships from port visits.30 But it is important to recognize the security cooperation agreement has not produced a Chinese base (or even a troop deployment) as was widely feared when it was first disclosed.

Moreover, China’s aggressive diplomacy in the Pacific had already sparked a pro-U.S. backlash elsewhere in the Second Island Chain. In 2020, the president of Palau openly requested the United States build bases on his territory in response to Chinese posturing.31 While the U.S. demurred on that specific request, it has since moved to invest in infrastructure for non-permanent deployments in Palau and the Free States of Micronesia.32 The United States also secured Palau’s agreement to construct a large phased-array radar on one of its islands, which should enhance long-range monitoring of Chinese air and naval movements.33

Meanwhile, the Federated States of Micronesia, the Republic of the Marshall Islands, and Palau all renewed their COFA agreements with Washington in 2023, ensuring exclusive U.S. air and naval access across those territories for another 20 years.34 China’s gambit in the Solomons has yielded few concrete results, while the U.S. has only deepened its already-superior position in the Second Island Chain.

Comparison of Chinese and U.S. security networks in the western Pacific

Expansion into the Indian Ocean?

China’s dual dependence on foreign energy and seaborne transport arguably makes the Indian Ocean a more likely venue for increased blue-water operations by the PLAN. According to U.S. government data, China imported about two-thirds of the oil it consumed in 2022, with a staggering 97 percent of those imports arriving by sea.35 Models developed by Chinese scholars show the country’s dependence on foreign oil continuing to increase, with China importing more than 80 percent by 2030.36 The Persian Gulf is an essential source: China is now the largest consumer of Saudi oil and recently tripled the amount it purchases from Iran.37 Overall, the Middle East accounts for 56 percent of China’s crude oil imports.38

The Indian Ocean also offers fewer impediments in terms of the United States’ own presence (particularly compared to U.S. basing dominance in the Pacific).39 And China does have two potential building blocks for a basing network in Ream and Djibouti. It must be emphasized, though, that each of these sites would need to be significantly upgraded and expanded from its current status to serve as part of a robust Chinese support infrastructure. They would also need to be linked to additional bases to maximize their utility to PLAN operations.

This highlights an important point about naval logistics in general: one-off bases scattered here and there are of little value without additional sites to bridge the journey between them and homeports. For example, some rumors have China establishing a naval base in the Atlantic Ocean at Equatorial Guinea.40 To be clear, there currently is even less foundation to believe China will actually construct a base in western Africa than there is in the Solomon Islands (where China at least has an access agreement). But even if China did build a naval base in Equatorial Guinea, its relative isolation would likely limit its utility. Without a global support network to cover the journey to and from west Africa, the value of the facility would be questionable.

The 71 sites the U.S. has access to in the Pacific are significant because they represent a web of interconnected facilities that can be utilized by the Navy and other U.S. military forces. The redundancy and complementarity those installations offer is what makes the U.S. position in the Pacific so strong—not just the raw numbers. China has nothing remotely comparable to this network in any ocean.

While this discussion should mute concerns about an imminent PLAN presence in the Atlantic, it does highlight the Indian Ocean as a more appealing prospect. China has repeatedly been tied to a possible naval base on the Arabian Peninsula, perhaps at Khalifa in the United Arab Emirates or Duqm in Oman.41 Either would serve as another link in an Indian Ocean basing network, one that might also incorporate the civilian ports at Gwadar, Pakistan, and Hambantota, Sri Lanka.42

It has been suggested by some U.S. analysts that China is trying to fashion these sites—some military, some civilian—into a “string of pearls” in the Indian Ocean.43 This would be China’s own modest, regional iteration of the integrated, global basing network the U.S. Navy enjoys.

But caveats are again needed. The bases in Oman and the UAE remain only speculation at the moment. And leveraging the civilian infrastructure at Gwadar and Hambantota could prove challenging. Indeed, there is an ongoing academic debate over the utility of civilian ports to China, particularly facilities in countries where China can exert strong economic leverage through its Belt and Road Initiative. Writing in a 2022 issue of International Security, Isaac B. Kardon and Wendy Leutert advocate for these civilian ports—many operated by Chinese firms—as a kind of stealth basing network to support PLAN blue-water operations.44

One major problem, though, is civilian ports are far more limited than dedicated naval bases in terms of the services they can provide. Weapons storage and specialized repairs are just two important areas where civilian ports lag in comparison to purpose-built naval bases. Kardon and Leutert themselves concede:

the technical limitations of most commercial ports further impede their military utility. Container terminals employ specialized handling equipment that is unsuitable for naval ships. Moreover, China would lack the hardened naval facilities, specialized parts, ordnance, equipment, and trained on-site personnel requisite for any complex or contested military operation. Chinese firms’ port network thus produces a distinct but restricted form of power projection: enabling the PLA to operate with growing scope and scale in peacetime, but providing only limited combat support in wartime.45

To underscore that last point, any country allowing the PLAN to use its civilian ports in wartime would essentially be signing up as a co-combatant to the conflict, a decision even Chinese economic leverage might not sway.46

Thus, while China’s prospects for overseas bases appear better in the Indian Ocean than anywhere else, difficulties remain. And even if “the string of pearls” is someday achieved, it will not alter China’s home geography. At the eastern end of an Indian Ocean basing network, PLAN vessels and civilian shipping would still be at the mercy of the three main chokepoints in and around the Indonesian Archipelago: the Malacca, Lombok, and Sunda straits. That aspect of China’s geography is immutable.

The challenges of at-sea replenishment

Absent a strong overseas basing network, Chinese naval task forces would be dependent on replenishment at sea.47 To some extent, all navies rely on supply ships for food, fuel, and ordnance as a supplement to what can be acquired at civilian ports and dedicated naval bases. But primary reliance on these vessels presents several challenges.

Foremost, it is necessary to have enough of them. In this regard, parsing precise numbers of Chinese supply vessels can be confusing. For example, reliable open sources like The Military Balance list the PLAN as having 153 support and logistics vessels in total.48 But in terms of directly supporting task force operations abroad, only a handful of these vessels are capable of restocking and refueling warships while underway. Of these, the most modern (and important) are the Type 903A and the Type 901 at-sea replenishment ships.49 The latter is the larger and faster of the two: it is capable of speeds of up to 25 knots, allowing it to keep up with and supply carrier battlegroups.50 Meanwhile, the Type 903A’s appear to have become the workhorse of smaller task force operations such as China’s ongoing deployment of a small anti-piracy flotilla in the Gulf of Aden.51

Each one of these vessels can only support a task force for short periods before it needs to be replenished itself. In the case of the Type 903A, it is believed to be able to sustain a small flotilla (two or three warships) for about a fortnight without taking on additional supplies.52 The operational duration of the Type 901 is less clear from open sources: although it is much larger, the Type 901 would also be expected to support a carrier, thereby expending its stores at a proportionally faster rate. It would be unsurprising if the Type 901 were also limited to just a few weeks of support time before requiring its own replenishment.

More importantly, China has just nine of these frontline replenishment ships—seven Type 903A’s and only two of the larger Type 901s.53 Of course, China can always build more. Curiously, though, it has not done so since completing the run of Type 903A’s constructed during the 2010s or the launch of the second Type 901 in 2017.54 Restarting the Type 903A and 901 production lines (or undertaking construction of a new-design replenishment ship) would seem to be an essential prerequisite for more robust PLAN blue-water operations. To date, this has not been seen.

Yet even if it augments its replenishment fleet significantly, China still faces another hard reality: these types of vessels are inherently vulnerable in wartime, possessing limited organic defense systems. And sinking an enemy’s supply ships can often do as much operational damage to a task force as striking combat vessels directly.55 Without fuel, munitions, and various sundries, warships quickly lose the capacity to fight.

Finally, while at-sea replenishment can support the materiel needs of ships, it offers no succor for crews. Bases provide needed outlets for personnel—everything from simple rest and recreation to advanced medical facilities. Impact on crew morale and performance is an under-discussed aspect of the importance of a basing network to sustained blue-water operations.

Examining current PLAN operations

The limitations of at-sea replenishment can be seen in current Chinese naval operations. While China is frequently cited in press reports as deploying its naval forces to various points around the globe, less careful attention is given to the actual scale and scope of those operations.

For example, in 2017, China deployed a task force to the Baltic Sea, sparking concern. Yet the number of ships involved was exactly three: a destroyer, a frigate, and a supply vessel.56 Likewise, China’s anti-piracy “flotilla” in the Gulf of Aden consists of just three ships—usually in the familiar configuration of a destroyer, a frigate, and an at-sea replenishment vessel.57

Such deployments are also not novel. In the late 1990s, as China’s naval modernization was in its earliest stages, small numbers of PLAN vessels deployed to various countries in Asia, Europe, and South America with far less fanfare.58

Moreover, these forays by the PLAN pale in comparison to the multi-ship, multi-month deployments the U.S. Navy regularly conducts. To cite one cogent example, within three weeks of the Hamas attacks of October 7, the U.S. had dispatched two carrier battlegroups and a Marine amphibious ready group to the Middle East.59 A week later, it added one of its conventionally armed guided-missile nuclear submarines (SSGNs).60 In total, the United States had 19 warships on station in the eastern Mediterranean, the Red Sea, and the Arabian Sea by December 2023.61 China simply lacks the capability to organize and sustain anything remotely similar in terms of global blue-water operations.

Of course, closer to home, China can muster much larger forces as it did in response to Speaker Nancy Pelosi’s visit to Taipei in the summer of 2022. Then the PLAN sortied 13 warships for retaliatory “exercises” in the waters around Taiwan.62 A year later, China would surge 20 warships into the waters around Taiwan in September 2023 for what was billed as the PLAN’s biggest exercise ever.63 But these large deployments close to home waters only serve to highlight the difference in capacity between the Chinese navy as a green-water force as opposed to a blue-water one.

Venturing outside the First Island Chain

In 2023, China did increase the frequency of its carrier operations beyond the First Island Chain. It deployed the carrier Shandong and her escorts into the Philippine Sea three times—in April, September, and late October into early November. The April deployment included exercises 400 miles west of Guam.64 Yet that deployment lasted just 19 days while the September maneuvers did not even extend a full week.65 Similarly, the October/November deployment was only nine days.66

For the most part, China’s naval forays outside the First Island Chain seem to last less than a month and remain limited in geographic scope.67 This duration is in keeping with the expected stamina of China’s existing at-sea replenishment ships.

The Aleutian Islands

In August 2023, PLAN forces conducted operations with the Russian Navy as part of an annual joint exercise. Although press coverage described the ships as operating “near Alaska,” in truth it is unclear if the combined task force ever left their side of the Pacific.68 Rather, proximity to Alaska was likely due to the expanse of the Aleutian Islands, which stretch U.S. territory to within 450 miles of Russia’s Kamchatka Peninsula.69 The actual scope of the Chinese-Russian exercise appeared to be the Sea of Okhotsk and the southeastern Bering Sea, followed by a joint deployment to the East China Sea.70 The maneuvers lasted a little over three weeks before the ships put to port on the Chinese mainland.71 These joint exercises are not unimportant, but they are relevant more for what they indicate about strategic cooperation between Beijing and Moscow rather than the blue-water capacity of the PLAN.

Force structure and capabilities

China also faces challenges to blue-water operations in terms of how its navy is constructed and the tasks for which its maritime forces are optimized. Here, it is important to note that the Chinese and U.S. fleets are far from mirror images of one another. Each is structured to perform different tasks and each has its own operational focus. Weighing the balance between the two navies is therefore not a precise apples-to-apples comparison.72

In the case of the U.S. Navy, it must undertake a range of missions, reflecting global U.S. interests. This requires the capacity for extended, long-range deployments—such as the 19-ship showing in the Middle East mentioned above. In contrast, the PLAN has largely been structured to defend the Asian littoral seas, with support from land-based air and missile forces. This is commonly referred to as anti-access/area denial, or A2/AD.73 It is worth briefly examining the specific systems that constitute A2/AD, as doing so illustrates how they differ from the capabilities needed to support blue-water operations.

Anti-access/area denial

The backbone of the Chinese A2/AD capability is two classes of ballistic missiles. The first is the medium-range DF-21, with a reach of approximately 1,500 kilometers (about 900 miles).74 The second missile is the DF-26, an intermediate system with a range of between 3,000 and 4,000 kilometers (or roughly 1,865 to 2,485 miles).75 The DF-26 is nicknamed “the Guam killer,” precisely because it has the range to strike that U.S. territory, which has become an important hub for U.S. military forces, as noted.76

These missiles can be used to target both fixed sites—such as U.S. and allied military bases in the region—and, potentially, naval forces themselves. That said, China’s ability to track mobile ships and effectively target them with land-based missiles remains to be proven in practice.77 Even without that aspect of A2/AD, though, China’s ability to strike U.S. bases provides it with an impressive capability for disrupting and possibly crippling U.S. military operations in the far western Pacific.78

Another important—if less publicized—aspect of the Chinese A2/AD complex is its large force of land-based fighter aircraft. Estimates suggest the PLA Air Force (or PLAAF) and PLAN aviation units have some 1,300 fourth-generation fighters between them.79 Although less advanced than leading U.S. fifth-generation aircraft—like the F-22 and F-35 stealth fighters—the sheer number of planes China could put in the sky would represent a challenging air defense problem for U.S. forces operating west of the First Island Chain.80

Likewise, China can bring to bear large numbers of land-based air defense systems in this zone to create additional threats to U.S. aircraft.81 Collectively, they would pose a significant challenge simply on the basis of volume.

Diesel-electric submarines form another component of China’s A2/AD complex. China has close to 50 of these vessels.82 Here, too, raw numbers could create problems for U.S. naval forces, although some of the PLAN’s diesel-electric boats also are of very high quality. The most capable is the Yuan-class, which is armed with a submarine-launched version of the YJ-18, an advanced anti-ship cruise missile (ASCM).83

A final feature of the A2/AD complex worth highlighting is the modernized H-6K long-range bomber.84 The H-6K and a maritime variant, the H-6J, are equipped to carry both land-attack and anti-ship cruise missiles, including the particularly lethal YJ-12 supersonic ASCM.85

Anti-access ≠ blue water

This short sketch of China’s A2/AD complex illustrates two key points. First, Chinese A2/AD capabilities pose a major challenge to U.S. air and naval forces in the far western Pacific. Few argue that point, even as specific aspects of A2/AD (e.g., targeting of ships at sea with land-based missiles) continue to be robustly debated.86 The same cannot be said at this time for Chinese naval forces operating abroad in blue water. Two sets of lenses are therefore needed for evaluating Chinese maritime capabilities, one for within the Asian littoral seas and one for the broader Pacific and the rest of the world’s oceans.87

This leads to a second essential point. The core of the A2/AD complex is firmly grounded on the Chinese mainland. The DF-21 medium-range missile, the DF-26 intermediate-range missile, the H-6 bomber variants, and the PLAAF’s large fleet of fighters are not deployable. China cannot take them anywhere else on an expeditionary basis.88 Even platforms like the Yuan-class submarines are likely limited to the Asian littoral seas or the waters immediately beyond (e.g., the western Philippine Sea).89

A2/AD gives China a particular set of advantages, but one wholly specific to the far western Pacific. PLAN surface forces can operate within the A2/AD envelope, augmenting it with their own air defense systems and ability to launch anti-ship missiles. But on their own, outside the A2/AD bubble, these same surface ships are more vulnerable to the perils of modern naval combat. A2/AD simply does not translate into support for global blue-water operations.

A one-dimensional fleet?

All of that said, it would be a mistake to suggest the PLAN surface fleet is completely helpless beyond the First Island Chain. China’s naval modernization has been impressive not only for the number of vessels it has built in the past three decades but also their quality.90 The U.S. Department of Defense has assessed that China’s latest frigates and destroyers are optimized to compensate for shortcomings in air defense and anti-submarine warfare (ASW), both longstanding areas of weakness for the PLAN surface fleet.91 Several analysts also highly rate the Renhai-class cruiser, both as an air defense system and a strike platform. It has been favorably compared to the U.S. Ticonderoga-class cruiser, a long-serving workhorse of the U.S. fleet.92

The problem for China is the same quality has not always been demonstrated in two other essential areas: carrier aviation and undersea warfare. Aircraft carriers and submarines have defined modern naval warfare since each became a dominant platform in the Second World War.93 The U.S. Navy is structured around a balance among its carriers, submarines (all of which are nuclear-powered), and surface forces (e.g., cruisers and destroyers). This combination allows it to function as a blue-water force operating in three domains—in the air, on the surface, and beneath it.

In contrast, the PLAN is heavily invested in surface forces at this time.94 Its carrier program is still maturing, while its submarine force is dominated by conventionally powered vessels of limited range. PLAN nuclear submarines have important qualitative issues and are few in number.95

Without the ability to operate in the same three domains as the U.S. Navy, the Chinese surface force will be at a fundamental disadvantage in global waters, particularly if it comes to combat. The PLAN would be fighting in one dimension (surface warfare) while the U.S. Navy could respond in three (air, surface, and undersea attack). This would hamstring the PLAN as a blue-water force even if China manages to solve the important logistical and basing problems identified earlier in this paper.

China’s carrier program and efforts to build better nuclear-powered submarines thus loom large for the PLAN’s blue-water prospects. The next two sections provide an overview of the current status of each.

China’s aircraft carriers

China has three aircraft carriers—the Liaoning, the Shandong, and the Fujian. All are conventionally powered, unlike U.S. carriers which feature nuclear propulsion.

As detailed in previous Defense Priorities analyses, the Liaoning and the Shandong should generally not be seen as direct equivalents to their U.S. counterparts.96 They are smaller and embark fewer aircraft, about 40 each as compared to approximately 70 aircraft on a U.S. Nimitz-class carrier.97 Also, neither the Liaoning nor the Shandong employs a catapult system, which on U.S. carriers assists in launching aircraft. Instead, they feature a swooped “ski-jump” front which is used to elevate the aircraft and abet takeoff. But the ski jump is less effective than a catapult: aircraft must reduce weight by carrying fewer weapons and less fuel. This limits their combat efficacy and operational reach once airborne.98

The third Chinese carrier, the Fujian, is intended to rectify this shortcoming. It has a flat deck like U.S. carriers and employs an electromagnetic catapult system.99 This is more advanced than the steam catapults used on the Nimitz-class carriers and is similar technology to that employed on the U.S. Navy’s latest carrier, the USS Gerald Ford. The Fujian’s fighters will not have the fuel/ordnance constraints currently seen with the ski-jump carriers.100

The Fujian will also be capable of launching fixed-wing airborne early warning (AEW) aircraft, similar to the U.S. E-2.101 (The two ski-jump carriers cannot do so.) AEW aircraft extend a task force’s radar picture over the horizon, increasing the range at which potential threats can be detected and engaged. The inclusion of this capability on the Fujian is likely as important as the improved fighter capacity the new carrier will support.102

All of that said, the Fujian is far from operational, a point frequently overlooked in coverage of China’s third carrier. It has perhaps another year to go before it is commissioned into the fleet.103 Still more time will be required for it to achieve an initial operating capability. This assumes China encounters no major technical challenges with the new carrier’s design, which would not be unexpected with a first-of-class ship of the Fujian’s complexity.

The PLAN will also be adapting to an entirely new type of flight operations with the catapult-assisted Fujian, different from its previous experience with the ski-jump carriers. This, too, could take additional time to master.104 Put differently, the Fujian is at least a few years away from conducting routine deployments for the PLAN, possibly more.

State of carrier operations

PLAN carrier aviation did show important improvements in 2023. Chinese carriers demonstrated enhanced capacity to generate sorties (i.e., number of aircraft launched and recovered) when operating outside the First Island Chain. It is worth remembering here that even though China commissioned its first carrier (the Liaoning) in 2011, it did not attempt flight operations outside the Asian littoral seas until a decade later.105 These initial exercises demonstrated anemic sortie generation rates. For example, during deployments by the Liaoning into the Philippine Sea in 2022, it averaged fewer than 20 sorties per day.106

During its last deployment of 2023, the Shandong more than tripled the Liaoning’s figures, with sortie rates in the low 60s.107 This is significant. Those numbers were better than the average sortie rates of the two U.S. carriers deployed in the Middle East in the last quarter of 2023, each of which averaged over 40 sorties a day during that time.108 However, an important difference is operational stamina: the Shandong’s deployments lasted a little over a week, while the U.S. carriers continued their operations for months, generating over 4,500 sorties combined during one stretch from October through early December.109

The Shandong’s deployment raises additional doubts about at-sea replenishment, even as it demonstrates enhanced skills on the part of Chinese air crews and flight deck personnel. Carrier propulsion also enters into this discussion. In China’s case, its supply ships must provide fuel for the carriers themselves, as well as their air wings. U.S. nuclear-powered carriers are self-sustaining in terms of fuel; they can therefore use onboard fuel storage tanks exclusively for their aircraft.110 China’s conventionally powered carriers cannot. They store less aviation fuel onboard and need to take on fuel more frequently—both for the ship itself and its air wing.111

It is possible the PLAN’s higher sortie rates are draining replenishment stocks at a much faster rate, resulting in the extremely short cruises seen. Regardless, the PLAN needs to demonstrate it can sustain robust sortie rates over an extended period of time—months not days—if its carrier force is to be considered a legitimate blue-water threat.

Future carrier force structure

China also faces a basic question of numbers with respect to its carriers. There is an old naval saw sometimes called “the rule of three.” It holds that for every vessel on station, two others should be counted—one gearing up as a replacement and one just standing down from its own deployment. Thus, even once the Fujian is fully operational, China would likely be able to deploy only one carrier at a time in blue-water operations.

Nor is it clear how many carriers Beijing intends to build. While it was once taken as a given that China was working toward a six-carrier fleet, this no longer seems certain. The U.S. Department of Defense briefly mentions another aircraft carrier is under construction in its annual report to Congress, but offers no further details.112 Other analyses suggest China is waiting to validate the design of the Fujian before moving forward with additional carrier builds. 113 Rumors also have China’s next carrier being nuclear-powered, a development which could extend the design and construction phase considerably. (As this paper was being completed, a senior PLAN official indicated an official announcement would be forthcoming soon on the status of the fourth carrier, including its propulsion system.114)

It is unlikely a fourth carrier would be fully operational before the early 2030s. At that point, the Liaoning’s hull would be around 45 years old and perhaps approaching the end of its service life.115 The overall number of Chinese carriers might hold at three, even as the fourth carrier would offer more capability than the Liaoning. Increasing the overall size of the force (e.g., a six-carrier fleet) by the mid-2030s would likely necessitate simultaneous construction of two or more carriers, something which has not yet been seen.116

The current state of China’s carrier force thus sends mixed signals. There are signs of promise in terms of capabilities (e.g., increased sortie generation rates, the enhanced capacity of the Fujian) but fundamental questions about future force structure and familiar issues with logistical support. In turn, this casts further doubt on the PLAN’s prospects as a blue-water navy, for the reasons discussed earlier. Without a significant expeditionary air component, the PLAN will remain at a major disadvantage to the U.S. Navy outside the First Island Chain and the supporting coverage of China’s A2/AD complex.

Chinese nuclear submarines

China’s nuclear submarine program also faces a mix of progress and uncertainty. On the one hand, China launched two new nuclear-powered vessels in 2023, known as the Type 093B. These were an evolution of the PLAN’s extant Shang-class nuclear attack submarines (SSNs), with the Type 093B incorporating the ability to carry a larger volume of cruise missiles. The Department of Defense speculates these could be used for stealthy strikes at targets ashore.117 Alternately, they could be used to launch a large volley of anti-ship missiles at a high-value surface target.

But the Type 093B’s do not meaningfully improve China’s overall position in undersea warfare. Rather, they augment existing missile-firing capabilities already present in the PLAN’s surface fleet. In terms of blue-water ASW capabilities—i.e., the ability to counter opposing submarines in the open ocean—they offer nothing new.

Most importantly, the Type 093B’s do not constitute a breakthrough in acoustic emissions. Their quieting level is thought to possibly be on par with the Soviet Sierra-class from the 1980s.118 This was a small run of attack submarines that were somewhat stealthy, but lacked the advanced quieting capability of their contemporaries, the Akula-class submarines.119

To date, China has not been able to solve the technological challenges to field submarines with acoustic emissions that could be described as “super quiet.” Such a capability can allow a submarine to avoid detection by passive undersea sensors, like the U.S. Sound Surveillance System (SOSUS).120

The United States has had very quiet submarines since the 1960s; the Soviet Union achieved this capability in the 1980s with the aforementioned Akula-class.121 Both the Soviet Union and Russia appear to have been reluctant to share quieting technology with China. In 2021, Chinese hackers were caught trying to compromise Russia’s Rubin submarine design bureau, suggesting this is not an area of “unlimited friendship” between China and Russia.122

Of course, there remain concerns that Moscow could trade elite quieting technology for greater support from Beijing in Russia’s war with Ukraine. Or China simply might master it on its own in time.123

Anticipating a super-quiet Chinese SSN

A super-quiet Chinese SSN could be a transformative capability for the PLAN. Russia’s ability to operate super-quiet attack submarines singlehandedly gives it a viable blue-water threat against the U.S. Navy despite having a limited number of these vessels in its active inventory.124 If China were able to replicate this capability and mate it with its impressive shipbuilding capacity, it could build a force that would present a threat to U.S. naval forces well beyond the Second Island Chain. In effect, very quiet Chinese SSNs would be a blue-water capability unto themselves.125

All of that said, China has yet to actually build one or demonstrate it can. In the late 2010s, China significantly expanded the submarine construction capacity at its Bohai shipyards. This led to widespread speculation China was about to begin large-scale production of new, super-quiet nuclear-powered submarines.126 But nothing came of this expectation in the ensuing years. The exception was the construction of the two Type 093B’s and two upgraded copies of the Jin-class nuclear ballistic missile submarine (SSBN), itself a flawed, noisy design.127

Once China finally masters the requisite technology, it will still take several years to vet designs and grow a fleet of super-quiet submarines. Time would also be required to train additional nuclear submarine crews, a cadre that can only be nurtured slowly, with experience. The human element in particular should not be underestimated in submarine operations.128 In sum, there will likely be an extended interval between an acoustic breakthrough by China and the era when the PLAN has large numbers of super-quiet submarines at sea.

Pacific undersea geography

Until China significantly improves the quality of its nuclear attack submarines and the crews that man them, undersea warfare will remain a weakness of the PLAN, especially on the open ocean.129 This will be partially due to the qualitative superiority of U.S. submarines. But in the Pacific itself, it will also entail U.S. geographic advantages and undersea sensing capabilities. This relates to access to the deep sound channel, or SOFAR.130

The SOFAR is a unique zone of acoustic propagation, one found only at extreme depths, beginning around 1,000 meters (roughly 3,300 feet).131 Here, sound becomes partially trapped by pressure and temperature and disseminates horizontally over hundreds or even thousands of miles. Underwater hydrophones can be used to tap into that sound signal, enabling tracking of submarines, sometimes at great distances (as in the case of SOSUS).132

However, the SOFAR can only be tapped in specific geographic areas, such as the edge of a continental shelf or the shelf of an island or archipelago. In the eastern Pacific, the United States can access the SOFAR immediately off its own coast.133 But it also has entree to the deep sound channel in the western Pacific. There, access to the SOFAR does not lie directly off China’s own coast, but rather on the eastern side of the First Island Chain.

Purported U.S. undersea sensor network

With that land barrier primarily controlled by two U.S. allies—Japan and the Philippines—as well as another close security partner in Taiwan, the United States can access the SOFAR on the opposite side of the ocean as well. To that end, the United States is believed to have a network of undersea sensors running along the eastern spine of the First Island Chain, extending down through Indonesia 134

The result is a massive asymmetric advantage in undersea sensing for the U.S. Navy. This is another important way the PLAN is at a detriment in blue-water operations in the Pacific. It also emphasizes the point made at the beginning of this paper: China is at a fundamental geographic disadvantage if it seeks to be a blue-water power. That weakness extends below the surface as well as above.

Command relationships and funding

In assessing China’s blue-water prospects, two final areas warrant consideration: command relationships and long-term funding for a blue-water navy. Neither of these topics can be assessed definitively at this time. But each has important bearing on how (and if) China conducts global naval operations.

“Control and command”

One study of Chinese command relationships by the RAND Corporation argued it is more appropriate to discuss “control and command” in the Chinese context as opposed to “command and control”—the term more familiar to U.S. audiences.135 Putting “control” first speaks to the centralized nature of communist China’s political and military culture. Here, it is important to remember that the People’s Liberation Army (PLA)—i.e., China’s collective armed forces—are part and parcel of the Chinese Communist Party (CCP).136 The two entities emerged entwined from the long Chinese civil war and the interceding struggle with Imperial Japan.

How that historical background affects practical command arrangements in the Chinese military has long been an essential question for outside observers. The standing assessment is the PLA likely has difficulty with “mission command,” a concept in military operations in which subordinates are empowered to carry out a given set of tasks and objectives.137 As the RAND study points out:

The CCP, the PLA, and the PLA Navy are defined by strict authoritarian rule, centralized control, and extremely limited delegation of authority. These factors shape organizational culture in the Chinese military and appear to preclude the practice of mission command, instead promoting a much more rigid concept of C2.138

The command culture in China would seem particularly at odds with naval operations, which by their very nature are decentralized activity. A frequently cited example from early PLAN blue-water efforts is illustrative. When China first implemented its anti-piracy task force, Chinese civilian vessels in the Gulf of Aden were instructed not to contact PLAN warships on-station directly for help. Rather, they were to call the Ministry of Transport—4,500 miles away in Beijing—which would then put the vessels in touch with their would-be escorts.139 Subsequent deployments might have improved upon this arrangement, but that initial misstep still speaks to the basic cultural incompatibilities communist China faces in overseeing devolved naval activity across the globe.

This is not merely an administrative issue. Questions of command cut to the core of how naval forces function and especially how they operate under combat conditions. Although well-trod, Lord Nelson’s triumph at the Battle of the Nile remains the seminal case study of decentralized command versus centralized control. In that engagement, Nelson defied conventional thinking by attacking the French fleet late in the day and into darkness. Most navies of his era (including the French) relied on flag-signaling to control fleet movements, seemingly prohibiting night battles. Yet while Nelson employed flags for normal fleet operations, he considered them useless in the chaos of combat. Instead, during his long pursuit of the French across the Mediterranean Sea, Nelson met regularly with the captains in his fleet, imparting his views on how to best engage the enemy. When battle finally came, British ship commanders acted on their own initiative in accordance with Nelson’s overall intentions, no visual signals needed as darkness fell.140

Nelson might not have thought in terms of the specific phrase “mission command,” but that is what he was practicing—delegating tactical decision-making to his subordinates. The results were unambiguous. The French lost 13 of 15 capital ships in night fighting and suffered 5,000 dead or missing; British losses totaled just 218 dead and a single ship grounded.141

It would be presumptuous to assume the Chinese navy will flounder as the French fleet did at the Nile. But that example, no matter how dated, still highlights the importance of distributed command and delegation of authority in naval warfare, characteristics for which the PLA is not renowned. Excessive layers of command, emphasis on collective decision-making, and fealty to ideological considerations have long been identified as potential weaknesses for the PLA in the event of war.142

Command issues might then provide another useful lens for viewing the disparity in Chinese naval capabilities within the First Island Chain as opposed to beyond it. Not only is the PLAN better positioned to contest the Asian littoral seas (and perhaps the western Philippine Sea) in terms of force structure, but that scope of operations keeps the bulk of the Chinese navy relatively close to political and military command centers. This is speculation, of course, but it is possible the CCP leadership is simply not comfortable with global naval operations on a mass scale because of the degree of delegation such operations necessitate.

A final wildcard in this discussion is the impact of major military reforms implemented by the CCP late in 2015. Their goal was to enhance the operational integration of the constituent services of the PLA—to increase “jointness” in the parlance of the U.S. military.143 This included attempts to streamline command arrangements and reduce organizational bloat.

The extent to which that has been achieved remains a focus of study.144 One recent analysis for the Naval War College still found major problems with redundant command layers and ideological interference in PLAN submarine operations.145 Other scholars have suggested jointness could possibly work against PLAN blue-water operations if naval assets are more tightly integrated into joint operations pertinent to Chinese security interests nearer to home.146 In this sense, jointness could codify the PLAN’s status as a green-water force, one enmeshed in executing defensive missions in concert with its sister services in the Asian littoral.

Long-term funding and Chinese economic health

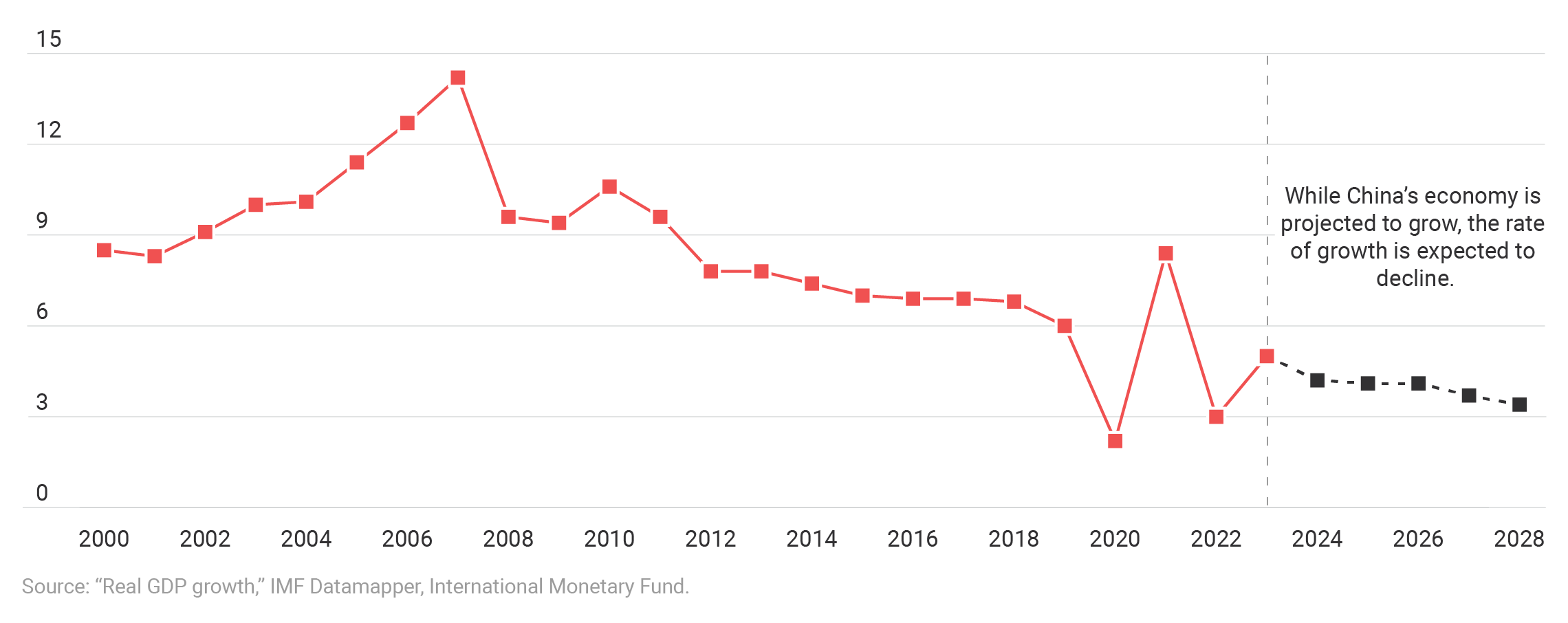

A final unknowable is the true health of the Chinese economy and its capacity to fund a blue-water navy over the long term. As early as 2020, a U.S. Department of Defense assessment for Congress noted the potential for Chinese economic growth to slow with possible implications for procurement. Specifically, it cited forecasts showing Chinese growth halving during the upcoming decade, decreasing from about 6 percent of GDP to 3 percent annually by 2030.147 Current IMF projections track with Chinese growth moving towards 3 percent of GDP by the end of this decade.148

More importantly, the past two years have focused attention on deeper structural concerns about the Chinese economy. A simplified list of China’s ailments includes a collapsing real estate market, high levels of domestic debt, limits on how far China can increase productivity, and an aging workforce.149

Chinese GDP growth (2000–2028)

Opinions remain divided on how dangerous these various elements are to China’s long-term economic health. One informed observer has argued the Chinese economy is “stumbling, not falling” and China still has the maneuver room and resources to avoid a more serious crisis.150 Yet even if Beijing does so, it might emerge with an economy that yields more modest growth rates than those to which China (and the world) are accustomed.151

Reduced or even stagnant growth could force choices among China’s funding priorities. China no longer appears to release data on internal security spending, but as recently as six years ago it accounted for a greater share of the Chinese state budget than defense spending.152 Among other factors, China must actively expend resources to maintain control over large portions of its territory, including Tibet, Xinjiang, and Hong Kong.153 It is unlikely Beijing would favor defense expenditures over its internal surveillance and policing apparatus in the event of constrained budgets. Put differently, military procurement is likely to be curtailed before internal security is cut.

More broadly, there is the issue of where defense spending sits in China’s overall budgetary priorities. In a salient study of funding sources for great-power competition, Rosella Cappella Zielinski and Samuel Gerstle emphasize the implicit social contract between the CCP and the Chinese people, one premised on rising living standards and a robust social safety net.154 Noting the cautionary tale of the Soviet Union, they suggest the Chinese leadership will be ill-inclined to sacrifice domestic prosperity for military spending at all costs.155

If revenue sources ultimately become constrained, Capella Zielinski and Gerstle conclude:

. . . Beijing will face the prospect of reducing its international ambitions, finding new ways to finance defense, or scaling back military competition with the United States to focus more narrowly on the security of China’s own region. Smaller defense budgets could entail a retreat from investment in expensive aircraft carriers and other tools for power projection.156

Shipbuilding could reasonably become a budgetary target at some point. This would be due not just to immediate outlays for construction but also extended life-cycle expenses. The cost of a naval vessel does not end when a finished hull touches water. Just the opposite: that is when ongoing expenditures for operations, maintenance, and personnel begin.

Consider an example from the U.S. side. In the waning days of the Trump administration, the chief of naval operations published a proposed shipbuilding plan to grow the U.S. fleet to 400 manned ships over the next two decades.157 A subsequent analysis by the Congressional Budget Office found that if completed, operating the 400-ship force would drive the Navy’s annual maintenance and support costs to a staggering $113 billion (in 2021 dollars) by 2051.158 This underscores an essential fact: building a large navy is immensely expensive, but so is actually sailing it.

Right now, China is projected to add 65 more vessels to its navy, reaching a total battle force of 435 ships by 2030.159 Perhaps the PLAN can run its fleet more economically than the U.S. Navy would. But operational budgets can only be reduced so far. Fuel and the provision of other essential supplies to an active blue-water fleet are unavoidable expenditures. Maintenance is another area where outlays will inevitably climb, the more consistently China deploys its fleet in global waters. And if the PLAN wants good officers and sailors in addition to high-quality vessels, there will be limits on how far it can economize in underwriting personnel costs.

It is possible China is willing (and able) to bear these expenses. But it is important to recognize the financial resources a fleet consumes increases proportionate to its size and the scope of its operations. A blue-water navy would occupy a steadily growing share of China’s overall defense/security budget in the decades ahead. Whether Beijing will view global naval operations as worth funding trade-offs elsewhere remains an open question.

Conclusion: A series of “if’s”

In summary, any discussion of China’s blue-water prospects inevitably comes back to two words: “if” and “could.”

For example:

- if China can obtain more and better overseas bases;

- if it restarts production on at-sea replenishment ships like the Type 901 and Type 903A;

- if it begins simultaneous construction of multiple carriers;

- if it solves super-quieting for its nuclear submarines; and

- if the Chinese economy remains vibrant enough to support the massive operations budget a 400-plus ship fleet will require,

. . . then the PLAN could pose a robust blue-water challenge to the U.S. Navy at some point in the future.

Given the scope of China’s naval modernization effort over the past 30 years, it would seem imprudent to dismiss out of hand China’s ability to do all of the above. In the mid-1990s, few would have taken the odds of China having the world’s largest fleet three decades later. That said, China accomplishing the many tasks needed to field a robust blue-water navy also should not be taken as a given by any means.

China’s shipbuilding program has been impressive, but it was also something entirely within China’s ability to control. In contrast, China cannot manifest a basing network to rival that of the United States by force of will alone. In fact, the more ham-fisted Beijing is in pursuit of such bases, the less likely it is to succeed. And adapting to capabilities like carrier operations or super-quiet submarine operations are other areas that cannot be conquered with industrial brute force. They require skill, time, and patience to cultivate. The same could be said for other core blue-water competencies like open-ocean ASW.

There are also serious questions regarding timelines. “If” everything goes right for China—i.e., super-quieting is solved soon, carrier development is accelerated, the Chinese economy stabilizes and recovers, and multiple nations in the right geographic locations sign up for large, capable Chinese naval bases—it is still hard to see China having a robust blue-water capability within the next decade. Aligning all those elements by, say, the mid-2030s is theoretically possible, but highly unlikely in practice.

Fundamental shifts in the PLA/PLAN command environment also would seem to be needed to support global naval operations. Such changes are difficult to fast-track. They need ample time to be fully inculcated into a military service’s culture. Changing how the PLAN commands at sea will be a slow process—assuming the CCP affords it true freedom to pursue effective changes.

Looking at 2040 or beyond therefore seems far more realistic for contemplating China as a global naval competitor—assuming all the “if’s” break in China’s favor. While such a development would be significant, it is still a very different situation than China having a robust, global blue-water capability in the here and now.

Just as important, it should be recognized that this is only one possible outcome. There also is a reasonable chance China never emerges as a global naval competitor. Unless it can convince several states to open their doors to permanent Chinese naval facilities (with far more robust infrastructure than currently seen in Djibouti or Cambodia), China’s lack of quality overseas bases will remain a fundamental impediment, as will its poor maritime geography.

Finally, there is the most important “if” cited above: the long-term health of the Chinese economy. China undertook the bulk of its naval modernization during the halcyon days of double-digit GDP growth. As discussed, slowing or even stagnant growth could force the CCP leadership to choose among contending priorities. A blue-water fleet might not be at the top of the list, particularly given the high cost of its operation and maintenance. While the PLAN might not follow its Soviet predecessor into outright obsolescence, it could be consigned to a regional role, permanently rendering it a green-water fleet, albeit one of impressive size and firepower.

Implications for the U.S.

Cynics might read the foregoing analysis and concede that for all the challenges the PLAN faces, the U.S. Navy also has more than its share of problems. Poor choices have been made over the past 30 years in terms of procurement, weakening the Navy’s overall force structure.160 Shipbuilding capacity is also a real concern as the Navy attempts to recapitalize the fleet.161 Maintenance backlogs and deficiencies pose another serious set of challenges, particularly with respect to submarines.162 Then there is the basic fact that, for all the assumed superiority of its personnel and seamanship, the U.S. Navy has not fought a peer competitor at sea in almost 80 years. No one really knows how it will perform.

Those cynics are absolutely right. The U.S. Navy does have serious problems. And as a maritime nation, the United States needs its navy to be properly structured and appropriately funded. But solving those challenges does not require overstating the Chinese blue-water threat. The United States needs a healthy navy for its own sake.

Finally, while the focus of this paper—Chinese blue-water operations—yields serious questions about the PLAN’s capacity, Chinese capabilities remain far more concerning within the First Island Chain. Questioning Beijing’s blue-water ambitions is therefore not synonymous with asserting there is no danger involved with China’s naval modernization, particularly if it emboldens Beijing to take offensive action against its immediate neighbors at some point.

But it is important to understand the specific nature of that threat and the geographic limits of its reach. Doing so can help U.S. policymakers make informed decisions about where China poses a legitimate threat and where its capabilities are lacking. It can also help the U.S. public parse the hype over China having “the world’s largest navy” and the reality of what Chinese naval forces actually can do outside the confines of the Asian littoral seas.

Endnotes

1 Current estimates by the Congressional Research Service (CRS) assign the U.S. Navy a force of 291 ships while the most recent estimate from the U.S. Department of Defense (DoD) gives China a force of 370 ships. But parsing exact ship numbers for the U.S. and Chinese navies can sometimes be difficult. Different accounting methods do or do not incorporate auxiliary and supply ships or China’s large fleet of coast guard vessels. A general rule of thumb in assessing the two navies is that the U.S. fleet has slipped below 300 ships and is struggling to maintain existing numbers while the PLAN has surpassed 300 ships and is continuing to grow. See U.S. Department of Defense, Military and Security Developments Involving the People’s Republic of China: Annual Report to Congress 2023 (2023) p. V, https://media.defense.gov/2023/Oct/19/2003323409/-1/-1/1/2023-MILITARY-AND-SECURITY-DEVELOPMENTS-INVOLVING-THE-PEOPLES-REPUBLIC-OF-CHINA.PDF, and Ronald O’Rourke, Navy Force Structure and Shipbuilding Plans: Background and Issues for Congress, U.S. Library of Congress, Congressional Research Service (RL32665) Updated December 21, 2023, (Summary), https://crsreports.congress.gov/product/pdf/RL/RL32665/402.

2 For one example of this view, see Joe Sestak, “The U.S. Navy’s Loss of Command of the Seas to China and How to Regain It,” Texas National Security Review, vol. 4, no. 1 (Winter 2020/21) p. 147–164, http://dx.doi.org/10.26153/tsw/11704.

3 The definitions used herein are the author’s own building on engagement with the maritime power literature, particularly as it relates to China’s naval capability. The U.S. Navy itself considers brown water, green water, and blue water to be “non-doctrinal terms,” although it offers its own shorthand interpretation of each in Department of the Navy, Naval Operations Concept 2010: Implementing the Maritime Strategy (2010) p. 8, https://apps.dtic.mil/sti/pdfs/ADA522333.pdf.

4 Andrew Erickson and Joel Wuthnow, “Barriers, Springboards and Benchmarks: China Conceptualizes the Pacific ‘Island Chains,’” China Quarterly, vol. 225 (March 2016) p. 6–7, https://doi.org/10.1017/S0305741016000011.

5 It is worth noting that implementing such a blockade would not be without major operational challenges. For one assessment, see Fiona S. Cunningham, “The Maritime Rung on the Escalation Ladder: Naval Blockades in a US-China Conflict,” Security Studies, vol. 29, no. 4 (2020) p. 730–768, https://doi.org/10.1080/09636412.2020.1811462.

6 Office of Naval Intelligence, The PLA Navy: New Missions and Capabilities for the Twenty-First Century, (2015) p. 33, https://www.oni.navy.mil/portals/12/intel%20agencies/china_media/2015_pla_navy_pub_print_low_res.pdf?ver=2015-12-02-081233-733, and Chart: “Theater Navy Headquarters,” in U.S. Department of Defense, Military and Security Developments Involving the People’s Republic of China: Annual Report to Congress (2022) p. 58, https://media.defense.gov/2022/Nov/29/2003122279/-1/-1/1/2022-MILITARY-AND-SECURITY-DEVELOPMENTS-INVOLVING-THE-PEOPLES-REPUBLIC-OF-CHINA.PDF.

7 “Chapter Six: Asia,” The Military Balance, (London: International Institute for Strategic Studies, 2023) p. 243–245, https://doi.org/10.1080/04597222.2023.2162718.

8 Damen Cook, “China’s Most Important South China Sea Military Base,” Diplomat, March 9, 2017, https://thediplomat.com/2017/03/chinas-most-important-south-china-sea-military-base/; Hans Kristensen, Matt Korda, and Eliana Reynold, “Chinese Nuclear Weapons, 2023,” Bulletin of the Atomic Scientists, vol. 79, no. 2, p. 125, https://doi.org/10.1080/00963402.2023.2178713; and U.S. Department of Defense, Annual Report to Congress (2023) p. 122.

9 Sam Lagrone, “AFRICOM: Chinese Naval Base in Africa Set to Support Aircraft Carriers,” USNI News, April 20, 2021, https://news.usni.org/2021/04/20/africom-chinese-naval-base-in-africa-set-to-support-aircraft-carriers.

10 U.S. Department of Defense, Annual Report to Congress (2023) p. 155.

11 Admittedly, this assertion is based on the lack of reports of any such visits in open sources. It is possible the PLAN is deploying surface combatants to Djibouti without public notice. But given the spotlight the U.S. Department of Defense shone on the March 2022 visit by a supply vessel (a Type 903A replenishment ship), it seems likely PLAN surface combatants docking at the Djibouti base would have been highlighted by U.S. government or other sources. That has not yet happened.

12 U.S. Department of Defense, Annual Report to Congress (2023) p. 155.

13 Runway length taken from Chad Peltier, with Tate Nurkin and Sean O’Connor, China’s Logistics Capabilities for Expeditionary Operations, (London: Jane’s Information Services, 2020) p. 28, https://www.uscc.gov/research/chinas-logistics-capabilities-expeditionary-operations. Open-sources list the Y-20’s takeoff distance as between 600 to 700 meters. See “Y-20 Kunpeng (Chubby Girl) Chinese Strategic Transport Aircraft: Notes,” Worldwide Equipment Guide, U.S. Army Training and Doctrine Command, Accessed February 4, 2024, https://odin.tradoc.army.mil/WEG/Asset/Y-20_Kunpeng_(Chubby_Girl)_Chinese_Strategic_Transport_Aircraft.

14 Peltier, China’s Logistics Capabilities for Expeditionary Operations, p. 36. The inability of China’s Djibouti base to support fixed-wing aircraft is also confirmed in an essay by the Director of Intelligence Analysis for U.S. Africa Command. See Eric A. Miller, “More Chinese Military Bases in Africa: A Question of When, Not If,” Foreign Policy, August 16, 2022, https://foreignpolicy.com/2022/08/16/china-military-bases-africa-navy-pla-geopolitics-strategy/.

15 Ellen Nakashima and Cate Cadell, “China Secretly Building Naval Facility in Cambodia, Western Officials Say,” Washington Post, June 6, 2022, https://www.washingtonpost.com/national-security/2022/06/06/cambodia-china-navy-base-ream/.

16 Niharika Mandhana, Sun Narin, and Chun Han Wong, “China to Upgrade Ream Naval Base in Cambodia, Fueling U.S. Concerns,” Wall Street Journal, June 8, 2022, https://www.wsj.com/articles/china-to-upgrade-ream-naval-base-in-cambodia-fueling-u-s-concerns-11654674382, and “Chinese Warships Dock at Cambodia’s Ream Naval Base for ‘Training,’” Radio Free Asia, December 5, 2023, https://www.rfa.org/english/news/cambodia/china-cambodia-ream-12052023042209.html.

17 For alternative perspectives on the value of Ream to the PLAN, see the comments by Thomas Shugart in “China-backed Naval Base in Cambodia ‘Continues to Grow,’” Radio Free Asia, November 15, 2023, https://www.rfa.org/english/news/cambodia/ream-development-11152023022730.html; the discussion in Nectar Gan, “The First Chinese Warships Have Docked at a Newly Expanded Cambodian Naval Base. Should the U.S. Be Worried?” CNN, December 6, 2023, https://www.cnn.com/2023/12/07/asia/cambodia-ream-naval-base-chinese-warships-us-analysis/index.html, and David Hutt, “What’s Happening at Cambodia’s Ream Naval Base?” Diplomat, December 14, 2023, https://thediplomat.com/2023/12/whats-happening-at-cambodias-ream-naval-base/.

18 This assessment is based on Google Map measurements of the respective distances from Singapore to Ream, Cambodia (660 miles) and Hainan Island, China (1,340 miles).

19 See “Table A1. U.S. Defense Sites in the Indo Pacific,” in Luke Nicastro, U.S. Defense Infrastructure in the Indo-Pacific: Background and Issues for Congress, U.S. Library of Congress, Congressional Research Service (R47589) June 6, 2023, p. 44–46, https://crsreports.congress.gov/product/pdf/R/R47589. That report lists the U.S. as having 66 installations in the “Indo-Pacific,” but all but one of these – Diego Garcia – are in or around the Pacific Ocean, resulting in a count of 65. Added to this are six sites in Papua New Guinea that the United States has gained access to since the CRS report was published. Their inclusion produces the count of 71 installations used herein. See “Appendix A” in U.S. Department of State, Treaties and Other International Acts Series 23-816, “Defense Cooperation Agreement between the United States and Papua New Guinea,” (entered into force August 16, 2023) https://www.state.gov/wp-content/uploads/2023/10/63374-Papua-New-Guinea-Defense-08.16.2023.pdf.

20 Derek Grossman, Michael S. Chase, Gerard Finin, Wallace Gregson, Jeffrey W. Hornung, Logan Ma, Jordan R. Reimer, and Alice Shih, America’s Pacific Island Allies: The Freely Associated States and Chinese Influence (Santa Monica: RAND Corporation, 2019) p. ix, https://www.rand.org/pubs/research_reports/RR2973.html.

21 See “Table 1: Geographic Reference Points for First and Second Island Chains,” in Erickson and Wuthnow, “Barriers, Springboards and Benchmarks,” p. 7.

22 First described by the Marine Corps strategist Earl Hancock Ellis during the early twentieth century, the cloud construct reflects the more amorphous nature of this set of islands as opposed to the more clearly delineated First Island Chain. See Andrew Rhodes, “The Second Island Cloud: A Deeper and Broader Concept for American Presence in the Pacific Islands,” Joint Forces Quarterly, vol. 76, no. 4 (2019) p. 46–53, https://ndupress.ndu.edu/Portals/68/Documents/jfq/jfq-95/jfq-95_46-53_Rhodes.pdf.

23 “Submarine Squadron 15,” Submarine Force Pacific, Accessed February 6, 2024, https://www.csp.navy.mil/css15/Submarines/, Jen Judson, “First Wave of Tech to Defend Guam from Newer Threats Due in 2024,” Defense News, March 17, 2023, https://www.defensenews.com/smr/defending-the-pacific/2023/03/17/first-wave-of-tech-to-defend-guam-from-newer-threats-due-in-2024/; Chris Gordon, “After Long Wait, Guam’s Missile and Air Defense Is About to Get A Whole Lot Better,” Air & Space Forces Magazine, March 24, 2023, https://www.airandspaceforces.com/after-long-wait-guams-missile-and-air-defense-is-about-to-get-a-whole-lot-better/.

24 For more detailed discussion of the COFA provisions, see Grossman et al, America’s Pacific Island Allies, p. 5–21, and Thomas Lum, “In Focus: The Compacts of Free Association,” Congressional Research Service (IF12194) Updated November 13, 2023, https://crsreports.congress.gov/product/pdf/IF/IF12194. Damien Cave, “China and Solomon Islands Draft Secret Security Pact, Raising Alarm in the Pacific,” New York Times, March 24, 2022, https://www.nytimes.com/2022/03/24/world/asia/china-solomon-islands-security-pact.html, and Damien Cave, “Why a Chinese Security Deal in the Pacific Could Ripple Through the World,” New York Times, April 20, 2022, https://www.nytimes.com/2022/04/20/world/australia/china-solomon-islands-security-pact.html.

23 Kirsty Needham, “Solomon Islands Pact with China Roils Australian PM’s Election Campaign,” Reuters, April 27, 2022, https://www.reuters.com/world/asia-pacific/solomon-islands-pact-with-china-roils-australian-pms-election-campaign-2022-04-27/.

24 While the final text has never been officially released, a draft of the agreement leaked online a month before it entered into force and can still be found on social media. See Twitter, Powles, Anna (@annapowles), “The draft security cooperation agreement between China and Solomon Islands has been linked on social media and raises a lot of questions (and concerns). (photos of agreement in this and below tweet) 1/6,” March 24, 2022, https://twitter.com/AnnaPowles/status/1506845794728837120?s=20&t=h4DpRVQS2VOEGoSpg7hgwg.

25 Damien Cave, “China’s Mad Dash into a Strategic Island Nation Breeds Resentment,” New York Times, January 23, 2023, https://www.nytimes.com/2023/01/23/world/asia/china-solomon-islands.html.

26 Kirsty Needham, “Solomon Islands Pact with China Roils Australian PM’s Election Campaign,” Reuters, April 27, 2022, https://www.reuters.com/world/asia-pacific/solomon-islands-pact-with-china-roils-australian-pms-election-campaign-2022-04-27/.

27 While the final text has never been officially released, a draft of the agreement leaked online a month before it entered into force and can still be found on social media. See Twitter, Powles, Anna (@annapowles), “The draft security cooperation agreement between China and Solomon Islands has been linked on social media and raises a lot of questions (and concerns). (photos of agreement in this and below tweet) 1/6,” March 24, 2022, https://twitter.com/AnnaPowles/status/1506845794728837120?s=20&t=h4DpRVQS2VOEGoSpg7hgwg.

28 Damien Cave, “China’s Mad Dash into a Strategic Island Nation Breeds Resentment,” New York Times, January 23, 2023, https://www.nytimes.com/2023/01/23/world/asia/china-solomon-islands.html.

29 Kirsty Needham, “Solomon Islands Won’t Allow Chinese Military Base, Says PM’s Office,” Reuters, April 1, 2022, https://www.reuters.com/world/asia-pacific/solomon-islands-says-wont-allow-chinese-military-base-knows-ramification-2022-04-01/, and Rob McGuirk, “Solomon Islands Leader Rules Out China Base in His Country,” Associated Press, October 6, 2022, https://apnews.com/article/china-australia-canberra-solomon-islands-government-and-politics-0ac755c18daa8e6fb81579d2216dfc63.

30 Edward Wong, “Solomon Islands Suspends Visits by Foreign Military Ships, Raising Concerns in U.S.,” New York Times, August 30, 2022, https://www.nytimes.com/2022/08/30/us/politics/solomon-islands-us-military-china.html.

31 Gordon Lubold, “U.S. Military Is Offered New Bases in the Pacific,” Wall Street Journal, September 8, 2020, https://www.wsj.com/articles/u-s-military-is-offered-new-bases-in-the-pacific-11599557401.